Indian stock markets are booming, and so are mutual fund companies. In June 2025, SIP (Systematic Investment Plan) investments reached a record Rs 27,269 crore, 2% higher than May. Over 8.64 crore SIP accounts contributed, and total SIP assets crossed Rs 15.31 lakh crore—about 20.6% of all mutual fund assets. At the current juncture, we are seeing two stocks, i.e. UTI AMC and Aditya Birla Sun Life AMC, standing out as promising opportunities. With strong technical and rising investor interest, they have the potential to deliver attractive long term returns.

UTI AMC : Breaking out from All Time High – Bullish Continue pattern

Source: Investing.com

Source: Investing.com

Outlook for UTI AMC

UTI AMC has recently broken out from a long-term ascending triangle pattern near its all-time high of Rs 1,400. After correcting nearly 35% to a low of Rs 905, the stock has since established a consistent higher-high, higher low structure. From February 2024 to June 2025, the stock returned approximately 58%. Currently, UTI AMC is trading above its 200-day moving average, & the weekly RSI remains above 60, indicating sustained bullish momentum.

Key signs indicating UTI AMC potential upside

- Bullish Continue Pattern Breakout: The stock is breaking out from a long-term consolidation and bullish continue pattern ascending triangle pattern, signifying that the price should move up.

- 200-Day Moving Average: The stock price has broken the 200DMA again from June 2025 on the daily time frame, which indicates there could be a trend continuation.

- Increasing RSI Momentum: The Relative Strength Index (RSI) is over 60 and is indicating strength, confirming that the share could move up.

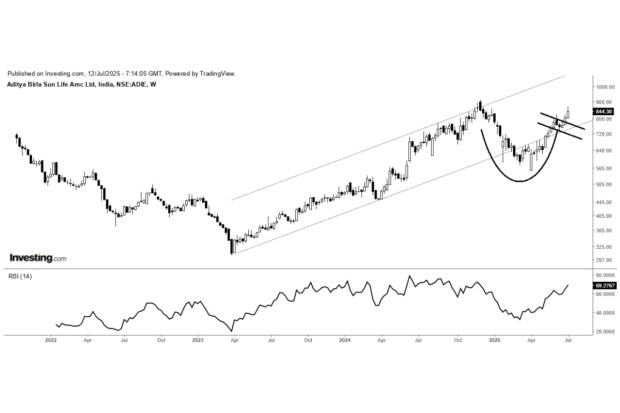

Aditya Birla Sun Life AMC: Ready for a Potential Up move once again

Source: Investing.com

Source: Investing.com

Outlook for Aditya Birla Sun Life AMC

Aditya Birla Sun Life AMC peaked at Rs 910 in December 2024 before undergoing a sharp 40% correction to Rs 556 by April 2025. Since then, the stock has recovered over 56%, and recently confirmed a breakout from a bullish cup-and-handle formation. Additionally, it has re-entered its rising price channel and is trading above the 200-day SMA. Weekly RSI has also moved above 60, suggesting building momentum.

Key technical levels favouring Aditya Birla Sun Life AMC’s reversal

- Bullish Continue Pattern: The stock was in a time correction, but recently it has given a breakout from a Cup and handle pattern, possibly entering an upward trend again.

- 200-Day SMA: After the 40% correction, the stock has again remained above its 200SMA, which is a classic sign of positive sentiment and a trend reversal.

- RSI Chart and Price Direction: The 14-period weekly RSI moved above 60, indicating bullish divergence and further momentum for price moves upward.

Final take

Given the structural growth of India’s mutual fund industry, supported by record SIPs & improving investor penetration, both stocks offer a favourable risk-reward setup. Investors looking for long term plays in the financial services space may consider accumulating these counters on dips while maintaining appropriate risk management protocols. Technically, both UTI AMC & Aditya Birla Sun Life AMC are exhibiting bullish chart patterns, indicating possible medium to long term upside.

UTI AMC has broken out from a long term ascending triangle pattern & remains above key moving averages, supported by a strong RSI. The structure suggests a continuation of the uptrend. Similarly, Aditya Birla Sun Life AMC has confirmed a bullish cup-and-handle breakout & reclaimed the 200-day SMA, with RSI strengthening.

Note: The purpose of this article is only to share interesting charts, data points and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educative purposes only.

As per SEBI guidelines, the writer and his dependents may or may not hold the stocks/commodities/cryptos/any other assets discussed here. However, clients of Jainam Broking Limited may or may not own these securities.

Kiran Jani has over 15 years of experience as a trader and technical analyst in India’s financial markets. He is a well-known face on the business channels as Market Experts and has worked with Asit C Mehta, Kotak Commodities, and Axis Securities. Presently, he is Head of the Technical and Derivative Research Desk at Jainam Broking Limited.

Disclosure: The writer and his dependents do not hold the stocks discussed here. However, clients of Jainam Broking Limited may or may not own these securities.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives and resources, and only after consulting such independent advisors if necessary.