The New State Pension is worth up to £11,973 over the current financial year. Pension Credit – Could you or someone you know be eligible?

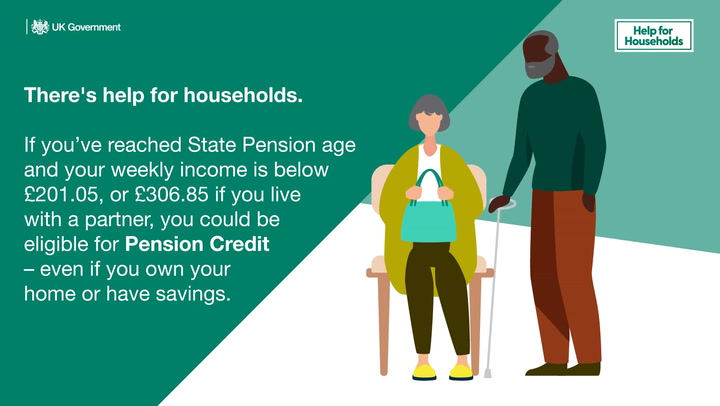

Pension Credit – Could you or someone you know be eligible?

A survey of 1,050 retired and semi-retired people by later-life specialist Just Group has found that a quarter (25%) of those aged 55-64 are unaware of the option to defer their State Pension. The official age of retirement is 66 for men and women, but is set to rise to 67 between 2026 and 2028 under current UK Government plans.

Those who are eligible for the New State Pension (post April 2016) can benefit from a one per cent increase in their weekly State Pension for every nine weeks they delay claiming the payment, equivalent to nearly 5.8 per cent extra income for every full year deferred.

The New State Pension is worth £230.25 each week over the 2025/26 financial year. People due to retire, who choose to defer claiming the State Pension, will benefit from an extra £13.35 every week – equivalent to a boost of £694.20 over the next 12 months.

READ MORE: New State Pension age set to change next year for people with these birthdaysREAD MORE: People on New State Pension could be due nearly £1,000 every month from next April

Those who reached retirement age before April 6, 2016, but chose to defer claiming the Basic State Pension, are treated more generously, according to Just Group.

These retirees receive an extra one per cent State Pension income for every five weeks deferred, equal to an annual rise of 10.4 per cent or £954.20, which can be taken either as extra income or a lump sum.

Example

- You get £176.45 a week (the full Basic State Pension)

- By deferring for 52 weeks, you’ll get an extra £18.35 a week (10.4% of £176.45).

The Just Group research indicated that women (26%) were significantly more likely than men (19%) not to know about the possibility of deferring the State Pension, while 26 per cent of those aged 75 and over also did not know deferral was an option.

Commenting on the findings, Stephen Lowe, group communications director at Just Group, said: “Deferring can be a good option for people who don’t need the income immediately – perhaps because they are still working or have other sources of cash – so it is disappointing a quarter of those approaching State Pension age don’t know about the option.”

However, he added: “While deferring might not be the right option for everyone, it should still be something everyone knows about given that the State Pension is widely considered a ‘bread and butter’ source of income in retirement, with 3.4 million retired households relying on it for more than half of their yearly income.

“Deferring has become less attractive in recent years because the terms have become less generous for those who reached State Pension age on or after 6 April 2016 and there is no option to take the deferred income as a lump sum. However, even for those who reached State Pension age after that date, in some circumstances it can still make sense to forgo some income in the short-term for a higher income in later life that is currently guaranteed to keep up with inflation.”

The retirement specialist said that the State Pension provides an important bedrock of income for many pensioners so it’s crucial people have a full understanding of all the options that are available to them.

State Pension payments 2025/26

Full New State Pension

- Weekly payment: £230.25

- Four-weekly payment: £921

- Annual amount: £11,973

Full Basic State Pension

- Weekly payment: £176.45

- Four-weekly payment: £705.80

- Annual amount: £9,175

Future State Pension increases

The Labour Government has pledged to honour the Triple Lock or the next five years and the latest predictions show the following projected annual increases:

- 2025/26 – 4.1% (the forecast was 4%)

- 2026/27 – 2.5%

- 2027/28 – 2.5%

- 2028/29 – 2.5%

- 2029/30 – 2.5%

State Pension and tax

The Personal Allowance will remain frozen at £12,570 over the 2025/26 financial year.

The most important thing to remember is that someone only on the full New State Pension will not pay income tax for the next two years, but older people with additional income through employment, private or workplace pensions, might need to pay tax.

The amount of tax paid is only on the amount over the personal allowance, and not the entire amount.

Anyone with additional income on top of their State Pension may need to pay tax. This is paid a year in arrears, so if the 2025/26 financial year’s uplift takes you over the threshold, you will not receive a tax bill from HM Revenue and Customs (HMRC) until July 2026.

Get the latest Record Money news

Get the latest Record Money news

Join the conversation on our Money Saving Scotland Facebook group for money-saving tips, the latest State Pension and benefits news, energy bill advice and cost of living updates.

Sign up to our Record Money newsletter and get the top stories sent to your inbox daily from Monday to Friday with a special cost of living edition every Thursday – sign up here.

You can also follow us on X (formerly Twitter) @Recordmoney_ for regular updates throughout the day or get money news alerts on your phone by joining our Daily Record Money WhatsApp community.