Contrary to our examination of struggling stocks, here we take a look at the opposite end of the spectrum: stocks that are seeing green pastures, enjoying strong momentum or poised for better days ahead. Today, we focus the on German industrial services provider Bilfinger.

Over the last eleven quarters, the German economy has only experienced two periods of growth. To break out of this rut, the government has decided to abandon the fiscal austerity that had been the norm until now. The stage is now set for a new proactive investment policy.

Two sectors have been singled out as priorities: infrastructure and defense, which will receive the lion’s share of new budgets. Other industries will undoubtedly benefit from indirect effects, although they are not at the heart of the stimulus plan.

The markets have not been mistaken, and the leading stocks in these sectors have seen spectacular stockmarket performances since the beginning of the year. In this episode, we focus on one of these popular industrial stocks, Bilfinger.

Bilfinger

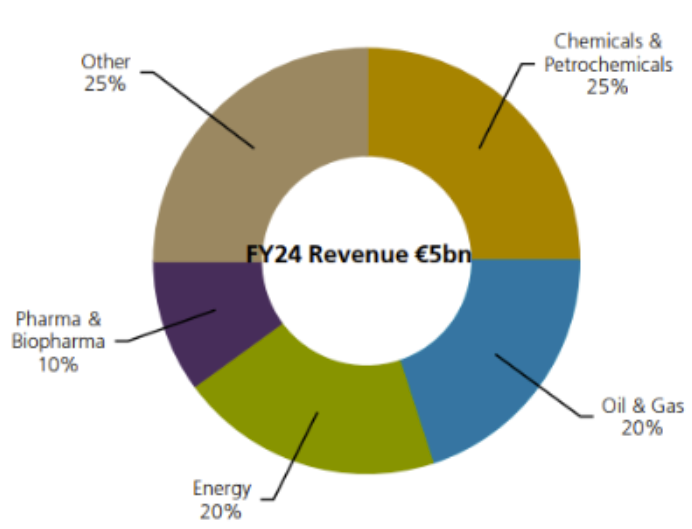

The group is a major player in the industrial services sector. It specializes in services for complex industrial facilities, particularly in the energy, chemical, pharmaceutical, and oil sectors. The core business is in the Engineering and Maintenance segment, which accounts for around 85% of revenue, 70% of which is generated in Europe alone. This segment focuses on the planning, execution, and long-term support of industrial facilities.

Bilfinger offers its customers technical expertise in the outsourcing of non-critical but complex activities with the aim of optimizing industrial performance.

Bilfinger’s sector exposure (Source: UBS)

In the early 2000s, services accounted for only 5% of revenue. Since then, the group has resolutely turned to this type of turnkey contract to capitalize on outsourcing trends. Since 2022, the strategic focus has led to a significant increase in the EBITA margin, which rose from 3.2% to 5.1% in 2024.

In the medium term, Bilfinger is targeting an EBITA margin of 7%-8%; UBS analysts are confident that these targets will be achieved.

Geographically, the group remains very European: 82% of its €5bn in revenue in 2024 is generated in Europe. Its domestic market, Germany, alone accounts for 21% of revenue.

The recovery plan

Bilfinger is ideally positioned to benefit from the German recovery plan. The group operates in segments considered strategic by the government, such as energy modernization and infrastructure digitization.

Concerns about underinvestment did not come out of the blue. In May 2024, the Cologne Institute for Economic Research estimated that €600bn would be needed over ten years to modernize the country’s infrastructure. Germany is thus set to become the continent’s largest public borrower, with clear objectives: to catch up on infrastructure, accelerate the digital transition, and strengthen green energy capacities.

Bilfinger has already worked on a wide range of public contracts, which represent 12% of its sales. It has been involved in the extension and maintenance of motorways, the construction of subways in Berlin, and tenders for energy services. According to Bloomberg, the group is well positioned to win contracts for all types of pipelines, including district heating, natural gas, and hydrogen.

However, optimism is not based solely on public orders. Germany is expected to become an attractive destination for private investment once again, thanks to solid economic fundamentals, investment plans with tax breaks, and upwardly revised growth forecasts. The government has committed to simplifying administrative procedures and shortening approval times—one of the priorities for manufacturers.

Made for Germany

Bilfinger embodies a commitment to Germany’s industrial revival. The government has recognized that it cannot act alone and has promised to create a favorable environment for private players by lowering energy costs, modernizing infrastructure, and reducing bureaucracy.

In line with this dynamic, 61 major German companies have joined forces under the “Made for Germany” initiative, pledging to invest €631bn by 2028. These funds will be spent on new sites, R&D, and infrastructure modernization. Chancellor Friedrich Merz’s message is clear: “Germany is back. It’s worth investing in Germany again. We are not a place of the past, but a place of the present and, above all, of the future.”

Watch out for

Some analysts are calling for caution regarding the timeline: according to UBS, the effects of the recovery plan will not be seen in Bilfinger’s accounts until the end of 2026. The stock has already factored in some of these expectations and is currently trading around its all-time high, having doubled its market value in seven months. Entry opportunities could arise along the way.