(Bloomberg) — European stocks retreated as lingering concerns that higher levies would crimp corporate earnings replaced optimism around a US trade deal.

Most Read from Bloomberg

The Stoxx Europe 600 Index fell 0.2% by the close, after initially rallying as much as 0.9% as the US and the European Union made a tariff agreement that will see the bloc face 15% tariffs on most of its exports, including autos.

Trade-exposed automakers reversed direction to drop 1.8%. Analysts said that while the deal provides clarity on the business outlook, levies are still above levels seen before President Donald Trump’s second term, adding pressure on earnings.

“We’re taking some positives from the deal as it takes away left tail risks of escalation, but there are still some uncertainties in sectors such as pharmaceuticals, aluminum and steel,” said Thushka Jeannequin, a global strategist at JPMorgan Asset Management in Paris. “We need more details but broadly we remain constructive on growth in the euro area.”

Automaker Stellantis NV fell 2.7% after earlier jumping as much as 4.6%. Volkswagen AG, Mercedes-Benz Group AG and Porsche AG also erased gains. On the other hand, auto parts suppliers Valeo SE and Forvia SE advanced 0.7% and 13%, respectively. The Stoxx 600 autos sector is down 2.2% this year, missing out on Europe’s broader rally.

Luxury goods maker LVMH was little changed, while drinks makers Diageo Plc and Pernod Ricard SA slipped.

Defense stocks including Rheinmetall AG, Hensoldt AG and Renk Group AG retreated as the deal calls for Europe to buy military equipment from the US. A Bloomberg index of defense firms remains 68% higher on the year.

What Bloomberg Strategists Say…

“As with all the deals the US has signed, the agreement is worse than the status quo, but what’s important in the world of markets is that it’s not as bad as initially feared. A new rate will impact prices and margins a bit, but not by enough to decimate consumption, which might have been the case with a higher levy.”

— Simon White, Macro Strategist. Click here for the full analysis

Other strategists said the agreement would boost stocks longer-term as it has averted fears of a prolonged trade war.

The deal is “good enough to unlock what equity markets needed most: visibility,” said John Plassard, head of investment strategy at Cité Gestion. “Tariff escalation risk is now off the table, and with that, a major macro overhang disappears. For investors, that’s not just a sigh of relief, it’s a green light.”

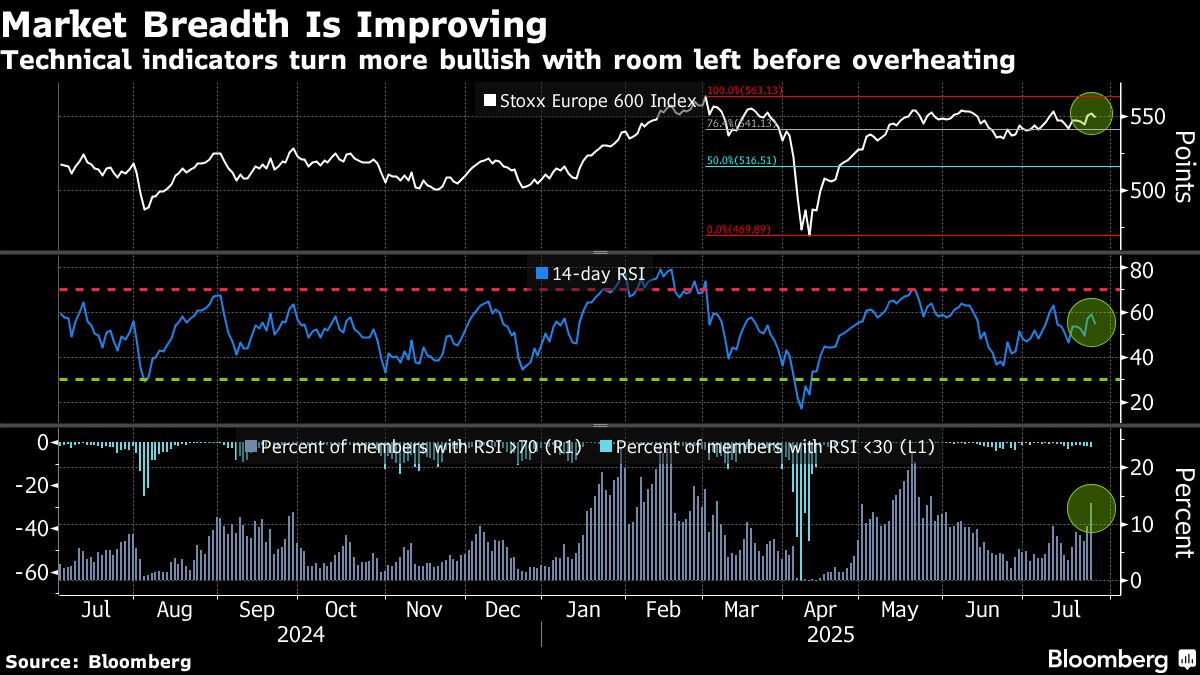

European stocks have been range-bound since May due to jitters around the outlook for global trade. A UBS Group AG basket of stocks sensitive to tariffs has underperformed this year, suggesting there’s room for the group to catch up to the broader regional benchmark.

For more on equity markets:

-

European Market Breakout Is Getting Closer Now: Taking Stock

-

M&A Watch Europe: MFE Raises ProSieben Bid, Mediobanca, Sabadell

-

US Stock Futures Rise

You want more news on this market? Click here for a curated First Word channel of actionable news from Bloomberg and select sources. It can be customized to your preferences by clicking into Actions on the toolbar or hitting the HELP key for assistance. To subscribe to a daily list of European analyst rating changes, click here.

–With assistance from Julien Ponthus, Michael G. Wilson, Kurt Schussler, David Goodman and Michael Msika.

Most Read from Bloomberg Businessweek

©2025 Bloomberg L.P.