US job creation revised sharply lower

Newsflash: Employment growth across America has been much weaker than previously thought over the last three months – a sign that the US labor market may be cooling.

The latest non-farm payroll, just released, shows that US employment rose by just 73,000 in July, rather weaker than the 110,000 new jobs expected.

But the big shock comes in the latest revisions to payrolls, with previous estimates for both May and June being revised sharply lower.

The Bureau of Labor Statistics now estimates that just 19,000 new jobs were created in May, 125,000 fewer than the 144,000 previously estimated.

June’s data has been revised down too – showing that just 14,000 new jobs were created, not the 147,000 reported a month ago.

That means 258,000 fewer jobs were created in May and June than previously thought.

The US unemployment rate has risen to 4.2% from 4.1% in June.

This surprisingly weak data may be a sign that Donald Trump’s trade wars, and the associated uncertainty, have cause more damage to the US economy than previously thought. There could also be an impact from cost-cutting DOGE program pushed by Elon Musk.

The BLS says:

Employment continued to trend up in health care and in social assistance. Federal government continued to lose jobs.

Updated at 08.48 EDT

Key events

Show key events only

Please turn on JavaScript to use this feature

A cut to US interest rates in September looks “increasingly likely”, argues James Knightley, ING’s chief international economist.

Knightley says:

It is impossible to deny that the July jobs report is weak with non-farm payrolls rising 73k versus 104k consensus, but the most striking thing is the huge 258k downward revision to the past two months of data. June job gains, which were originally 147k, are now 14k and May’s initially reported gain of 144k is now 19k.

This puts a completely different light on what has been happening in the US economy post the 2 April ‘Liberation Day’ announcements.

Illustration: INGShare

Illustration: INGShare

Updated at 10.15 EDT

Some countries get reprieve in latest Trump tariffs Lisa O’Carroll

Lisa O’Carroll

Lesotho isn’t the only country to receive a reprieve from Donald Trump.

As flagged earlier (see here), Lesotho was facing 50% tariffs on 2 April, an existential threat to its textile industry, but came out on Friday with a 15% rate.

That’s a relief for a state which Trump said “nobody has ever heard of” when he halted USAID earlier this year.

Also getting a drastic reduction in tariffs are Madagascar, down from 47% on 2 April to 15% on 1 August, and Botswana, down from 37% to 15%

Liechtenstein, the wealthy European state best known as a financial centre, has seen rates slashed from 37% to 15%, while the Falkland Islands have gone from 41% to 10%.

Cambodia went from 49% to 19%, while Iraq only got a four-point reduction, from 39% to 35%

Updated at 10.17 EDT

Wall Street opens with a bump

Ding ding goes the opening bell on the New York Stock Exchange – the signal for an early burst of selling!

The main US stock indices have fallen sharply at the start of trading, as investors react to the flurry of tariffs announced last night and today’s weak US jobs report.

The Dow Jones industrial average (which contains 30 large US companies) has fallen by 1.1% at the start of trading, shedding 501 points to 43,629.

The broader S&P 500 index is down 1.2%, while the tech-focused Nasdaq has lost 1.5% – with Amazon falling almost 7% after issuing disappointing forecasts last night.

Today’s weak payroll report has punctured the narrative of a resilient US economy, says Kathleen Brooks, research director at XTB, explaining:

Tariffs have yet to meaningfully kick in, so the fact that jobs growth has been anemic at this early stage is worrying. As we start a new month and end the week, a new narrative about the US economy is emerging. It is one where the labour market is rapidly softening, where wage growth remains strong, which could pressurize corporate margins down the line, and where the US economy needs interest rate cuts.

For now, that narrative is bad news for global stocks.

Updated at 09.42 EDT

Most of the 73,000 jobs created across the US economy in July were in healthcare.

Today’s non-farm payroll report shows that healthcare added 55,000 jobs in July, above the average monthly gain of 42,000 over the prior 12 months. That includes 34,000 in “ambulatory health care services” and 16,000 at hospitals.

Social assistance employment rose by 18,000.

But on the other side of the ledger, federal government employment levels fell by 12,000 in July and are down by 84,000 since reaching a peak in January.

That won’t give a full insight into Doge-related job cuts, though, as employees on paid leave or receiving ongoing severance pay are counted as employed.

There was little change in employment levels in other major industries, including mining, quarrying, and oil and gas extraction; construction; manufacturing; wholesale trade; retail trade; transportation and warehousing; information; financial activities; professional and business services; leisure and hospitality; and other services, the Bureau for Labor Statistics adds.

Updated at 09.43 EDT

US jobs report: what the experts say

Today’s non-farm payrolls report does not paint a pretty picture, points out Nicholas Hyett, investment manager at investment service Wealth Club:

July’s job creation is slower than expected, but the bigger news is the major revision to May and June’s job numbers which are down a combined 258,000. If Fed governors were looking for reasons to cut interest rates, this is one.

The problem is that for all the extra clarity, these numbers still only show what’s happening in the rearview mirror. In hindsight, the journey so far has been bumpier and more precarious that it seemed at the time, but the road ahead is still clouded in fog. Just today, President Trump has reignited the global trade war with major knock-on effects for stock markets and the global economy. Investors and policymakers will be stuck slaloming through unexpected obstacles for some time yet.

Seema Shah, chief global strategist at Principal Asset Management, fears the US jobs market will keep weakening:

Not only was this a much weaker than forecast payrolls number, the monster downward revisions to the past two months inflicts a major blow to the picture of labor market robustness. What’s more concerning is that with the negative impact of tariffs only just starting to be felt, the coming months are likely to see even clearer evidence of a labor market slowdown.

Of course, with Powell emphasising his focus on the unemployment rate which has only ticked up to 4.2%, perhaps it is too early to press the panic button. The shrinking of labor supply is somewhat offsetting the weakness in labor demand, keeping the labor market in an uneasy state of equilibrium. Even so, the sheer weakness of today’s payrolls number means that Powell will have to take notice. The odds of a September cut just took a big leap higher.

Thomas Ryan, North America economist, agrees that today’s weak jobs report will embolden the dovish policymakers at the Federal Reserve who want to cut interest rates, saying:

The weak 73,000 rise in non-farm payrolls in July, combined with large downward revisions to May and June’s gains and an uptick in the unemployment rate to 4.2%, will strengthen the case for those on the [federal open market committee of the Federal Reserve] pushing for imminent interest rate cuts.

[Reminder, the Fed left rates on hold on Wednesday, in a split vote.]

Updated at 09.23 EDT

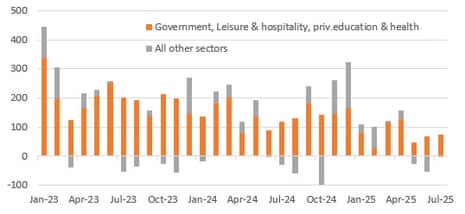

This chart shows just how bad the last three months have been for job creation in the US:

A chart showing US non-farm payroll dataShareTrump demands interest rate cut

Donald Trump has again repeated his plea for the US Federal Reserve to cut interest rates.

Shortly after today’s weak jobs report was released, Trump posted on his Truth Social site:

Too Little, Too Late. Jerome “Too Late” Powell is a disaster. DROP THE RATE! The good news is that Tariffs are bringing Billions of Dollars into the USA!

[Factcheck: tariffs are paid by the company or individual importing goods into the US. They only way they can “bring in dollars” is if the exporting company lowers its prices, to keep its goods competitive, meaning the importer doesn’t suffer a relative loss once it has paid the tariff.]

Updated at 09.20 EDT

US dollar slides after weak jobs report

The US dollar is being hammered on the foreign exchange markets, as today’s weak jobs report alarms traders.

The dollar index, which tracks the greenback against a basket of currencies, is now down 0.9% today.

The euro has surged by almost a cent and a half, to $1.154, while the pound is up three-quarters of a cent at $1.328.

Here’s snap reaction from Heather Long, chief economist at credit union Navy Federal:

This is a gamechanger jobs report.

The labor market now looks a lot weaker than expected.July job gains were a mere 73,000

June just 14,000

May just 19,000Note: 75% of the jobs in July came from healthcare

This puts a September rate cut from the Federal Reserve back on the… pic.twitter.com/AgmMJNAvuB

— Heather Long (@byHeatherLong) August 1, 2025

Today’s surprisingly weak US jobs report is causing ructions in the market.

The yields, or interest rates, on US government bonds are falling sharply – a sign that investors are piling into bonds because they expect cuts to US interest rates to support the economy, or are simply seeking a safe-haven asset.

Reuters has the details:

US. Treasury yields fell after data showed on Friday the world’s largest economy created fewer jobs than expected in July, increasing the odds that the Federal Reserve will resume cutting interest rates at the September meeting.

U.S. two-year yields, which are tied to the Fed’s monetary policy, dropped 14.2 bps to 3.811%.

UK government bond yields – which track the cost of Britain’s government borrowing – have also dropped.

ShareUS job creation revised sharply lower

Newsflash: Employment growth across America has been much weaker than previously thought over the last three months – a sign that the US labor market may be cooling.

The latest non-farm payroll, just released, shows that US employment rose by just 73,000 in July, rather weaker than the 110,000 new jobs expected.

But the big shock comes in the latest revisions to payrolls, with previous estimates for both May and June being revised sharply lower.

The Bureau of Labor Statistics now estimates that just 19,000 new jobs were created in May, 125,000 fewer than the 144,000 previously estimated.

June’s data has been revised down too – showing that just 14,000 new jobs were created, not the 147,000 reported a month ago.

That means 258,000 fewer jobs were created in May and June than previously thought.

The US unemployment rate has risen to 4.2% from 4.1% in June.

This surprisingly weak data may be a sign that Donald Trump’s trade wars, and the associated uncertainty, have cause more damage to the US economy than previously thought. There could also be an impact from cost-cutting DOGE program pushed by Elon Musk.

The BLS says:

Employment continued to trend up in health care and in social assistance. Federal government continued to lose jobs.

Updated at 08.48 EDT

Donald Trump’s tariff playbook is becoming clearer following last night’s announcement, says Paul Diggle, chief economist at Aberdeen Investments.

This playbook consists of:

-

A 10% global baseline tariff

-

A rate of at least 15% on countries with goods trade deficits with the US

-

An additional 40% on goods transhipped to evade higher rates elsewhere

-

A variety of new country-specific rates on smaller trading partners, such as 20% on Taiwan or 39% on Switzerland

-

Trump has also announced a 35% tariff on Canada, although the carve-out for USMCA-compliant trade remains [that’s the United States-Mexico-Canada Agreement]

Diggle adds that there are still plenty of uncertainties, including where US-China tariffs settle….