European defence companies are having another strong earnings season, with research showing that UK investors don’t think their growth will stop here, as they bet the sector will outperform in the second half.

Rolls-Royce (RR.L) shares hit a new high on Thursday morning, jumping nearly 11% in early trading after reporting a 50% rise in half-year profits.

The FTSE 100-listed (^FTSE) aero-engineer, which is up 91% year-to-date, reported an underlying operating profit of £1.76bn in the first half of the year, versus £1.15bn a year ago.

Underlying revenue of £9.06bn was also up on the £8.18bn Rolls-Royce reported in the first half of last year.

Read more: Mercedes-Benz, Porsche and Aston Martin among latest carmakers hit by Trump’s tariffs

On the back of its strong performance, Rolls-Royce raised its full-year guidance, saying it now expected underlying operating profit to come in at between £3.1bn and £3.2bn for 2025, versus its previous forecast of £2.7bn to £2.9bn. It said it now expected to report free cash flow in the range of £3bn to £3.1bn in 2025, compared to previous guidance of £2.7bn to £2.9bn.

Neil Wilson, UK investor strategist at Saxo Markets, said: “Strategy and execution [are] nearly flawless, combined with powerful secular tailwinds in defence and aerospace, make for a stock that’s about 13 times from its lows in late 2022.

He highlighted that the company posted “beats in aerospace and power systems and [was] only slightly behind in defence, which is probably just a budget timing thing really – defence spending [is] coming down the pipe.”

LSE – Delayed Quote • USD

As of 14:18:10 BST. Market open.

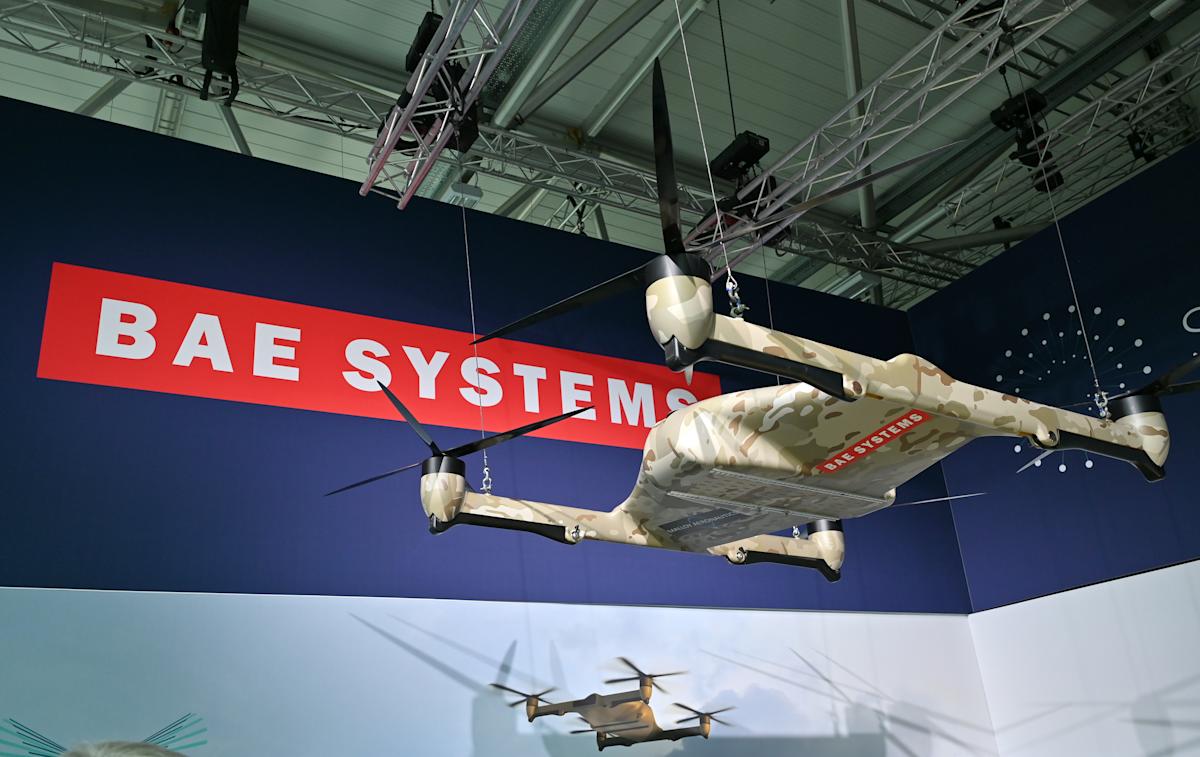

Rolls-Royce’s results come after BAE Systems (BA.L) released its first-half figures on Wednesday morning. BAE reported first half sales of £14.6bn, just ahead of expectations of around £14.5bn. Underlying earnings before interest and tax (EBIT) came in at £1.55bn, which topped estimates.

BAE also raised its guidance for the year, expecting sales growth of between 8% and 10%, up from a previous estimate of 7% to 9%. Underlying EBIT was expected to grow by 9% to 11%, versus previous guidance of 8% to 10%.

Despite beating expectations on the top and bottom lines, shares dipped following the release of the results. This came as the company’s new orders came in at £13.2bn for the six months ended 30 June, which was lower than the £15.1bn reported a year ago. However, the company’s order backlog stood at £75.4bn at the half-year point, which was just shy of record levels.

Garry White, chief investment commentator at Charles Stanley, said that BAE is “operating in an industrial sweet spot, as defence budgets worldwide grow. With Nato now focusing a significant amount of its expenditure on digital defence, there remains a significant opportunity for its cybersecurity business too.”

Story Continues

The jump in Rolls-Royce shares on Thursday also lifted BAE’s stock, sending it nearly 2% higher in early afternoon trading, contributing to a 58% gain year-to-date.

Shares in Italian defence company Leonardo (LDO.MI) also rose on Thursday, trading 1.4% in the green by the early afternoon. The share price has soared 87% so far this year.

In its first half results, published on Wednesday, Leonardo reported a near 13% increase in revenue to €8.9bn. Earnings before interest, tax and amortisation (EBITA) rose 15% to €581m, while new orders were up 9.7% to €11.2bn.

Partly based on that performance, the company upgraded its guidance for new orders in 2025, now expecting this figure to come in the range of €22.25bn (£19.23bn) to €22.75bn, versus a previous estimate of around €20.9bn. Leonardo also confirmed that it expected to deliver revenues of approximately €18.6bn and EBITA €1.66bn for the year.

Separately, Leonardo announced later on Wednesday that it had agreed to buy the defence division of truck maker Iveco Group (IVG.MI) for €1.7bn, which it said would consolidate its position as a “leading player in the European land defence sector”.

Stocks operating in the sector have rallied this year as European leaders have pledged to spend more on defence. Western military alliance Nato said following a summit last month that members had committed to increasing spending on defence and related areas to 5% of their countries’ gross domestic product (GDP) by 2035.

Nato leaders said the pledge came “in the face of profound security threats and challenges, in particular the long-term threat posed by Russia to Euro-Atlantic security and the persistent threat of terrorism.”

There has also been increased pressure from the Trump administration for US allies to share more responsibility for security.

Stocks: Create your watchlist and portfolio

London-listed Babcock International (BAB.L) is another company whose share price has been boosted by such pledges, with the stock up 108% year-to-date. In its results last month, Babcock reported revenue of £4.8bn for the year ended 31 March 2025, up from £4.4bn last year, while operating profit rose to £363.9m, up from £241.6m in 2024.

One of the next big names to report in the sector will be Germany’s Rheinmetall (RHM.DE) on 7 August. Its share price has rocketed 183% so far this year, thanks to a strong performance.

While there are some questions as to how much further defence stocks can rise, a survey by trading platform IG found that UK retail investors believe that defence will outperform all other sectors over the next six months.

In the research, published on Wednesday, IG said this is the first time since the survey began that defence has taken the top spot. More than half (55%) of the 1,800 UK investors surveyed included defence in their top three growth sectors, compared to 45% for artificial intelligence related industries.

Read more:

Download the Yahoo Finance app, available for Apple and Android.