TwentyEA’s analysis of the property market in Q2 shows a 7% year-on-year rise in demand. The property tech’s CEO warns ‘systemic issues’ may yet lead to a cool-off, but others believe the market will remain ‘buoyant’.

The report, which is based on factual and real-time property sales data, shows that demand, supply and sales are all up on the same period last year. The supply of new instructions in Q2 increased by 5.6% compared to Q2 2025, taking the supply of properties for sale to the highest point for seven years.

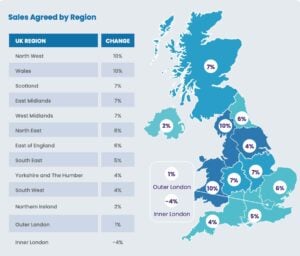

Sales agreed volumes were up by 5.3%, which represents a year-on-year increase of more than 7%. Q2 experienced an 8.7% drop in exchanges compared to the same time last year, however residential transactions for the year to date are 30% higher than in 2024.

TwentyEA CEO Colin Bradshaw said the Q2 figures show strong transactional sales activity, but ‘persistent structural challenges’ remain.

He commented:

“While overall demand remains resilient, slower transaction timelines and rental affordability issues point to systemic issues that could dampen momentum if left unaddressed. It is also the case that the recent Stamp Duty changes are still working their way through the system. This, in the short term, may lead to a cooling in buyer demand. Sellers may therefore need to adjust pricing expectations accordingly.

“In the medium to longer term, if inflation and interest rates stabilise, the market should rebalance, but affordability will remain a key constraint to activity and demand.”

However, relaxed lending criteria means the mortgage market may have become a more attractive prospect than renting for many, with the average UK rent now at £1,814 (up £46 since Q1). Alex Bannister, TwentyEA independent board advisor and the former director of Future Ventures at Nationwide Building Society, explained:

“Lenders are continuing to relax their affordability criteria with little resistance from regulators, and one suspects some cheerleading from the government. Q1 stats from the Bank of England show that nearly 4.9% of lending was both over 90% LTV and at an income multiple above 2.75%. That is the highest level since 2008, as the GFC began.

“While this risks stability if taken too far, in the short term it will help provide impetus for the market and be reinforced by a steady reduction in mortgage rates (latest projections suggest UK rates are heading towards 3% over the next twelve months, which will gradually reduce mortgage rates).

“The post stamp duty slowdown may persist for a bit longer and price sensitivity will remain, but the overall picture is of a market which has and will maintain momentum through the rest of the year.”

Market buoyancy is evident in the regions, TwentyEA notes, with Manchester continuing its run as the nation’s property hotspot thanks to a 14.5% year-on-year increase in sales agreed. Every region experienced an increase except inner London, where sales agreed fell by 3.6%. Outer London recorded an increase of 1.1% – modest in comparison to the majority of the UK.

Source: TwentyEA

Source: TwentyEA

Overall, Bannister believes the data points to a buoyant market which continues to adjust following the stamp duty changes. ‘While the UK economy is hardly booming, prospective homebuyers remain largely employed, getting pay rises and renting remains an unattractive alternative,’ he commented.

“Steady as she goes appears to be the order of the day for the UK housing market.”

TwentyEA’s Property & Homemover Report for Q2 2025 can be seen in full at https://www.twentyci.co.uk/phmr/twentyci-property-homemover-report-q2-2025/

\\r\\n\\r\\n\\r\\n\\r\\n\\r\\n\\r\\n\\r\\n\”,\”body\”:\”\”,\”footer\”:\”\\r\\n\\r\\n\\r\\n\\r\\n\\r\\n\”},\”advanced\”:{\”header\”:\”\”,\”body\”:\”\”,\”footer\”:\”\”}}”,”gdpr_scor”:”true”,”wp_lang”:””,”wp_consent_api”:”false”};