Wednesday 16 July 2025 1:38 pm

Share

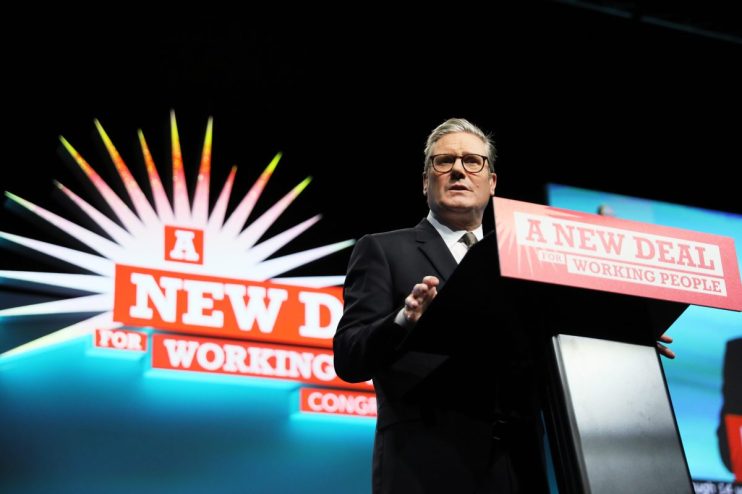

Keir Starmer has refused to rule out a pension tax raid.

Keir Starmer has refused to rule out a pension tax raid.

Prime Minister Keir Starmer shied away from ruling out a pensions tax raid at the Autumn Budget despite top researchers’ calls for the government to refrain from adding ever-higher cost burdens on Britons.

Keir Starmer has faced repeated questions about several taxes being introduced later this year given City estimates that as much as £24bn extra will have to be raised to cover expenditure for the next five years.

During Prime Minister’s Questions on Wednesday, Starmer stuck firmly to the government’s line on refusing to comment on Budget plans.

He blamed the previous Conservative government for its poor record on the UK economy in response to opposition leader Kemi Badenoch’s prompts about taxes on pension contributions, which could take place if the government reduces the current 40 per cent rate of tax relief for higher earners.

“We made absolutely clear manifesto commitments which she asked me about last week and we’re keeping to it: I’m not going to write the budget months out.”

“I’m proud of the decisions that we took to invest in our NHS, to invest in our public services, all the decisions that they opposed.

“It’s no wonder that after a first year of a Labour government, business confidence is [at] a nine-year high” he added, referring to a recent business survey by Lloyds seen as something of an outlier among surveys that tend to show a significant slump in corporate optimism.

“I’ll tell you what’s bad for growth: 14 years of a Tory government – stagnant growth for 14 years.”

Read more

Keir Starmer refuses to rule out £40bn tax raid

Pensions tax alternatives offered

Starmer’s latest refusal to comment on taxes follows the Office for Budget Responsibility (OBR) chief Richard Hughes’ warning that the UK could not afford to see the tax burden grow further as it was already at record highs.

“It needs to bear in mind that higher and higher levels of taxes are also not good for growth,” Hughes told MPs on Tuesday.

Top researchers are also now scrutinising tax changes announced at the last Autumn Budget, fearing the inclusion of inheritance tax on pensions could fail to work as intended.

Researchers at Oxford Economics, backed by The Investing and Saving Alliance and firms including AJ Bell and Hargreaves Lansdown, urged the government to add a standalone flat rate on unused pension funds over a certain threshold.

Their report on “simpler alternatives” to taxing unused pension wealth also urges the government to allow people whose deceased family member’s pension pots add up to less than £90,000 to pay no tax on the sum.

Economic modelling suggests the government would raise the same level of revenue without creating “delays for grieving families” and affecting “behavioural change among consumers that we don’t fully understand”, according to TISA head of retirement Renny Biggins.

Tom Selby, director of public policy at AJ Bell said current measures in place were “arguably the most complex, time-consuming way” of raising cash.

Other ways the government could tax workers and save more include lowering the pensions annual allowance from £60,000 and lowering limits for tax-free cash from pensions.

Read more

Starmer thanks business for shouldering tax burden

Similarly tagged content:

Sections

Categories

People & Organisations