Borrowing in Northern Ireland is 21% higher than the UK average, but many residents struggle to spot reputable lenders, according to new research.

A recent survey by Loqbox, the UK’s leading credit-building business, in partnership with Censuswide, has unveiled critical insights into how people in Northern Ireland are managing personal borrowing—and where many are getting it wrong.

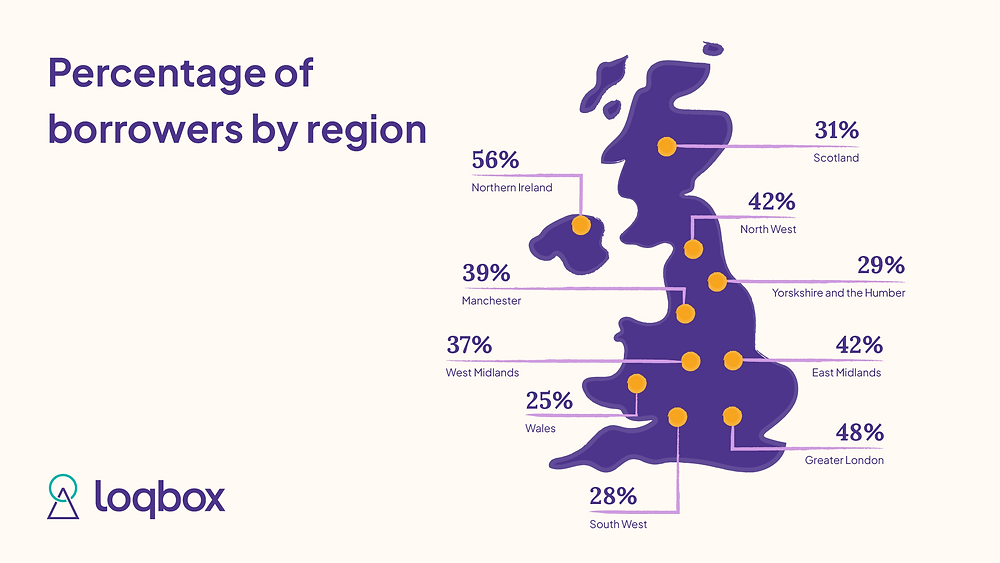

The study found that 52% of people in Northern Ireland borrowed money in the past year, a figure that is 21% above the national UK average. Yet despite this high borrowing rate, financial confidence appears lacking, with one in three (33%) respondents admitting they don’t feel confident identifying trustworthy lenders—the highest level of uncertainty recorded across all UK regions.

What are people borrowing and why?

Among the forms of credit used, personal loans (57%) were most popular, closely followed by credit cards (50%). The majority of borrowers took out loans of less than £5,000 (44%), though 7% borrowed sums greater than £5,000.

When choosing a lender, Northern Ireland respondents cited benefits offered (36%) and transparency in fees and charges (21%) as the most influential factors. However, this doesn’t always translate into responsible borrowing behaviour.

Only 37% of people consistently consider their ability to make repayments long term, and just a quarter (25%) always read the small print in loan agreements—both factors which can lead to serious financial consequences.

BNPL used for essentials

Alarmingly, the survey found that 14% of respondents used Buy Now, Pay Later (BNPL) services to pay for essentials like food or fuel—a figure 3% higher than the UK average. This rising dependency on BNPL suggests a worrying trend in which short-term borrowing is being used to plug essential spending gaps.

Tom Eyre, CEO and Co-Founder of Loqbox, expressed concern over the findings:

“It’s concerning to see that while borrowing in Northern Ireland is significantly above the UK average, so many people lack confidence in identifying reputable lenders. This uncertainty can lead to risky borrowing decisions.

“At Loqbox, we believe that borrowing should work for you, not against you. Everyone deserves to feel in control of their finances and make informed decisions that truly work for them.”

Financial education: a missing piece

The research highlights a clear need for greater financial education to bridge the gap between borrowing habits and smart financial management.

“There’s an urgent need for clearer communication and better financial education, empowering consumers to make informed, confident choices about their borrowing,” Tom added.

He warned of the dangers facing those who struggle to assess lenders properly:

“With one in three people in Northern Ireland struggling to tell the difference between reputable and unreliable lenders, there’s a real risk that people could take on credit that doesn’t work for them. That’s why financial education is so important – it gives people the power to borrow safely and on the right terms for their circumstances.”

A practical guide to smarter borrowing

To help tackle the issue, Loqbox has released a new free resource: ‘How to borrow money: What people get wrong and how to get it right’. The guide offers accessible explanations of borrowing terminology like APR, repayment terms, and how to verify a lender’s legitimacy via the FCA’s Financial Services Register.

It also includes actionable tips such as:

-

Setting up repayment reminders

-

Keeping a low credit utilisation rate

-

Using budgeting apps to track expenses

-

Evaluating the risks of BNPL offers

“When people have the right financial knowledge, they’re better equipped to navigate credit cards and loans with confidence — sidestepping traps like sky-high interest rates and unmanageable repayments,” said Tom Eyre.

“But financial literacy isn’t just about avoiding risks; it’s a powerful tool for unlocking opportunities. From building a strong credit history to securing better borrowing terms, understanding how to use credit wisely can help people turn their financial aspirations into reality.”

Want to learn more?

Loqbox’s full guide and research findings are available to download here.

To find out more, take a look at the full report here.