Key Takeaways

DOGE may be on the verge of a major breakout, with on-chain indicators and sentiment showing early signs of a potential bull run—despite past exits by long-term holders.

As the weekend approaches, Dogecoin [DOGE] appears to be taking center stage among memecoins, with investor sentiment shifting in its favor.

The asset has climbed 8.98% in the past day, bringing its weekly gain to 30.37%, at press time. Analysis shows that rising demand and key on-chain metrics have played crucial roles in this surge.

AMBCrypto’s latest analysis explores why DOGE may outperform other memecoins and even go parabolic this weekend.

Miners could lead DOGE rally

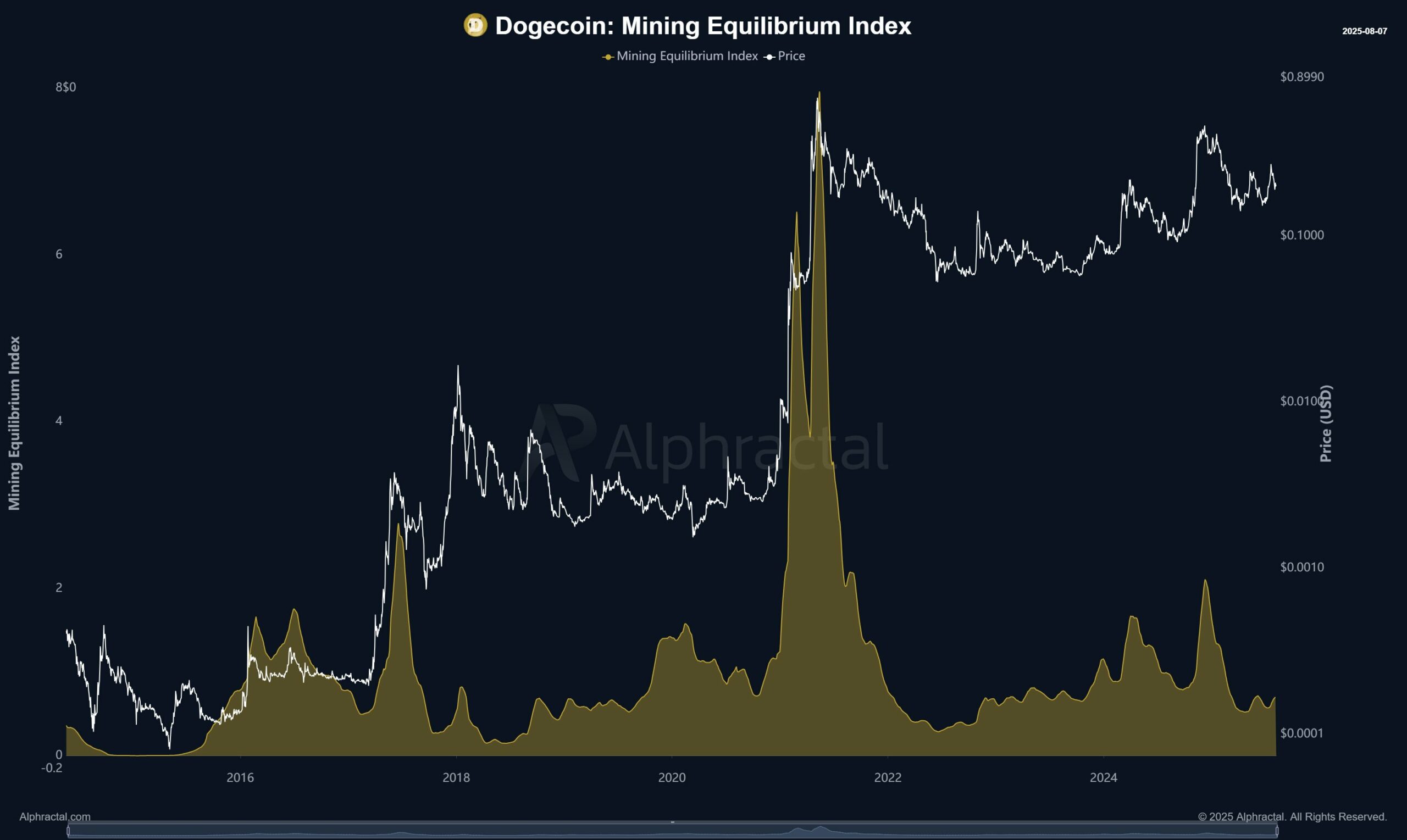

An analysis of the Mining Equilibrium Index on Alphatractal—a metric used to track miner profitability—shows early signs that a rally could be imminent.

Miners are entering a highly profitable zone on the chart as the indicator trends upward. Historically, such high profitability has coincided with the start of market rallies.

Source: Alphractal

This bullish trend is not occurring in isolation.

The Bubble Risk metric reveals that DOGE isn’t in an overheated or euphoric phase typically followed by sharp sell-offs.

This suggests that the increasing profitability among miners is unlikely to trigger a wave of selling. Instead, it strengthens the case for further upside, and the market shows room to rally.

No capitulation in sight

According to AMBCrypto’s findings, miner capitulation—or large-scale sell-offs—remains unlikely at this point.

This conclusion stems from analysis of the Hash Capitulation Oscillator and Market Capitulation Oscillator.

Both indicators shows that market sentiment hasn’t crossed into the fearful zone. Historically, traders have triggered major selling pressure in this fear zone when prices enter premium territory.

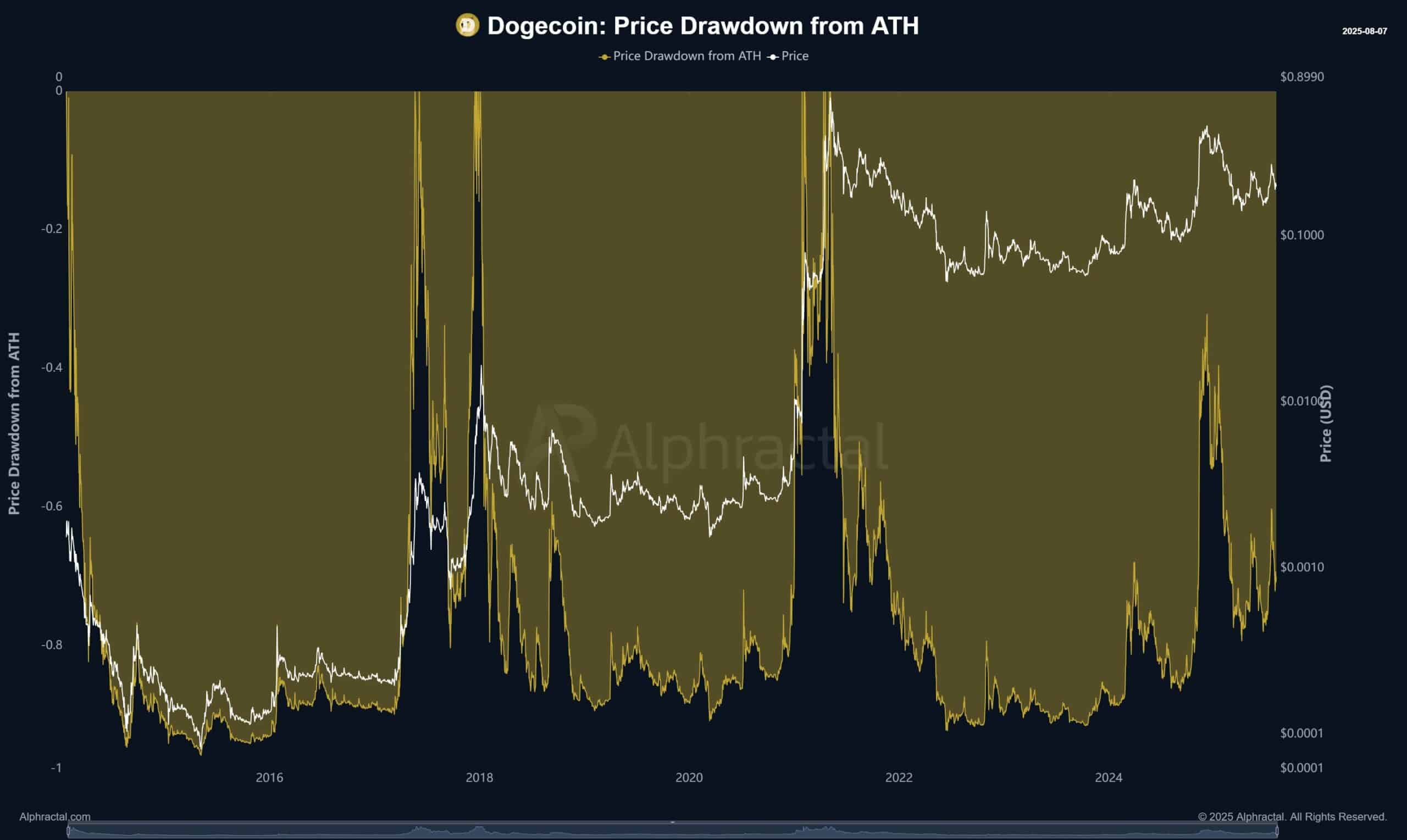

Source: Alphractal.

DOGE has dropped to an extreme drawdown from its all-time high, suggesting a rebound may be closer than expected. At press time, the drawdown sits below -0.6.

If the metric continues to trend toward the 0 region, it would suggest a strong likelihood of price recovery and further gains.

Whales are not sitting out

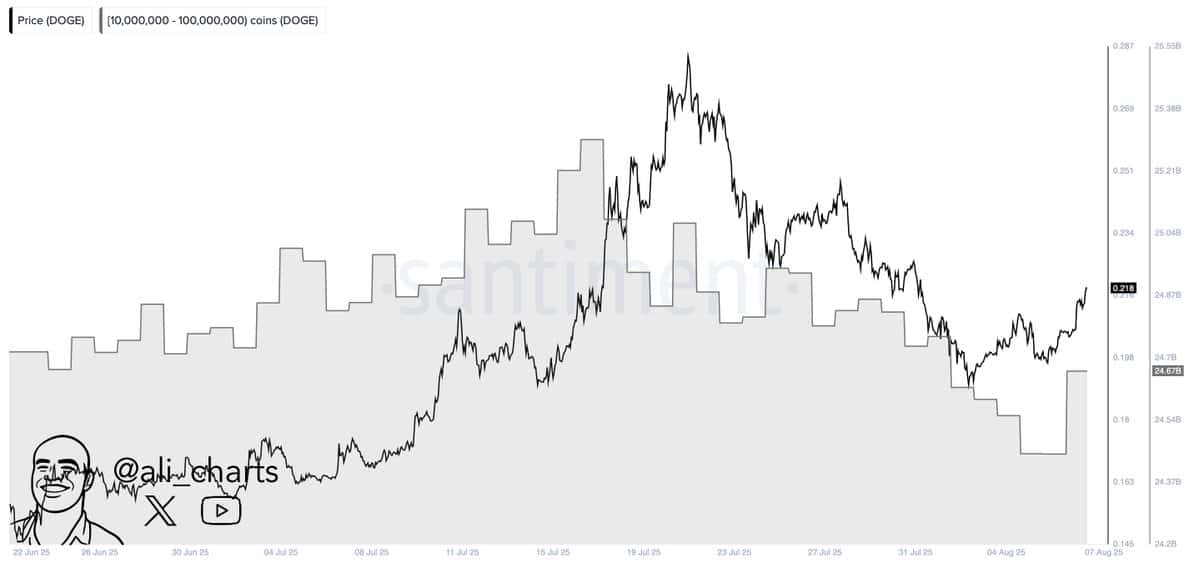

Large holders appear to be treating DOGE’s current price levels as a discount opportunity.

Whales have acquired 230 million DOGE at the time of writing, tightening the available supply and increasing the chances of a supply squeeze.

Source: Santiment

Continued whale accumulation will likely fuel DOGE’s upward momentum, support additional gains in the coming trading sessions, and potentially position it as the leading memecoin.

Next: Why the Bitcoin Dominance chart may be warning traders of THIS shift!