Germany’s two-year government bond yields were set for a weekly rise as traders unwound rate-cut bets that had surged following last week’s weaker-than-expected U.S. jobs data.

The Bank of England’s policy decision pushed two-year gilt yields higher on Thursday, helping lift euro zone short-dated borrowing costs as well.

Analysts expect U.S. Treasury yields to decline, while euro zone yields are seen rising later this year as Germany kicks off a major fiscal spending push aimed at reviving growth.

Germany’s 10-year yields (DE10YT=RR), the euro area’s benchmark, were set for a slight weekly rise, up one basis point (bp). On the day, they climbed five basis points to 2.65%.

The policy-sensitive German two-year yield (DE2YT=RR) was on track for a weekly increase of 4.5 bps, trading 3.5 bps higher on the day at 1.96%.

Market pricing for Federal Reserve rate cuts held steady around the levels seen last Friday after the latest economic data, with around a 90% chance of an easing move next month and 122 bps of cuts priced in by October 2026.

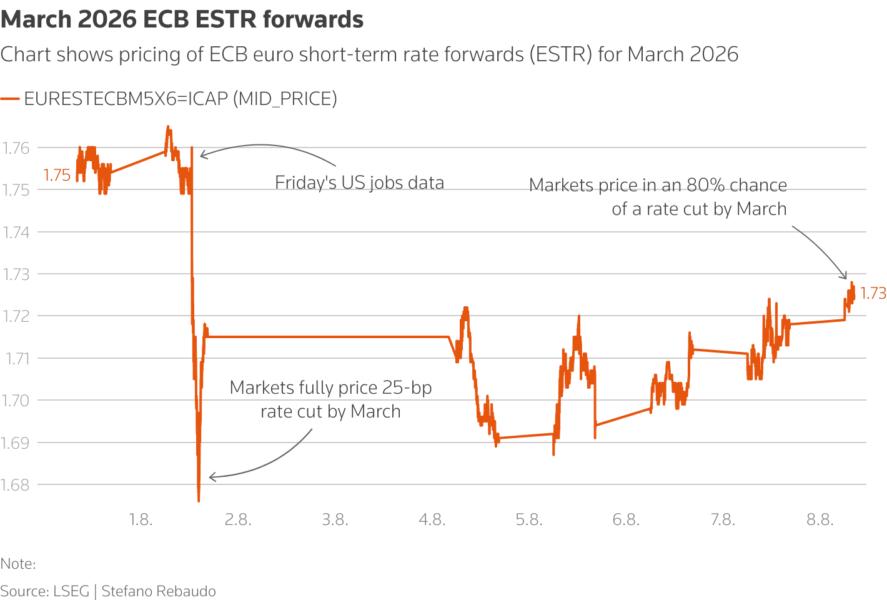

ECB euro short-term rate (ESTR) forwards last implied a 75% probability of a 25-bps cut by March 2026 (EURESTECBM5X6=ICAP), down from fully pricing it after Friday’s U.S. jobs data. The depo rate is currently at 2%.

Thomson ReutersMarch 2026 ECB ESTR forwards

Thomson ReutersMarch 2026 ECB ESTR forwards

However, traders also see a good chance of a rate hike by December 2026, with the deposit rate projected at 1.92%. (EURESTECBM1X12=ICAP)

“We believe the implications of the recent economic data are generally in favour of lower (U.S.) Treasury yields,” said Anshul Pradhan, head of U.S. rates research at Barclays.

“The revised jobs data have helped reconcile the discrepancy between the apparent resilience of job gains and real gross domestic product growth having moved sharply lower amid rising tariff rates in the first half of the year.”

Markets are also watching closely for signs of who might succeed Jerome Powell as Fed Chair, with Christopher Waller emerging as a top candidate. Powell is expected to step down when his term ends in May 2026.

“Waller as next Fed Chair would reduce uncertainty about the Fed reaction function on the margin, which would also bode well for the long end,” Barclays’ Pradhan argued.

Bond prices move inversely to their yields.

Italy’s 10-year government bond yields IT10Y were up 5 bps at 3.51%. The yield gap between Italian and German bonds (DE10IT10=RR) – a market gauge of the risk premium investors demand to hold Italian debt – was at 82 bps after hitting a fresh 15-year low at 81 bps.

Analysts argued that with the ECB easing cycle close to an end, the air for a further BTP-Bund spread compression will probably become thinner after the summer.

They said technical factors supporting BTPs could also fade. Positive ratings kicked off the tightening, but declining volatility favouring carry trades and lower supply over the summer backed the rally.