Key Takeaways

Ethereum’s surge past $4,300 and declining Bitcoin dominance could signal a potential “flippening,” with experts predicting shifting momentum between Bitcoin and altcoins over the coming months.

Ethereum [ETH] surged past $4,300 while Bitcoin’s [BTC] dominance declined, fueling speculation that Ethereum could surpass Bitcoin in value within the next year.

In fact, with strong technical indicators and growing institutional interest backing this momentum, experts are now increasingly discussing the possibility of a “flippening.” This is the term for if and when Ethereum overtakes Bitcoin as the world’s leading cryptocurrency.

Bitcoin dominance analysis

At the time of writing, Bitcoin’s market dominance stood at 60.74%. However, analysts like Lark Davis believe that previous drops of this magnitude have usually preceded Ethereum hitting new all-time highs.

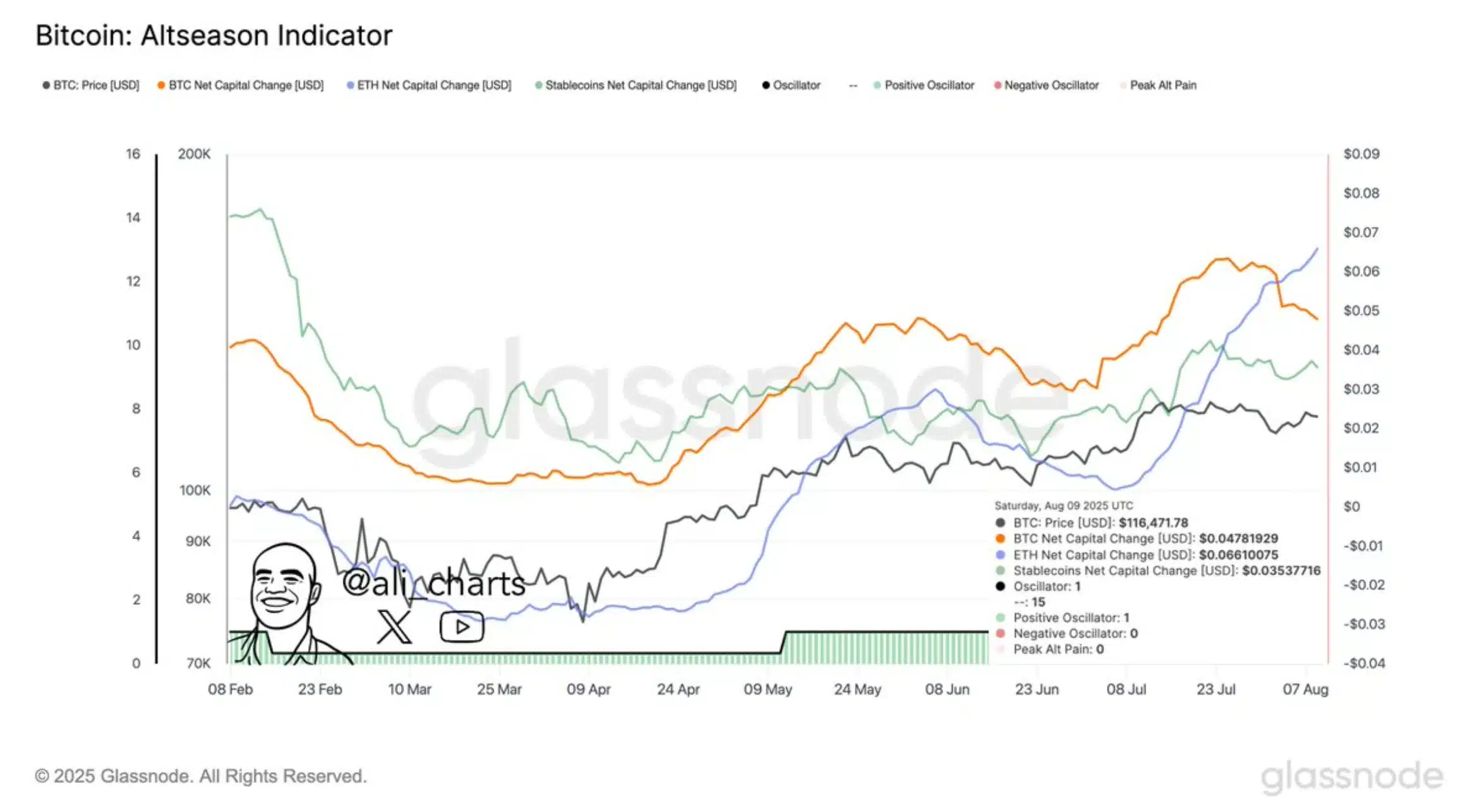

That’s not all though as Glassnode data shared by analyst Ali Martinez revealed Ethereum’s Net Capital Change outpacing Bitcoin’s. This has prompted some market watchers to call this a clear sign of altcoin season.

Source: Ali Martinez/X

Ethereum’s price strength meets institutional appetite

At press time, ETH was trading at $4,298 on the price charts, with the altcoin up 1.72% in the last 24 hours.

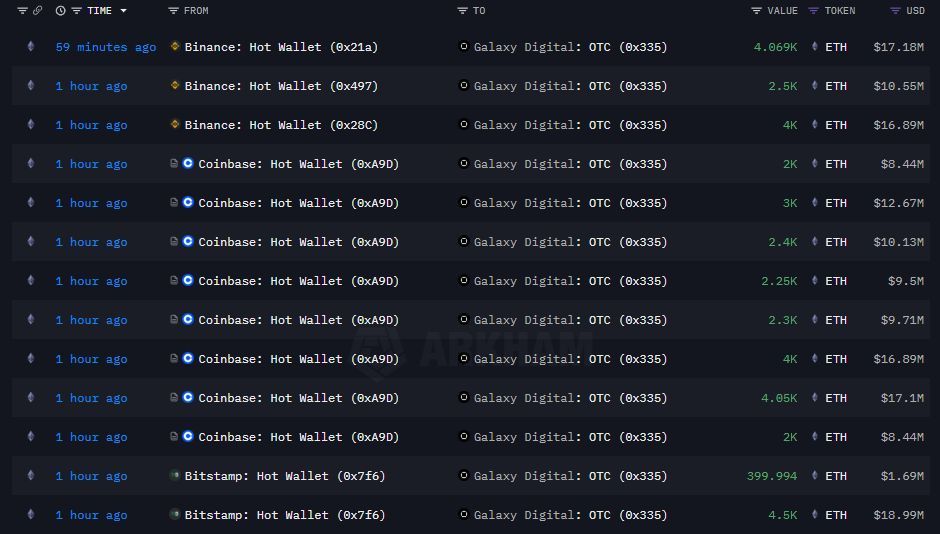

This seemed to coincide with its OTC desk activity signaling strong whale interest in the altcoin’s market.

Source: X

Crypto’s R Us reported that Binance, Coinbase, and Bitstamp moved about $160 million in ETH to Galaxy Digital in one hour. The largest transaction was worth 4,500 ETH ($18.99 million). On top of that, Ethereum co-founder Vitalik Buterin’s holdings exceeded $1 billion amid reports of scarce ETH supply on OTC desks.

The level of scarcity showcased liquidity challenges for large buyers.

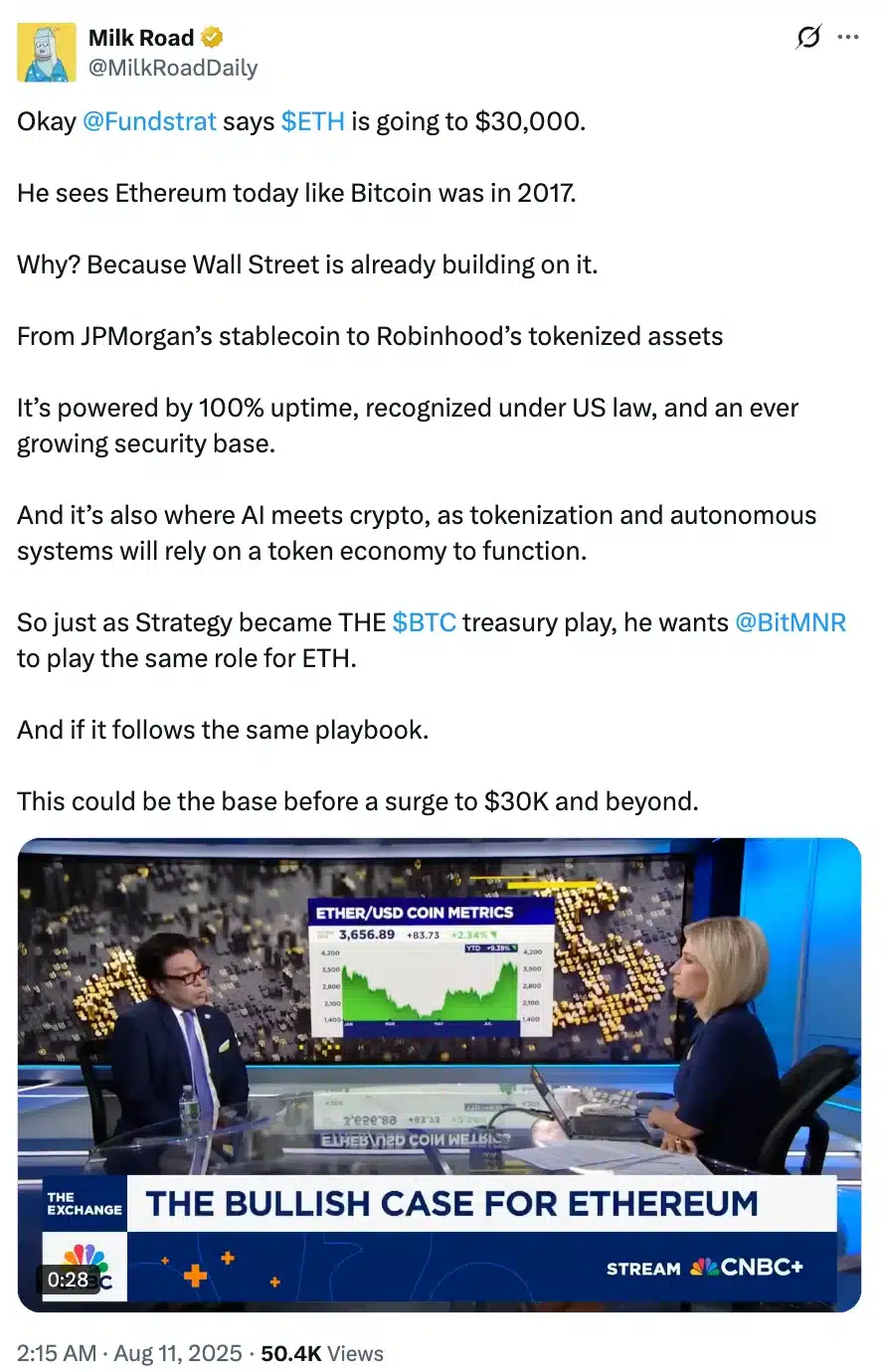

Here, it’s worth pointing out that various institutions are also backing Ethereum. Milk Road pointed out the same on X, claiming,

Source: Milk Road/X

Is altcoin season around the corner?

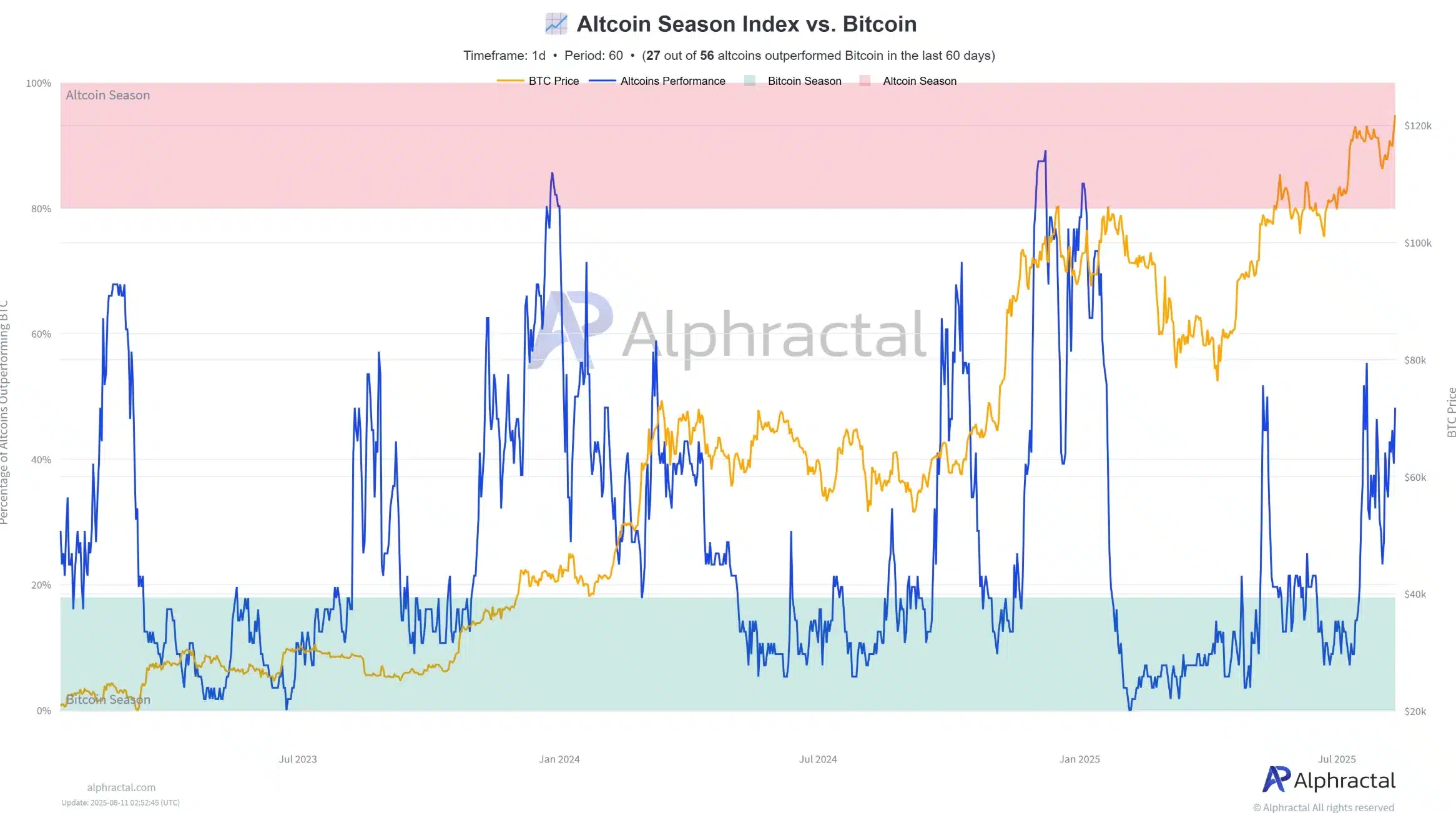

At the time of writing, the CMC Altcoin Season Index had a reading of 38/100 – A sign that the market was still Bitcoin-leaning, despite ETH’s recent gains.

Its findings were backed by Joao Wedson, Founder & CEO of Alphractal. He noted,

“The real Altcoin Season hasn’t even started yet. Smart money flows from BTC to ETH, then to Top Caps, and finally to Mid & Low Caps. Altcoin fun is just getting started — and it could last until November.”

Source: Joao Wedson/X

Rotation cycles in play

There may still be some cause for optimism though. Amidst this market uncertainty, Ted Pillows, a partner at OKX, projected a rotation pattern, one where ETH breaks its ATH and triggers a mini alt season. He added,

“Then, capital rotates into BTC, aiming for $140K.”

Lukas Enzersdorfer-Konrad, Deputy CEO of Bitpanda, supported this view. He claimed that last week’s altcoin surge showed investors are increasingly willing to venture beyond Bitcoin and Ethereum into riskier assets.

Next: Is Bitcoin too centralized now to succeed? Binance’s grip raises new red flags!