Space On Board Computing Platform Market Size and Share Forecast Outlook 2025 to 2035

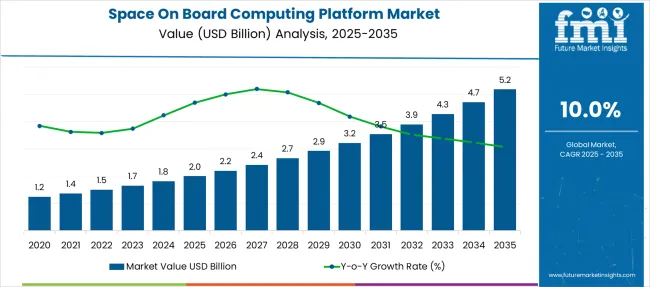

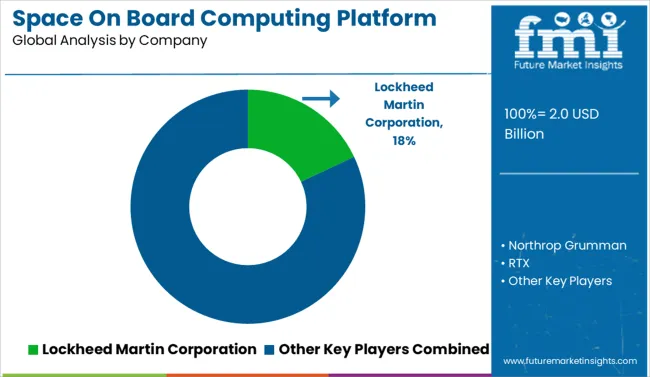

The Space On Board Computing Platform Market is estimated to be valued at USD 2.0 billion in 2025 and is projected to reach USD 5.2 billion by 2035, registering a compound annual growth rate (CAGR) of 10.0% over the forecast period.

Quick Stats for Space On Board Computing Platform Market

- Space On Board Computing Platform Market Value (2025): USD 2.0 billion

- Space On Board Computing Platform Market Forecast Value (2035): USD 5.2 billion

- Space On Board Computing Platform Market Forecast CAGR: 10.0%

- Leading Segment in Space On Board Computing Platform Market in 2025: Small Satellite (36.0%)

- Key Growth Regions in Space On Board Computing Platform Market: North America, Asia-Pacific, Europe

- Top Key Players in Space On Board Computing Platform Market: Lockheed Martin Corporation, Northrop Grumman, RTX, Honeywell International Inc., Boeing, BAE Systems, Thales Alenia Space

Space On Board Computing Platform Market Key Takeaways

Metric

Value

Why is the Space On Board Computing Platform Market Growing?

The space on board computing platform market is advancing rapidly, driven by increased satellite deployment, miniaturization of components, and the demand for real-time data processing in orbit. Growing reliance on satellite-based services such as earth imaging, global communications, and scientific missions is accelerating investment in high-performance onboard computing systems that can manage autonomy, AI-based analytics, and edge computing.

With the shift toward constellation models and small satellite missions, mission-critical computing is being adapted to operate efficiently under radiation-hardened, thermally constrained environments. Integration of COTS (commercial-off-the-shelf) components alongside specialized aerospace-grade hardware is enabling a balance of cost-efficiency and operational robustness.

Regulatory support for commercial space ventures and collaborative partnerships among public and private players are expanding the addressable market. Looking ahead, future growth is expected to be underpinned by advancements in low-power architectures, AI accelerators, and the growing need for inter-satellite networking capabilities..

Segmental Analysis

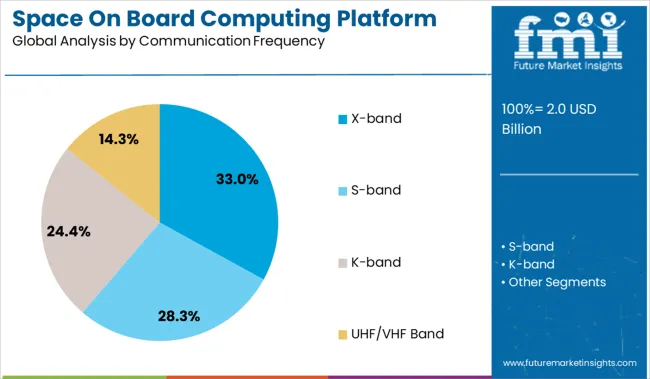

The space on board computing platform market is segmented by platform type, communication frequency, and application type and geographic regions. The space on board computing platform market is divided by platform type into Small Satellite, Nano Satellite, Micro Satellite, Medium Satellite, Large Satellite, and Spacecraft. In terms of communication frequency, the space on board computing platform market is classified into X-band, S-band, K-band, and UHF/VHF bands. Based on the application type of the space on board computing platform market, it is segmented into Earth Observation, Communication, Navigation, Meteorology, and Other. Regionally, the space on board computing platform industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Insights into the Small Satellite Platform Type Segment

Small satellites are projected to capture 36.0% of the total revenue share in the space on board computing platform market by 2025, making them the leading platform type. Their dominance is being driven by the increasing use of nanosatellites and microsatellites in LEO constellations, which require compact, low-power, and cost-effective computing platforms for autonomous operation.

The shift toward small, distributed satellite systems for communications, earth observation, and technology demonstration missions has accelerated demand for adaptable onboard processors. Development cycles for small satellites are shorter, creating a need for modular and upgradable computing systems.

Additionally, rising commercial interest in rapid deployment and real-time data access has pushed OEMs to innovate lightweight, radiation-tolerant computing solutions that can be integrated without adding excessive mass or power burden to the satellite bus..

Insights into the X-band Communication Frequency Segment

The X-band frequency segment is expected to account for 33.0% of the overall market share in 2025, emerging as the most prominent frequency in use for onboard computing integration. Its adoption is being fueled by the band’s high data transmission capability, atmospheric resilience, and established use in defense, earth observation, and deep space missions.

X-band frequencies offer a balance between bandwidth efficiency and antenna size, enabling efficient downlink of large imaging and sensor datasets from LEO and MEO satellites. With missions increasingly demanding onboard processing and high-volume data transfer, computing systems are being designed to handle optimized packet routing and dynamic bandwidth management over X-band.

Its compatibility with both government and commercial mission protocols further solidifies its relevance in next-generation platform design..

Insights into the Earth Observation Application Type Segment

Earth observation applications are forecast to lead the market with a 41.0% revenue share by 2025, positioning the segment as the top adopter of onboard computing systems. The growth of this segment is being supported by increasing demand for high-resolution satellite imagery and real-time environmental monitoring across agriculture, defense, disaster management, and climate analytics.

Onboard computing allows for immediate data preprocessing, compression, and analysis, reducing latency and transmission costs. The requirement to autonomously manage sensor calibration, payload operation, and anomaly detection has made edge computing an essential capability in earth observation missions.

Investments in commercial remote sensing and governmental climate initiatives are further driving the development of resilient, AI-enabled processing units that meet the rigorous data throughput and autonomy needs of modern observation satellites..

What are the Drivers, Restraints, and Key Trends of the Space On Board Computing Platform Market?

Demand for space on board computing platforms is increasing due to expanding satellite constellations, AI-driven in-orbit analytics, and private-sector-led payload launches. Sales of modular, radiation-tolerant architectures are surging in low-earth orbit and deep-space missions.

AI and Edge Processing Drive Constellation-Based Demand

Demand for space on board computing platforms with AI and edge inference capabilities rose by 23% in 2025, reflecting the pivot to real-time onboard analytics in Earth observation and imaging. Over 60% of small satellites launched in 2025 integrated reprogrammable processors or FPGA-based accelerators, supporting autonomous image classification, object detection, and fault response. Providers offering sub-150 millisecond signal processing latency are gaining traction in multi-orbit constellations. Operators using onboard inference have reduced data transmission volumes by 30%, improving bandwidth efficiency and network agility. Growth is strongest in the 50 to 500-kilogram satellite category used in commercial agriculture and environmental surveillance.

Sales of Radiation-Hardened Systems Accelerate in GEO and Deep-Space Missions

Sales of radiation-hardened space on board computing systems expanded by 28% in 2025, supported by high demand from geostationary and interplanetary missions. More than 75% of new orders for systems used above 20,000 kilometers now include ECC memory and latch-up prevention. Quad-core fault-tolerant SoCs are emerging as standard configurations in telecom satellite hardware, enabling sustained compute throughput over operational lifespans exceeding 12 years. Design priorities in deep-space platforms are shifting toward enhanced thermal cycling tolerance, power management, and firmware-driven maintenance. Penetration is rising across government-led exploration and defense aerospace programs.

Analysis of Space On Board Computing Platform Market By Key Countries

Country

CAGR

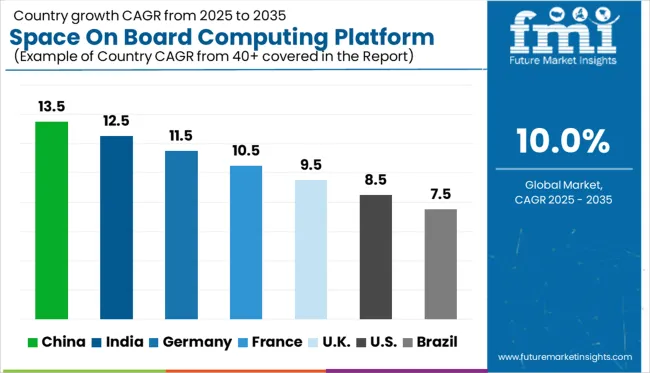

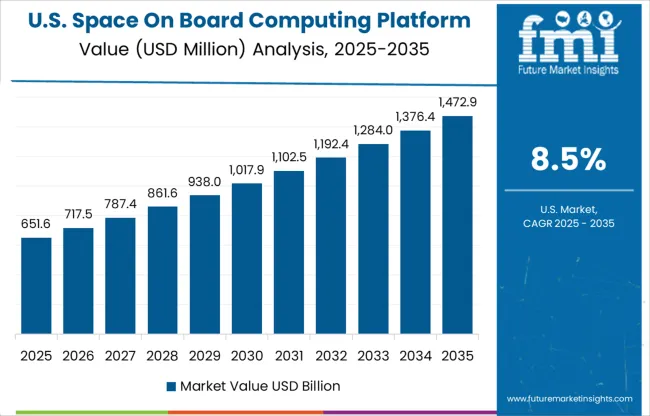

The global market is expected to grow at a CAGR of 10.0% between 2025 and 2035. China leads with 13.5% CAGR, 3.5%age points above the global average, reflecting strong investment in satellite mega-constellations and lunar missions. India follows at 12.5%, boosted by ISRO expansion and private-sector ventures. Germany posts 11.5%, backed by ESA participation and aerospace R&D. The United Kingdom records 9.5% CAGR, slightly below the global rate due to evolving post-Brexit partnerships. The United States grows at 8.5%, with growth moderated by legacy platforms and slower procurement cycles. The report provides insights across 40+ countries. The five below are highlighted for their strategic influence and growth trajectory.

Sales Outlook for Space On Board Computing Platform in China

China is forecast to expand at a CAGR of 13.5% through 2035, led by national initiatives promoting advanced satellite infrastructure and defense-grade payload capabilities. From 2020 to 2024, growth was constrained by dependence on imported legacy computing modules. However, the government is now prioritizing domestic production of AI-capable onboard systems for LEO missions. Public-private efforts are accelerating the fabrication of radiation-hardened processors. Strategic investments are also targeting reusable launch platforms and hardware for deep-space probes.

- High-throughput satellite missions are boosting demand for embedded computing units

- Chinese OEMs are scaling AI-powered onboard system development

- National funding supports self-reliance in space-grade chip production

Market Forecast for Space On Board Computing Platform in India

India is expected to grow at a CAGR of 12.5% during 2025 to 2035, supported by its constellation programs and vibrant space-tech startup scene. Between 2020 and 2024, growth stemmed from ISRO-driven missions. Future momentum is shifting toward private microsatellite makers and defense-sector projects. The country is emphasizing low-power, high-performance hardware suitable for both commercial and military use. Innovation hubs in Bengaluru and Hyderabad are working with international firms to enhance system reliability and export readiness.

- Aerospace startups are building next-generation onboard computing systems

- Heat-resilient and compact modules are preferred for Indian LEO missions

- Government schemes support dual-use computing applications

Growth and Expansion Outlook for Space On Board Computing Platform Market in Germany

Germany is projected to grow at a CAGR of 11.5% between 2025 and 2035, driven by its role in ESA-led missions and strong government support for aerospace innovation. From 2020 to 2024, adoption centered on academic cubesats and scientific payloads. Over the next decade, demand is rising for automation-ready onboard systems aligned with climate monitoring and deep-space exploration goals. German aerospace suppliers are co-developing platforms that meet stringent fault-tolerance and thermal performance standards.

- ESA-backed programs are fueling demand for reliable computing architectures

- Edge analytics and AI integration are becoming baseline design criteria

- National R&D funding supports modular, fault-tolerant space hardware

In-depth Analysis of Space On Board Computing Platform Market in the United Kingdom

The United Kingdom is forecast to grow at a CAGR of 9.5% from 2025 to 2035, following a stable trajectory from 2020 to 2024. British technology providers are advancing ultra-efficient computing systems for nanosatellite missions. Government accelerators have catalyzed partnerships between hardware innovators and launch service firms. Growth is also supported by increasing deployment of autonomous onboard processing in commercial Earth observation. The researchers are developing quantum-resilient firmware tailored to defense payloads.

- Shift toward energy-efficient computing cores is reshaping UK demand

- Cross-sector collaborations are enhancing module resilience and testing

- Commercial imaging missions are increasing demand for high-throughput platforms

Demand Analysis for Space On Board Computing Platform in the United States

The United States is projected to grow at a CAGR of 8.5% during 2025 to 2035, rising from a more mature base built during 2020 to 2024. NASA, Department of Defense, and commercial ventures like SpaceX are investing in scalable onboard systems with AI acceleration. Replacement of legacy computers with real-time inference-capable hardware is accelerating. Hybrid architectures that combine FPGA and GPU cores are gaining adoption across LEO and planetary missions.

- Real-time imaging and autonomous guidance are top application drivers

- AI processing is becoming standard in defense aerospace platforms

- Modular systems are being integrated into ISS upgrades and Mars-bound payloads

Competitive Landscape of Space On Board Computing Platform Market

The market is expanding in 2025 as commercial constellations, interplanetary missions, and defense programs increase demand for high-performance onboard platforms. Lockheed Martin leads with a significant share, offering radiation-tolerant and modular systems. Northrop Grumman and RTX are scaling secure processors designed for autonomous operation. Boeing and Honeywell are focused on AI-integrated computers capable of real-time telemetry and decision-making. BAE Systems has consolidated its position with widespread adoption of the RAD750 and RAD5545 platforms in military satellites. Thales Alenia Space is serving European and Middle Eastern markets with compact, low-SWaP platforms. Across the board, vendors are optimizing for resilience, low power usage, and cross-platform compatibility.

Key Developments in Space On Board Computing Platform Market

In June 2024, Northrop Grumman deployed the Arctic Satellite Broadband Mission, featuring two satellites equipped with onboard processors to enable high-speed communications over polar regions. This underscores Northrop’s growing focus on space-based digital infrastructure and in-orbit edge computing capabilities.

Scope of the Report

Item

Value