Bangladesh’s interim government marks one year in power, following the fall of Sheikh Hasina’s regime in the student-led July uprising. It inherited a fragile economy, plagued by inflation, dwindling reserves, and a strained banking sector. Governance and law and order remain major concerns, alongside persistent challenges in investment, employment, and education. TBS reviews the key achievements and setbacks across various sectors over the past turbulent year — and looks at the road ahead.

08 August, 2025, 08:00 am

Last modified: 08 August, 2025, 08:08 am

Illustration: TBS

“>

Illustration: TBS

When the interim government assumed office in August 2024, Bangladesh’s economy was teetering on the edge – foreign exchange reserves were dangerously low, the taka was tumbling, inflation was entrenched, and the banking sector was mired in bad loans and chronic misgovernance.

Twelve months on, green shoots of stability are beginning to emerge – if not yet fully blooming.

A troubling economic signal – persistently high inflation hovering around 9% for over three years – had finally begun to ease, showing a steady decline over the past three months. However, in a sudden reversal, the trend shifted in July, reigniting concerns about price stability. The reserves are gradually rebuilding, and the exchange rate has stabilised after months of turbulence.

Keep updated, follow The Business Standard’s Google news channel

Importers, who once waited weeks for US dollars, are now experiencing timely settlements. Panic has receded in the banking system, and industrial production is slowly gaining traction.

The signs of recovery are clear. But so are the deep structural cracks that persist.

While Bangladesh’s troubled banking sector has begun to show signs of recovery, several banks are still unable to repay depositors. Regulatory reforms over the past year have improved governance, but have also revealed a rise in hidden non-performing loans.

Outside the banking sector, the government has taken no steps to address the deepening crisis in insurance and non-bank financial institutions. With the exception of a few, most such entities have failed to return depositors’ money due to large-scale embezzlement by their directors during the previous administration.

Several life insurance companies are on the brink of bankruptcy. Yet no meaningful reform or action has been taken to protect customers’ interests.

The capital market remained a topic of debate throughout the year, but the government has failed to restore investor confidence.

Over the past year, the public administration has seen growing instability over recruitment, promotions, and postings. Many top officials who held key positions under the previous government still remain gripped by fear, slowing down the bureaucracy and causing delays in policy formulation and development work.

Infographics: TBS

“>

Infographics: TBS

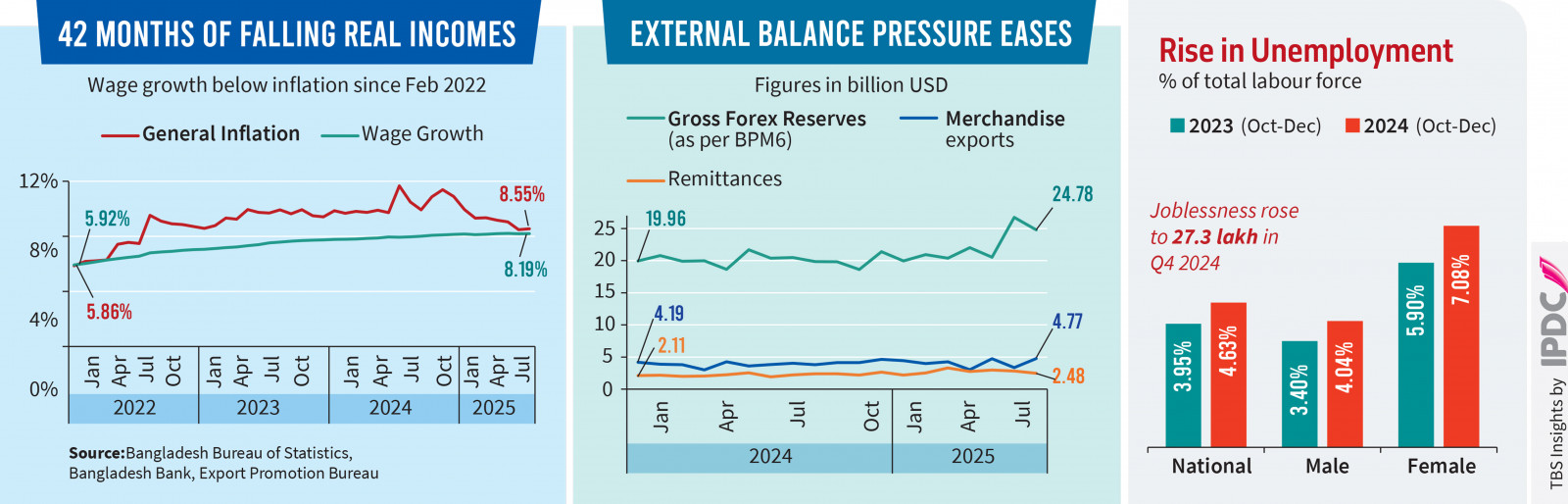

Recovery without jobs

Unemployment has risen, not fallen, over the past year. According to the Bangladesh Bureau of Statistics, 2.74 million people were unemployed in the fourth quarter of 2024 – 4.63% of the labour force – up from 3.95% a year earlier. This coincides with a steep drop in the investment-to-GDP ratio to 29.8% in FY25, the lowest in a decade.

Private investment remains subdued. Credit growth is stuck below 8%, and capital machinery imports are thin – clear signs that confidence among entrepreneurs has not returned.

Consumer sentiment also remains fragile. Inflation, though lower than before, still outpaces wage growth, shrinking real incomes. Interest rates remain elevated, leaving both borrowers and lenders cautious.

ADP spending hits record low

The government’s Annual Development Programme (ADP) implementation dropped to a historic low of 67.85% in the just-concluded FY2024-25, the lowest in at least 13 years, according to IMED data. This marks a sharp fall from over 80% in the previous fiscal year. With development projects being a key source of temporary employment for millions, the decline signals fewer job opportunities for the country’s poor.

Earlier in March, following the approval of the revised ADP, Planning Adviser Dr Wahiduddin Mahmud had predicted a lower implementation rate for FY2024–25, attributing it to the political transition.

“The interim government had to re-evaluate many projects, cut down on several, and revise those taken up by the previous administration,” he told reporters at the time. “Implementation was further hindered as many project directors and contractors left [after the regime change], affecting continuity and project execution.”

Fiscal reform: Promises, pitfalls, partial progress

While macroeconomic indicators show signs of improvement, fiscal and financial sector reforms remain a mixed bag.

The Chief Adviser’s Press Secretary Shafiqul Alam yesterday said the government selected 121 reform proposals from 11 commissions, with 16 already implemented, 85 underway, and 10 partially executed. Another 10 are still under review.

Zahid Hussain, former lead economist at the World Bank’s Dhaka office, notes that much of the progress on inflation, exports, and remittances owes more to global trends and private sector resilience than government action.

“Where the government did have full control – especially in banking reform – the progress was partial and the missed opportunities significant,” he told The Business Standard.

Early reform promises were hampered by bureaucratic reshuffles and policy drift. While efforts were made – including updated reporting systems for non-performing loans and steps toward resolving distressed banks – no major resolution was finalised.

“The government could have made a mark by resolving even one or two major troubled banks. That moment was lost,” said Zahid.

Fahmida Khatun, executive director of the Centre for Policy Dialogue, acknowledged visible reforms such as forensic audits of weak banks and efforts to recover stolen funds. However, “some banks still can’t return depositors’ money, even after receiving central bank support,” she said.

The 2024–25 budget, inherited from the previous regime, was implemented largely unchanged. The following year’s budget faced added pressure from mid-2025 trade tensions, including reciprocal US tariffs in response to Bangladesh’s high trade barriers.

Zahid criticised the continued avoidance of tariff reform: “Some rates were tweaked, but the overall protection structure stayed intact — a major setback for LDC graduation preparedness.”

One ambitious move – the ordinance to split the National Board of Revenue into separate policy and enforcement units – was passed despite resistance, though implementation remains stalled.

Meanwhile, the government reversed its initial decision to retain the controversial black money whitening scheme following public backlash.

Stability achieved, but at the cost of growth

Macroeconomic imbalances have improved, said Sadiq Ahmed, vice chairman of the Policy Research Institute. The balance of payments has stabilised, aided by a more flexible exchange rate regime that supported exports and remittances.

Inflation is being addressed by tighter fiscal management and reduced government borrowing from banks.

But Sadiq warns that “the progress on reforms is uneven.” While stability was achieved, it came at the expense of growth: GDP in FY25 dropped below 4%.

“The adjustment curtailed imports and private credit, slowing down economic activity. That’s not an ideal trade-off,” he said.

Revenue, corruption, policy paralysis

Despite expectations, tax reform has made little headway. Bangladesh’s tax-to-GDP ratio remains among the lowest in the region. Zahid Hussain blamed this on entrenched corruption and lack of automation.

“Everyone knows there are backdoor dealings between taxpayers and officials,” he said. “Unless face-to-face interactions are eliminated, the problem will persist.”

The new budget also introduced new slabs under customs and supplementary duties rather than streamlining the system.

Meanwhile, inflation management appears to have slipped as a policy priority. Despite claims of monetary tightening, Bangladesh Bank recently injected liquidity by purchasing $500 million from commercial banks.

“With dollar demand falling, the taka was appreciating — helping tame inflation. But the central bank’s actions reversed that trend,” Zahid said. “They’re more focused on rebuilding reserves than controlling inflation.”

Structural reforms abandoned

Fahmida Khatun pointed to the lack of action on broader reform proposals. “A high-level task force proposed changes in 17 sectors. Many needed only policy adjustments. Nothing happened.”

Corruption, extortion, and bureaucratic hurdles remain rampant. “There are even reports of increased extortion,” she added. “Businesspeople are afraid to invest.”

Real wages have fallen. Job creation is stagnant. “For low- and middle-income groups, life has become harder,” she said.

Fahmida was referring to the task force led by KAS Murshid, which proposed sweeping reforms to reframe development strategies. These included overhauling the planning commission, merging universities, scrapping duties and surcharges on internet usage, creating an independent oversight body for the National Board of Revenue, and dissolving the government’s Financial Institutions Division.

The task force outlined seven key recommendations for institutional reform of the planning commission. It also urged university mergers to stretch limited education budgets and improve global rankings.

As part of a push for a more inclusive and sustainable economic strategy, the task force called for the immediate withdrawal of the 20% supplementary duty and 2% surcharge on internet services, recruitment of qualified agencies for project feasibility studies, and reforms to the country’s social protection programmes.

Countdown to LDC graduation, but no strategy in sight

Bangladesh is set to graduate from Least Developed Country status in 2026, but no serious policy groundwork has been laid, said Fahmida.

“There’s no tariff strategy, no trade deal preparations. This is still an interim government with limited legitimacy. Foreign investors want political stability — and that depends on credible elections.”