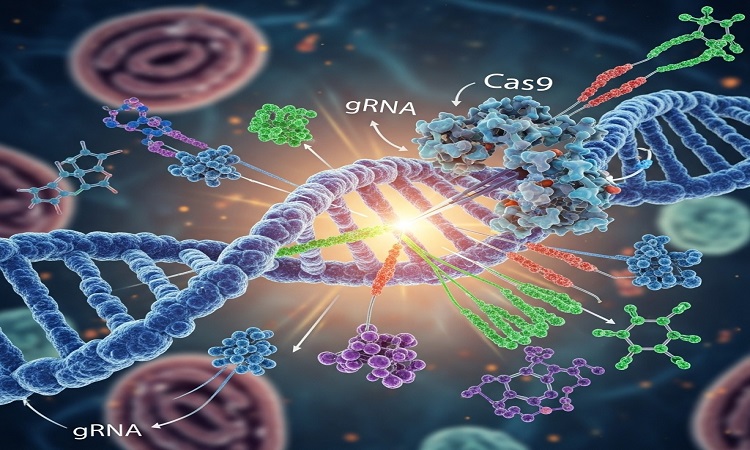

The gene editing market represents one of the most transformative sectors in modern biotechnology, fundamentally reshaping how we approach genetic diseases, agricultural development, and therapeutic innovation. This revolutionary field enables scientists to precisely modify DNA sequences within living organisms, offering unprecedented opportunities to treat previously incurable conditions and enhance biological systems. The market’s remarkable growth trajectory reflects increasing recognition of gene editing’s potential across multiple industries, from healthcare and pharmaceuticals to agriculture and industrial biotechnology. Driven by technological breakthroughs like CRISPR-Cas9, expanding applications in therapeutic development, and growing investment in genomic research, the gene editing market has emerged as a cornerstone of next-generation healthcare solutions. The convergence of artificial intelligence with gene editing technologies, coupled with supportive regulatory frameworks and rising prevalence of genetic disorders, continues to fuel market expansion and innovation across global markets.

Download Sample Report (Get Full Insights In PDF- 191+ Pages) at: https://www.vantagemarketresearch.com/gene-editing-market-2402/request-sample

According to analysts at Vantage Market Research, The global Gene Editing Market is valued at USD 9.3 Billion in 2024 and is projected to reach a value of USD 46.62 Billion by 2035 at a CAGR (Compound Annual Growth Rate) of 15.85% between 2025 and 2035.

Top Key Players

- Lonza Group Ltd. (Switzerland)

- Perkinelmer Inc. (U.S.)

- CRISPR Therapeutics AG (Switzerland)

- Thermo Fisher Scientific Inc. (U.S.)

- Eurofins Scientific (Luxembourg)

- Aglient Technologies Inc. (U.S.)

- Danaher Corporation (U.S.)

- Genscript Biotech Corporation (U.S.)

- Merck KGAA (Germany)

- Editas Medicine Inc. (U.S.)

Market Dynamics

The gene editing market operates within a complex ecosystem of technological innovation, regulatory evolution, and increasing therapeutic demand. Multiple market research firms project substantial growth, with the market expected to expand from approximately $9.8 billion in 2025 to between $25 billion and $44.95 billion by the early 2030s, representing compound annual growth rates ranging from 16.1% to 17.8%. This robust growth stems from several interconnected factors, including the success of preclinical models driving demand for genome editing therapeutics, rising competition among market participants for business development opportunities, and technological advancements making gene editing more accessible and affordable. The integration of artificial intelligence models into medical care systems has enhanced clinicians’ ability to make informed decisions about gene editing interventions, providing insights into potential genetic conditions and predicting patient responses to specific treatments. Supply chain dynamics have also evolved significantly, with automation in assembly lines for CAR-T cell manufacturing and CRISPR kits effectively reducing production expenses by 20% since 2021, while investments in research, development, and deployment reached $5.2 billion as of 2023, with 70% allocated specifically to therapeutics development. Regulatory harmonization across major markets, including the EU’s reviewed ATMP Regulation streamlining gene therapy approvals and China’s NMPA fast-tracking multiple therapies, has created a more favorable environment for market expansion.

Key Segment Covered

By Product & Service

- Reagents & Consumables

- Software & Systems

- Services

By Technology

- CRISPER

- TALEN

- ZFN

- ANTISENE

- Other Technologies

By Application

- Cell Line Engineering

- Genetic Engineering

- Drug Discovery & Development

- Other Applications

By End User

- Pharmaceutical & Biotechnology Companies (55.0%)

- Academic & Research Institutes (30.0%)

- Other End Users (15.0%)

Read Full Research Report with TOC: https://www.vantagemarketresearch.com/industry-report/gene-editing-market-2402

Top Trends

The gene editing landscape is experiencing several transformative trends that are reshaping the industry’s trajectory and applications. CRISPR-Cas9 technology continues to dominate the market, expected to hold approximately 67.5% market share by 2034, driven by its affordability, scalability, and precision compared to alternative options like TALENs and ZFNs. The technology’s modular design has enabled rapid customization, reducing development duration by 46% and facilitating breakthrough therapeutic applications. Therapeutic applications are leading market growth, with FDA-approved treatments like Casegevy for sickle cell disease generating significant revenue streams, as evidenced by CRISPR-related therapies from companies like Vertex generating $625 million in sales as of 2023. Agricultural and livestock applications are expanding rapidly, with gene editing technologies being used to develop genetically modified crops with improved traits and enhance disease resistance and growth rates in livestock. Manufacturing innovations are driving cost efficiencies, with automated CRISPR assembly lines successfully reducing per-unit expenses by 30%, while companies like Thermo Fisher Scientific have invested heavily in viral vector manufacturing capabilities. Asia Pacific markets are emerging as growth engines, particularly China, which has allocated $5.5 billion for CRISPR commercialization and research as of 2024, with the NMPA fast-tracking four gene therapies including the world’s first CRISPR-based cancer treatment solutions. The integration of artificial intelligence and machine learning technologies is enhancing various aspects of the genome editing process, from target identification to treatment optimization.

Top Report Findings

- The global gene editing market is valued at USD 9.3 billion in 2024 and is projected to reach USD 46.62 billion by 2035, with a CAGR of 15.85% from 2025 to 2035.

- North America holds the largest market share, driven by advanced healthcare infrastructure, significant R&D investments, and supportive regulatory frameworks.

- The CRISPR segment dominates the technology landscape, with applications in both therapeutics and agriculture.

- Cell line engineering and reagents/consumables are leading product segments, reflecting high demand in research and clinical settings.

- The Asia Pacific region is expected to experience the fastest growth, fueled by rising healthcare investments and expanding biotechnology capabilities.

- Key players in the market include Thermo Fisher Scientific, Synthego, Precision BioSciences, Ginkgo Bioworks, and Agilent Technologies.

- Strategic collaborations, licensing agreements, and government funding are accelerating innovation and market expansion.

- The market is witnessing increased adoption of gene editing in agriculture, with a focus on developing disease-resistant and high-yield crops.

Challenges

Despite its tremendous potential, the gene editing market faces significant challenges that could impact its growth trajectory and widespread adoption. Ethical considerations remain paramount, particularly regarding germline editing and the long-term implications of genetic modifications, creating ongoing debates within scientific and regulatory communities about appropriate boundaries and applications. Regulatory complexity presents substantial hurdles, as different countries maintain varying approval processes and safety standards, creating challenges for companies seeking global market access and consistent product development pathways. Supply chain vulnerabilities have become increasingly apparent, with the U.S. dependency on imported viral vectors rising to 58% as of 2023, exposing risks in manufacturing and distribution networks that could disrupt product availability. Technical limitations persist in delivery mechanisms and targeting precision, particularly for in-vivo applications where ensuring specific tissue targeting and minimizing off-target effects remain ongoing challenges. High development costs and lengthy clinical trial processes continue to burden smaller companies and limit innovation, while intellectual property disputes surrounding key technologies like CRISPR create uncertainty for market participants. Public acceptance varies significantly across different regions and applications, with consumer concerns about genetically modified products potentially limiting market adoption in certain sectors, particularly agriculture and food production.

Opportunities

The gene editing market presents extraordinary opportunities for growth and innovation across multiple sectors and applications. Expanding therapeutic applications offer immense potential, particularly in addressing rare genetic diseases where traditional treatments have proven ineffective, with over 2.7 million patients in China alone suitable for gene therapy treatments. Agricultural biotechnology represents a significant growth avenue, as gene editing technologies enable the development of crops with enhanced nutritional profiles, improved disease resistance, and better adaptability to climate change, addressing global food security challenges. Industrial biotechnology applications are emerging rapidly, including the development of biofuels and bio-manufacturing processes that leverage genetically modified organisms for sustainable production methods. Personalized medicine opportunities continue expanding as costs decrease and precision improves, enabling targeted treatments based on individual genetic profiles and disease characteristics. International market expansion presents substantial prospects, particularly in emerging economies where government investment and regulatory support are increasing, as demonstrated by South Korea’s 2030 Bio-Vision allocating $2.3 billion for gene editing development. Strategic partnerships and vertical integration opportunities abound, with pharmaceutical and biotechnology companies increasingly seeking to acquire capabilities across the gene editing value chain, from research tools to manufacturing and delivery systems. Novel delivery mechanisms and combination therapies offer pathways to overcome current technical limitations while expanding the range of treatable conditions and improving patient outcomes.

Key Questions Answered in the Report

- What is the current market size and projected growth trajectory for the global gene editing market?

- Which technologies dominate the gene editing landscape, and how are market shares distributed among different approaches?

- What are the primary applications driving demand for gene editing products and services across different industries?

- How do regulatory frameworks vary across major markets, and what impact do they have on product development and commercialization?

- Which regions show the highest growth potential for gene editing technologies, and what factors contribute to regional market dynamics?

- What are the key technological innovations and breakthroughs shaping the future of gene editing capabilities?

- How are supply chain dynamics evolving, and what challenges do companies face in manufacturing and distribution?

- What role do strategic partnerships and mergers and acquisitions play in market consolidation and competitive positioning?

- What are the primary investment trends and funding patterns supporting gene editing research and development?

- How do ethical considerations and public acceptance influence market development across different applications and regions?

- What are the emerging applications and novel use cases that could drive future market expansion?

- How do cost structures and pricing models vary across different gene editing technologies and applications?

Regional Analysis

The global gene editing market exhibits distinct regional characteristics, with North America maintaining market leadership, accounting for approximately 44.45% of the global market in 2024. This dominance stems from the region’s robust research infrastructure, well-established biotechnology sector, and high levels of government and private investment in genomic research. The United States specifically held a market value of $3.13 billion in 2024 and is projected to reach $14.82 billion by 2034, growing at a CAGR of 16.82%. Government initiatives, such as the NIH’s All of Us Program aiming to sequence 1.5 million genomes, have significantly boosted demand for precision therapies and supporting technologies. Europe represents a significant market presence, benefiting from progressive regulatory frameworks and strong pharmaceutical industries, though specific market share data varies across sources. The European Union’s reviewed ATMP Regulation has streamlined gene therapy approvals, creating a more favorable environment for market development. Asia Pacific emerges as the fastest-growing region, with an expected market share of 22.2% during the forecast period, driven primarily by China’s dominance at 48.5% of the region’s CRISPR market. China’s aggressive investment strategy, including $5.5 billion allocated for CRISPR commercialization and research, coupled with the NMPA’s fast-tracked approval of four gene therapies, positions the country as a major growth driver. India contributes through generic collaborations and increased government spending, while South Korea’s 2030 Bio-Vision has allocated $2.3 billion for gene editing development. Latin America and the Middle East & Africa represent emerging markets with growing potential, though they currently maintain smaller market shares while developing their biotechnology infrastructure and regulatory frameworks.