Financial expert Claire Trott suggests further increases to the age of retirement may help control soaring State Pension costs. Pension Credit – Could you or someone you know be eligible?

Pension Credit – Could you or someone you know be eligible?

Under the Triple Lock, the New and Basic State Pensions increase each year in-line with whichever is the highest between average annual earnings growth from May to July, Consumer Price Index (CPI) inflation in the year to September or 2.5 per cent. Over the 2025/26 financial year, the State Pension will cost the UK Government an estimated £145.6 billion.

Last month, Pensions Minister Torsten Bell quashed growing speculation on social media that the State Pension would become means-tested under the Labour Government. However, Claire Trott, Head of Advice at St. James’s Place, warns that the long-term sustainability of the State Pension Triple Lock is a topic that won’t go away, despite political parties’ reluctance to address it.

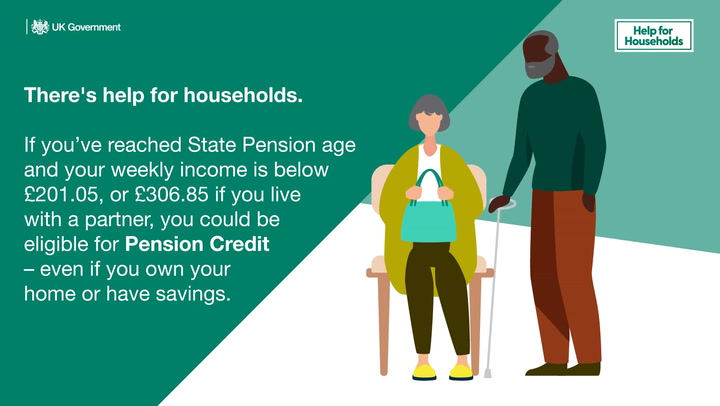

She suggests one way around the ever-increasing costs of the Triple Lock could be to freeze the State Pension and increase access to Pension Credit, the most under-claimed means-tested benefit delivered by the Department for Work and Pensions (DWP).

READ MORE: New State Pension age set to change next year for people with these birthdaysREAD MORE: People on New State Pension could be due nearly £1,000 every month from next April

Another option could be to increase the State Pension age, which she said is the “most viable and publicly palatable option”.

The State Pension age is set to start rising from 66 to 67 next year, with the increase due to be completed for all men and women across the UK by 2028.

The planned change to the official age of retirement has been in legislation since 2014 with a further State Pension age rise from 67 to 68 set to be implemented between 2044 and 2046.

People born on April 6, 1960 will reach State Pension age of 66 on May 6, 2026 while those born on March 5, 1961 will reach State Pension age of 67 on February 5, 2028. You can check your own State Pension age online here.

Ms Trott explained: “The long-term affordability of the Triple Lock has been questioned for some time and understandably so. With people living longer and the Triple Lock delivering higher increases more frequently than originally anticipated, the cost has exceeded expectations and is only set to rise further.

“Yet despite the fiscal pressure, it remains a politically sensitive promise. With many pensioners still living in poverty, and also being a reliable voting demographic, few politicians are willing to risk tampering with it.

“If reform were to be considered, any proposal would need to ensure adequate support for those on the lowest incomes. Means-testing is often raised as a solution, but in practice it’s unlikely to be pursued, given the cost and complexity of implementation outweighs the savings.”

The financial expert continued: “There are other options such as freezing the State Pension and increasing access to Pension Credit which might be a more pragmatic route – it’s already in place and better targeted to those who need help most.

“Raising the State Pension age has been controversial in the past, but it’s arguably the most viable and publicly palatable option in the longer term, as people continue to live and work for longer.”

State Pension Triple Lock

Nearly 13 million State Pensioners across Great Britain, including over one million living in Scotland, should start to keep an eye on the Consumer Price Index (CPI) inflation rate as it forms part of the Triple Lock measure which determines the annual uprating for the contributory benefit.

The latest figures from the Office for National Statistics (ONS) show UK inflation decreased to 3.4 per cent in May, down from 3.5 per cent in April. Annual growth in employees’ average wages for regular earnings (excluding bonuses) was 5.6 per cent and total earnings (including bonuses) was 5.5 per cent.

The New and Basic State Pension increased by 4.7 per cent in April, which means someone on the full New State Pension currently receives £230.25 per week, or £921 every four-week pay period.

Those on the full Basic State Pension receive £176.45 each week, or £705.80 every four-week pay period.

State Pension uprating predictions for 2026/27

The Triple Lock is currently on track to be determined by the earnings growth element which is currently at 5.5 per cent. However, this figure may go up or down and isn’t the final metric that will determine the level of uprating.

The next CPI figure will be published by the ONS on July 17.

That being said, a 5.5 per cent increase on the current State Pension would see people receive the following amounts.

Full New State Pension

- Weekly: £242.90

- Four-weekly pay period: £971.60

- Annual amount: £12,630.80

Full Basic State Pension

- Weekly: £186.25

- Four-weekly pay period: £744.60

- Annual amount: £9,679.80

The annual uprating won’t be confirmed until the Autumn Budget, but pensioners – and those due to retire next year – can start to plan their finances by following the Triple Lock measurements. The September CPI figure will be published in mid-October, but the wages growth figure is usually published in August.

Get the latest Record Money news

Get the latest Record Money news

Join the conversation on our Money Saving Scotland Facebook group for money-saving tips, the latest State Pension and benefits news, energy bill advice and cost of living updates.

Sign up to our Record Money newsletter and get the top stories sent to your inbox daily from Monday to Friday with a special cost of living edition every Thursday – sign up here.

You can also follow us on X (formerly Twitter) @Recordmoney_ for regular updates throughout the day or get money news alerts on your phone by joining our Daily Record Money WhatsApp community.