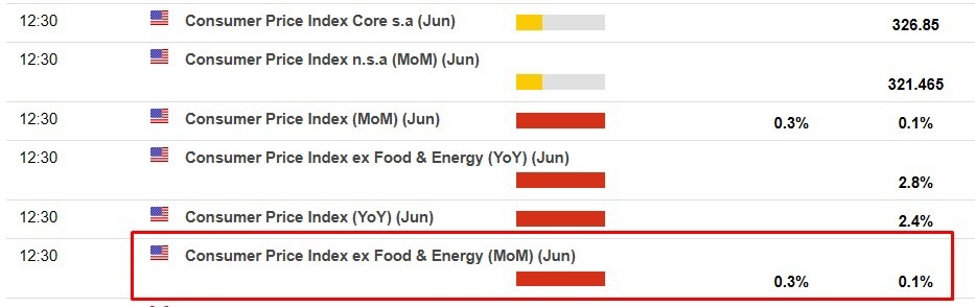

The US inflation report, CPI, is due on Tuesday July 15 at 8.30 am US Eastern time, which is 1230 GMT.

TD Securities are with the consensus, forecating m/m core to be up 0.3%, this highest since 0.4% in January:

- “we look for goods prices to gather steam in June, reflecting some tariff passthrough”

- “we don’t expect the services segment to help offset that strength”

Bank of America are also looking for +0.3% m/m and 3.0% y/y for core:

—

A key thing to watch in the inflation report will be how broad the inflationary pressures are:

- if it shows inflation reaccelerating broadly it poses a risk to the bond market, i.e higher yields for ‘bad’ reasons

- a key implication that the market would likely draw is that there could be fewer Fed rate cuts than currently priced

- that could then leak into into equity markets

mix in the hefty tariffs being proposed and it could get ugly, until TACO saves the day of course.

Later this year,

ForexLive.com

is evolving into

investingLive.com, a new destination for intelligent market updates and smarter

decision-making for investors and traders alike.