STR cites actual occupancy levels, the weather, and

difficult event comparisons for soft performance.

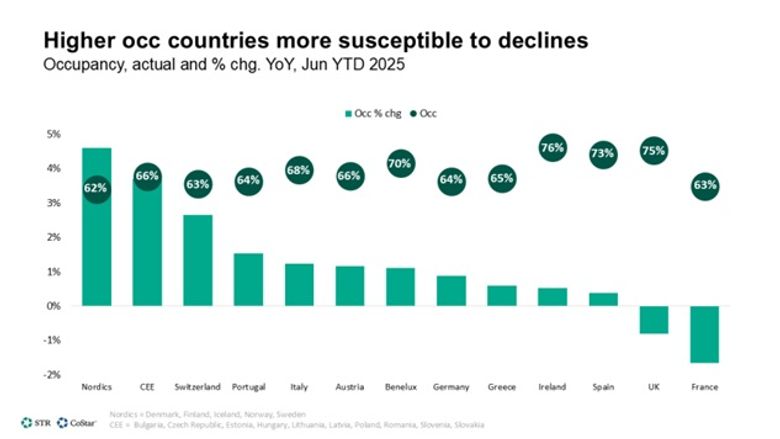

INTERNATIONAL REPORT – When it comes to actual occupancy,

very high levels, as seen in most Western European countries, can be difficult

to grow or even maintain in some cases, according to a new STR report.

As was the case in June 2025, small year-over year (YoY)

occupancy declines in high-occupancy countries are a normal occurrence,

although persistent or substantial declines may point to other factors

impacting hotel demand. However, higher-occupancy markets or countries will

typically have greater volatility in year-over-year changes.

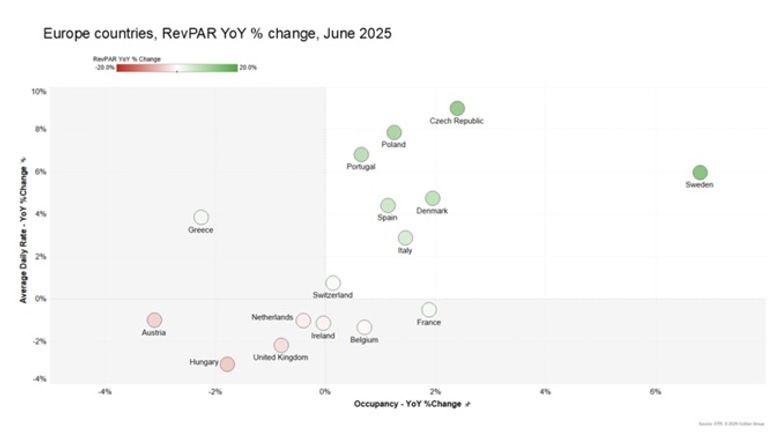

Unseasonable heat in June drove travelers out of Hungary and

the U.K. and towards cooler Nordic countries like Sweden and Denmark.

Southern European countries continued to post strong

occupancy and ADR growth despite the heat. A combination of beach access and

long-haul travel – North American summer travel typically takes place during

June and July, as compared to Europe’s July and August – underpinned strong

hotel performance in Portugal, Spain, and Italy.

Finally, June was a challenging month for YoY comparisons

for many European markets. Last year was a spectacular year for events,

according to STR, and many YoY RevPAR declines can be attributed to the return

to a more ‘normal’ event calendar this year.

Three major international events – the Champions League

final in London, the Eras tour in the U.K. and Ireland, and the UEFA Euros

tournament in Germany – lifted hotel performance in June 2024 and led to RevPAR

declines across host markets in 2025.

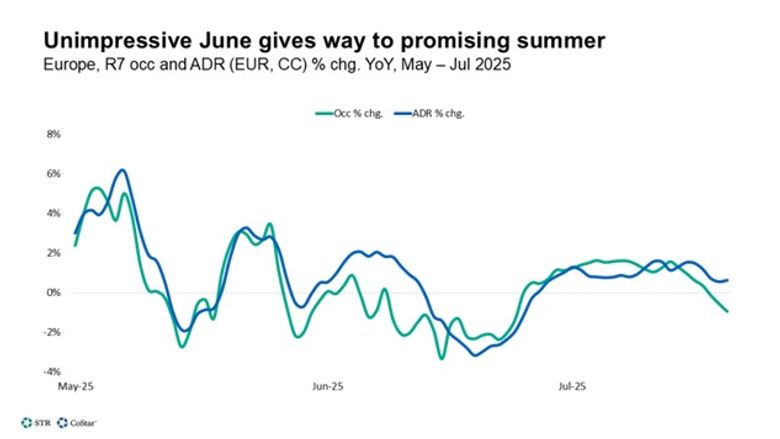

While June 2025 was a soft month, July held more promise as

the start of the European summer holiday season lifted performance across the

continent.

UEFA Euros offsets will impact performance in Munich and

Berlin in August, and Paris and the surrounding areas will be challenged by the

2024 Olympic Games comparisons.

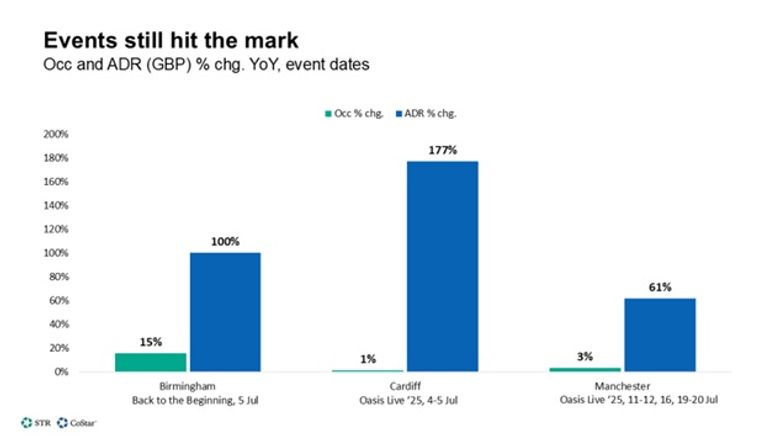

New events are still taking place, however. Black Sabbath’s

farewell concert, Back to the Beginning, lifted Birmingham RevPAR at the start

of July. One week later, Oasis kicked off their much-anticipated Live ’25 tour to

a sold-out Cardiff crowd, before carrying out five hometown shows in

Manchester.

High occupancy levels and strong rate growth across both

dates suggest that Oasis concerts will lift performance across the U.K. for the

next few months.