Company Logo

The UK prepaid card and digital wallet market is set for substantial growth, anticipating 10.3% annual growth to reach $59.83 billion by 2025. Key trends include increased digital payment adoption, strategic bank-fintech collaborations, and e-commerce expansion, driving consumer shift toward a cashless economy.

United Kingdom Prepaid Card and Digital Wallet Market

United Kingdom Prepaid Card and Digital Wallet Market

Dublin, July 07, 2025 (GLOBE NEWSWIRE) — The “United Kingdom Prepaid Card and Digital Wallet Market Intelligence and Future Growth Dynamics Databook – Q2 2025 Update” has been added to ResearchAndMarkets.com’s offering.

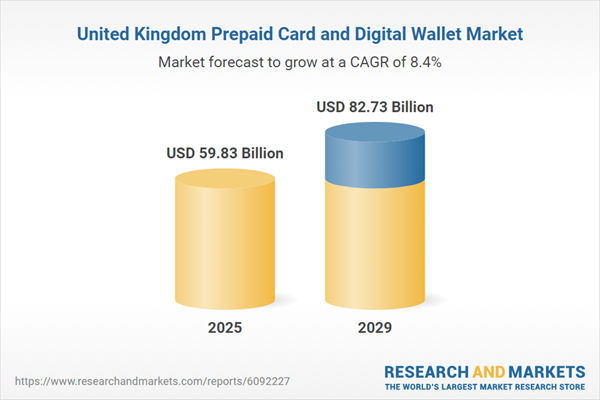

The prepaid card and digital wallet market in the United Kingdom is on a positive growth trajectory, expected to expand by 10.3% annually to reach USD 59.83 billion in 2025. The market has shown impressive growth from 2020 to 2024 with a CAGR of 14.6%, and it’s projected to grow at a CAGR of 8.4% from 2025 to 2029. By 2029, the market’s value is estimated to rise to approximately USD 82.73 billion from USD 54.26 billion in 2024.

Key Trends and Drivers

The UK prepaid card market is evolving due to the widespread integration of digital payment solutions, strategic partnerships between banks and fintechs, and the booming e-commerce sector. These elements are restructuring consumer payment preferences, increasing the use of prepaid cards in digital wallets for secure spending.

Regulatory advancements are pivotal, ensuring consumer protection and industry standardization, though compliance may raise operational costs. Businesses must align with these trends to leverage opportunities and maintain competitiveness as the market grows by 2028.

Adoption of Digital Payment Solutions

-

Prepaid cards are increasingly popular due to seamless digital wallet integration and mobile payment platforms, which enhance transaction security and convenience. Technological advancements, such as NFC, are making prepaid cards reliable alternatives to traditional banking.

Strategic Bank and Fintech Collaborations

-

Partnerships between banks and fintech firms are reshaping the prepaid card landscape, with banks leveraging fintech expertise to develop innovative solutions. This is driven by consumer demand for flexible payments and fintech disruption in financial services. Such partnerships are expected to grow, improving product offerings and consumer benefits.

E-commerce Growth Fueling Prepaid Card Use

-

The rapid expansion of e-commerce is pushing consumers toward prepaid cards for safer online transactions, reducing fraud exposure. Prepaid cards help manage budgets and address security concerns, driving their increased adoption.

Story Continues

Regulatory Developments Influencing Dynamics

-

Regulatory changes are enhancing the prepaid card market through consumer protection measures and standardizing practices. These changes are expected to build consumer confidence, driving higher adoption rates and making prepaid cards more integral in financial services.

Competitive Landscape

The UK’s prepaid card market is set for sustained growth, influenced by regulatory adjustments and technological advances. Financial institutions and fintechs are fostering innovation and expanding offerings, increasingly integrating prepaid solutions into digital banking ecosystems.

Current Dynamics

-

Consumer preference shift towards prepaid cards over credit cards for better spending control and security fuels market expansion. Government initiatives and corporate adoption are further contributing to growth with targeted prepaid solutions for specific segments like welfare disbursements and payroll cards.

Key Players and Market Share

-

The market features key providers like Cashplus, Caxton, and Revolut, known for integrating cards with mobile wallets. Fintech startups and challenger banks intensify competition by offering enhanced features. Established players are thus pushed to innovate further.

Recent Launches and Partnerships

-

There is a trend of consolidation through strategic partnerships, especially between banks and fintechs, to enhance prepaid offerings. Mergers and acquisitions are expanding technological capabilities and market reach.

Anticipated Evolution (Next 2-4 Years)

-

As digital transformation accelerates, prepaid card competition will intensify. Partnerships will increase, fostering innovation, with prepaid cards becoming even more accepted due to regulatory support and consumer trust.

Regulatory Changes

-

New regulations, such as capping interchange fees and mandating transparent fee disclosures, aim to protect consumers and enhance market fairness. These changes may increase compliance costs but will enhance consumer confidence in prepaid products.

This report offers a comprehensive analysis of the UK’s prepaid card and digital wallet market. It includes a detailed breakdown of market segments, trends, and dynamics, supported by extensive data and insights into consumer behavior and retail spending patterns.

Key Attributes:

Report Attribute

Details

No. of Pages

159

Forecast Period

2025 – 2029

Estimated Market Value (USD) in 2025

$59.83 Billion

Forecasted Market Value (USD) by 2029

$82.73 Billion

Compound Annual Growth Rate

8.4%

Regions Covered

United Kingdom

Key Topics Covered:

-

United Kingdom Prepaid Payment Instrument Market Size and Future Growth Dynamics by Key Performance Indicators

-

Transaction Value Trend Analysis, 2020 – 2029

-

Transaction Volume Trend Analysis, 2020 – 2029

-

Average Value per Transaction, 2020 – 2029

-

Market Share Analysis by Prepaid Card vs. Digital Wallet, 2020 – 2029

-

-

Digital Wallet Market Size and Future Growth Dynamics by Key Performance Indicators, 2020 – 2029

-

Transaction Value Trend Analysis, 2020 – 2029

-

Average Value per Transaction, 2020 – 2029

-

Transaction Volume Trend Analysis, 2020 – 2029

-

Market Share Analysis by Key Segments

-

-

United Kingdom Digital Wallet Market Size and Future Growth Dynamics by Key Segments

-

Retail Payments Market Size and Future Growth Dynamics by Key Performance Indicators

-

Travel Payments Market Size and Future Growth Dynamics by Key Performance Indicators, 2020 – 2029

-

Restaurants & Bars Payments Market Size and Future Growth Dynamics by Key Performance Indicators

-

Entertainment, Gaming, & Event Payments Market Size and Future Growth Dynamics by Key Performance Indicators

-

Recharge and Bill Payments Market Size and Future Growth Dynamics by Key Performance Indicators

-

-

United Kingdom Digital Wallet Retail Spend Dynamics

-

Market Share Analysis by Key Retail Categories, 2024

-

Food and Grocery – Transaction Value Trend Analysis, 2020 – 2029

-

Health and Beauty Products – Transaction Value Trend Analysis, 2020 – 2029

-

Apparel and Foot Wear – Transaction Value Trend Analysis, 2020 – 2029

-

Books, Music and Video – Transaction Value Trend Analysis, 2020 – 2029

-

Consumer Electronics – Transaction Value Trend Analysis, 2020 – 2029

-

Pharmacy and Wellness – Transaction Value Trend Analysis, 2020 – 2029

-

Gas Stations – Transaction Value Trend Analysis, 2020 – 2029

-

Restaurants & Bars – Transaction Value Trend Analysis, 2020 – 2029

-

Toys, Kids, and Baby Products – Transaction Value Trend Analysis, 2020 – 2029

-

Services – Transaction Value Trend Analysis, 2020 – 2029

-

Others – Transaction Value Trend Analysis, 2020 – 2029

-

-

United Kingdom Prepaid Card Industry Market Attractiveness

-

Prepaid Card Market Size and Future Growth Dynamics by Key Performance Indicators

-

Market Share Analysis by Functional Attributes – Open Loop vs. Closed Loop, 2020 – 2029

-

Market Share Analysis by Prepaid Card Categories

-

-

United Kingdom Open Loop Prepaid Card Future Growth Dynamics, 2020 – 2029

-

United Kingdom Closed Loop Prepaid Card Future Growth Dynamics, 2020 – 2029

-

United Kingdom Prepaid Card Market Share by Key Players

-

United Kingdom Prepaid Card Consumer Usage Trends

-

United Kingdom Prepaid Card Retail Spend Dynamics

-

United Kingdom General Purpose Prepaid Card Market Size and Forecast, 2020 – 2029

-

United Kingdom Gift Card Market Size and Forecast, 2020 – 2029

-

United Kingdom Entertainment and Gaming Prepaid Card Market Size and Forecast, 2020 – 2029

-

United Kingdom Teen and Campus Prepaid Card Market Size and Forecast, 2020 – 2029

-

United Kingdom Business and Administrative Expense Prepaid Card Market Size and Forecast, 2020 – 2029

-

United Kingdom Payroll Prepaid Card Market Size and Forecast, 2020 – 2029

-

United Kingdom Meal Prepaid Card Market Size and Forecast, 2020 – 2029

-

United Kingdom Travel Forex Prepaid Card Market Size and Forecast, 2020 – 2029

-

United Kingdom Transit and Tolls Prepaid Card Market Size and Forecast, 2020 – 2029

-

United Kingdom Social Security and Other Government Benefit Programs Prepaid Card Market Size and Forecast, 2020 – 2029

-

United Kingdom Fuel Prepaid Cards Market Size and Forecast, 2020 – 2029

-

United Kingdom Utilities, and Other Prepaid Cards Market Size and Forecast, 2020 – 2029

-

United Kingdom Virtual Prepaid Card Industry Market Attractiveness, 2020 – 2029

-

United Kingdom Virtual Prepaid Card Market Size and Future Growth Dynamics by Key Categories, 2020 – 2029

For more information about this report visit https://www.researchandmarkets.com/r/nmhz5i

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world’s leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

Attachment

CONTACT: CONTACT: ResearchAndMarkets.com Laura Wood,Senior Press Manager press@researchandmarkets.com For E.S.T Office Hours Call 1-917-300-0470 For U.S./ CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900