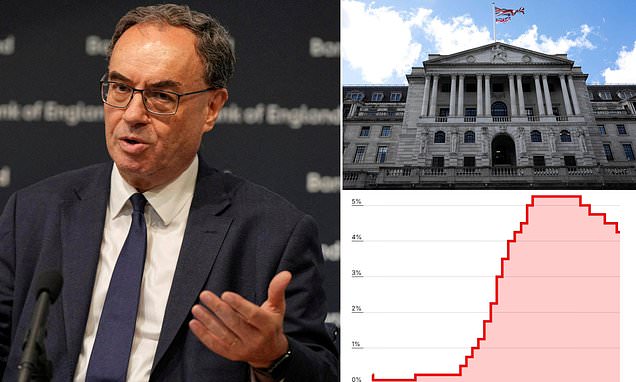

The Bank of England has cut base rate by 0.25 percentage points to 4 per cent in a knife-edge decision that saw the Monetary Policy Committee forced into a second vote for the first time in its history.

It marked the fifth decrease in borrowing costs since the base rate peaked at 5.25 per cent in August last year and will help further relieve pressure for some mortgage holders and home buyers.

Today’s decision marked the first ever time the Monetary Policy Committee has been forced into a second vote, demonstrating the uncertainty over the UK’s economic outlook

The Bank of England’s MPC voted by a majority of 5 to 4 to reduce base rate, with four members of the committee preferring to hold a 4.25 per cent.

In the first round, MPC Alan Taylor voted for an even bigger cut to 3.75 per cent.

But the move comes amid fears over the state of the UK economy with inflation reaching an 18-month high in June by climbing to 3.6 per cent, while unemployment rose to 4.7 per cent, its highest level in four years, in May.

It follows a 0.1 per cent GDP contraction in May, following a 0.3 per cent drop the previous month, and signs of growing pressure on the jobs market.

Bank of England Governor Andrew Bailey said earlier this month that the Bank would be prepared to cut rates if the jobs market showed signs of weakening.

This live page has closed

BoE opts for ‘perplexing’ rate cut as inflation rises

Boost for borrowers – but a blow to savers

Inside the unusual and historic Bank of England vote decision: JESSICA CLARK saw the three-way deadlock unfold…

Next rate cut in the balance ahead of Autumn Budget

Next rate cut in the balance ahead of Autumn Budget

‘Competing forces of economic deterioration and sticky price rises obscure’ outlook for UK economy

How the two votes played out…

‘The Bank of England is getting increasingly concerned about the health of the UK economy’

First ever second vote over base rate as decision goes to the wire

Rate cut ‘good news’ for borrowers with tracker or variable rate mortgages

What the Bank of England’s interest rate cut to 4% means for your money

Breaking:BoE cuts base rate to 4%

Breaking:BoE cuts base rate to 4%

The previous interest rate cuts

Bank of England governor Andrew Bailey to hold press conference

Starmer refuses to rule out tax hikes amid warnings Labour faces £50 billion black hole

FTSE 100 surges as traders bet on interest rate cut

FTSE 100 surges as traders bet on interest rate cut

Expert view: Bank economists will be split but interest rate cut ‘almost certain’

Expert view: Bank economists will be split but interest rate cut ‘almost certain’

With the MPC balancing signs of fragility in the labour market against evidence of lingering inflationary pressure, the committee will likely signal that further gradual interest rate cuts remain appropriate.

House prices on the rise amid hopes cheaper mortgage deals are on the way

Investors hope interest rate cut will help boost business confidence

Investors are grasping for silver linings to the tariff turmoil and there’s an expectation that that weaker growth will lead to lower borrowing costs.

Investors are primed for an interest rate cut from the Bank of England later today, given the highly sluggish nature of the economy, and the rising unemployment rate.

There will be hopes that if loans become cheaper, it will help boost consumerecon and business confidence but there’s a long way to go.

How do interest rates affect you?

Why the Bank of England may reduce interest rates again?

Bank of England tipped to cut interest rates TODAY

Share or comment on this article:

Bank of England cuts interest rates for fifth time in a year to 4% despite inflation fears