Literature review

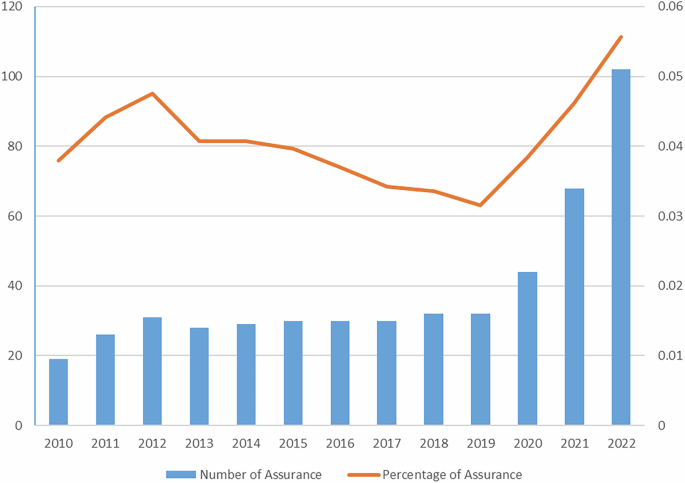

The literature relevant to this paper can be categorized into two main streams: the first focuses on the economic consequences of SRA, and the second explores the factors influencing corporate employment decisions. In the first stream, previous studies have revealed the impacts of SRA on corporate behavior or performance, capital market reactions, and stakeholders’ decisions. In terms of capital market reactions, research has indicated that SRA can reduce stock price volatility, increase the number of institutional investors (Dhaliwal et al. 2012), and improve the accuracy and coverage of analyst forecasts (Casey and Grenier 2015). Regarding corporate behavior or performance, studies have confirmed that SRA can enhance the credibility and quality of information disclosure (Moroney et al. 2012; Michelon et al. 2015; Ballou et al. 2018), improve corporate reputation (O’Dwyer et al. 2011; Birkey et al. 2016; Sethi et al. 2017), and lower corporate capital costs (Martínez-Ferrero and García-Sánchez 2017). It is worth noting that the actual impact of SRA on corporate value remains uncertain. Regarding the impact on stakeholders’ decisions, existing literature has revealed that SRA positively affects investors’ willingness to invest (Cheng et al. 2015) and enhances bank confidence (Quick and Inwinkl 2020). Furthermore, recent research highlights the role of internal corporate governance mechanisms in shaping the quality and effectiveness of sustainability disclosures. Internal factors such as executive turnover and board gender diversity may also influence the credibility and impact of such disclosures (Rauf et al. 2021; Naveed et al. 2023).

The second stream of literature explores the factors affecting corporate employment from the perspective of sustainability. However, there is little research directly studying how sustainability affects employment structure; most studies examine the impact of green development on employment scale indirectly from the perspective of macro-level environmental regulation policies (Ren et al. 2020; Liu et al. 2021). The existing literature presents diverse and complex conclusions regarding the relationship between environmental regulations and employment scale, which can be categorized into three main perspectives: employment suppression, employment promotion, and no significant impact on employment. The employment suppression perspective argues that environmental regulations increase firms’ compliance costs, which in turn negatively affect labor demand (Walker 2011; Liu et al. 2021). The employment promotion perspective is primarily based on the Porter Hypothesis, which suggests that well-designed environmental regulations can effectively stimulate employment. Such regulations “compel” firms to adopt environmental protection measures, such as modifying green innovation models, strengthening research and development in green technologies, implementing environmental management practices, and investing in pollution control equipment (Li and Gao 2022). The implementation of these measures requires additional labor, leading to a net increase in corporate labor demand, which manifests as the green employment effect (Bezdek et al. 2008; Ren et al. 2020). Among them, the study by Liu and Nemoto (2021), which explores the positive impact of sustainability information disclosure on employee attraction, is the most relevant to this paper. It provides a valuable theoretical foundation and research insights for this study. Finally, some studies suggest that environmental regulations have no significant impact on labor demand. In summary, existing literature primarily focuses on the employment or unemployment effects of environmental regulations from a scale perspective, with less consideration given to the impact of environmental regulations on the adjustment of corporate employment structure. Unlike the aforementioned studies, this paper focuses on exploring the impact and mechanisms of SRA on corporate employment decisions from the perspective of employment structure.

Theoretical analysis and hypothesis developmentSRA and corporate employment structure

As a third-party external governance mechanism, SRA can be seen as a process of verifying and enhancing the credibility of sustainability information. Assurance providers, through professional assessments and assurance procedures, conduct an independent third-party review of the sustainability information disclosed by firms, thereby functioning as a “filter” or “gatekeeper” in the information transmission chain, ultimately enhancing the credibility of sustainability reports (Clarkson et al. 2019; Pinnuck et al. 2021). The enhanced credibility not only conveys positive signals to external stakeholders but also effectively mitigates information asymmetry between the firm and its external stakeholders (Pflugrath et al. 2011; Casey and Grenier 2015), providing a solid foundation for further influencing the decision-making of external stakeholders. Based on this, how does SRA further impact corporate employment structure?

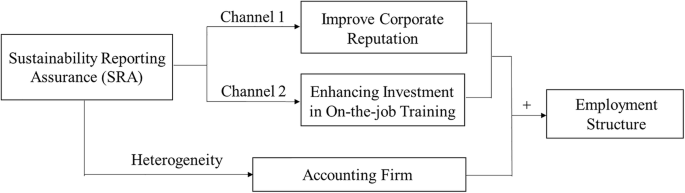

Corporate reputation and investment in on-the-job training are important factors influencing corporate employment structure (Lange et al. 2011; Mvuyisi and Mbukanma 2023). This paper argues that SRA impacts corporate employment structure through two channels: on the one hand, it affects employment structure by enhancing corporate reputation; on the other hand, it influences employment structure by increasing corporate investment in on-the-job training. This ultimately results in an increased proportion of high-skilled employees and a decreased proportion of low-skilled employees. The relevant theoretical framework is shown in Fig. 2. Next, this paper will provide a detailed analysis based on the above logic.

Fig. 2

Enhancing corporate reputation

In an environment of information asymmetry, a company’s reputation, as an intangible asset, helps reduce information asymmetry between the firm and external stakeholders, particularly potential job applicants. As a third-party external governance mechanism, SRA enhances the credibility of a company’s sustainability information disclosure (Casey and Grenier 2015), further transmitting positive signals about the company’s employee care, environmental governance, and social responsibility to external stakeholders. This helps to shape a more credible and reputable image for the company (O’Dwyer et al. 2011; Birkey et al. 2016). Given that employment contracts cannot fully encompass all aspects of a company’s and employees’ development, a strong corporate reputation can serve as a trust endorsement in this context, helping firms attract labor in the job market and reduce employee turnover rates. Although this attractiveness applies to all employees, high-skilled and low-skilled employees display different decision-making preferences regarding corporate reputation.

High-skilled employees, when making employment decisions, not only consider economic benefits such as salary but place greater emphasis on corporate social responsibility, long-term development potential, and sustainable business practices (Turban and Greening 1997). Prior studies have demonstrated that firms’ efforts in ESG practices can effectively stimulate green innovation behavior, thereby attracting high-skilled talent who value sustainability and long-term development (Rauf et al. 2023; Rauf et al. 2024). In this process, the corporate social values and environmental governance commitments conveyed through SRA become important reference factors for high-skilled employees in selecting an employer. Given that high-skilled employees typically seek to join companies that offer career development opportunities and align with their personal values, the reputation enhancement brought by SRA has a relatively stronger attraction for high-skilled labor. Compared to high-skilled employees, low-skilled employees’ recruitment decisions are more driven by short-term economic benefits. They tend to pay less attention to a company’s social responsibility and long-term development potential (Lange et al. 2011), focusing more on salary and immediate job opportunities. As a result, the reputation enhancement brought by SRA has a relatively weaker attraction for low-skilled labor. Therefore, as a company’s reputation improves due to SRA, it is likely to attract more high-skilled talent than low-skilled labor in the job market, thereby increasing the proportion of high-skilled employees and decreasing that of low-skilled employees.

In summary, this paper proposes the following research hypotheses:

H1: SRA can significantly affect corporate employment structure, manifested by an increase in the proportion of high-skilled employees and a decrease in that of low-skilled employees, holding other conditions constant.

H1a: SRA affects corporate employment structure by enhancing corporate reputation.

Increasing investment in on-the-job training

Human capital theory suggests that a company’s investment in employee training and education can directly enhance their technical skills (Mvuyisi and Mbukanma 2023). This not only improves the technical level of high-skilled employees but also provides an opportunity for low-skilled employees to undergo transformation and upgrade. First, SRA enhances the credibility of non-financial information received by investors and creditors, reducing the perceived risk for investors (García-Sánchez et al. 2019; Quick and Inwinkl 2020), thereby alleviating the company’s financing constraints. The improved financing environment allows companies to access more financial resources, enabling them to increase investment in on-the-job training. Secondly, as a third-party external governance mechanism, SRA helps companies identify potential sustainability risks. During the assurance process, weaknesses in employee development are exposed, prompting companies to formulate corresponding improvement plans, which include encouraging increased investment in on-the-job training. The increase in investment in on-the-job training not only further enhances the professional skills and job adaptability of existing high-skilled employees but also provides an opportunity for some employees originally in low-skilled positions to gradually acquire the knowledge and skills required to perform more complex tasks. This facilitates their transition from low-skilled to high-skilled roles. Therefore, as SRA leads to increased investment in on-the-job training, companies overall improve the technical capabilities of their employees, manifested by an increase in the proportion of high-skilled employees and a decrease in that of low-skilled employees.

In summary, this paper proposes the following research hypotheses:

H1: SRA can significantly affect corporate employment structure, manifested by an increase in the proportion of high-skilled employees and a decrease in that of low-skilled employees, holding other conditions constant.

H1b: SRA affects corporate employment structure by increasing investment in on-the-job training.

Differences in the impact of assurance provider types on corporate employment structure

Assurance providers can be roughly categorized based on their nature into the following types: accounting firms, consulting agencies, industry associations, and expert certifications. Alternatively, assurance providers can be simply divided into accounting firms and non-accounting firms (Edgley et al. 2015). The quality of assurance directly affects the effectiveness of assurance services (O’Dwyer and Owen 2005). The Global Reporting Initiative also sets requirements for assurance quality: the assurance provider of a sustainability report should be independent of the reporting entity and conduct assurance in a systematic, documented manner, following professional assurance standards. However, the quality of assurance varies significantly among different types of assurance providers (Shen et al. 2017). Due to their specialized background in accounting and auditing, accounting firms possess higher professionalism and independence (Knechel and Willekens 2006), and are generally believed to provide higher quality assurance services (Steinmeier and Stich 2019). Additionally, accountants must adhere to strict professional and ethical standards, resulting in higher market and investor trust in the assurance services provided by accounting firms (Hodge et al. 2009; Pflugrath et al. 2011; Moroney et al. 2012).

Therefore, due to their professionalism and independence, accounting firms provide higher quality assurance, which better enhances corporate reputation and increases investment in on-the-job training, thereby more effectively influencing corporate employment structure. In summary, this paper proposes the following research hypothesis:

H2: Compared to non-accounting firms, the SRA provided by accounting firms has a more pronounced impact on corporate employment structure.