In a summer where Liverpool are threatening to twice break the British transfer record, it is telling that the club’s commercial business has still attracted huge interest.

The new partnership with Adidas may not have generated quite as many column inches as the Alexander Isak saga or Google hits as the Florian Wirtz signing, but the kit deal has been a phenomenon in its own right.

The deal could be worth up to £1bn to Liverpool over the course of its 10-year contract and broke several sales records before its first competitive outing, against Crystal Palace in the Community Shield. But could the Adidas-made kits soon feature a new front-of-shirt sponsor?

Photo by Robbie Jay Barratt – AMA/Getty Images

Photo by Robbie Jay Barratt – AMA/Getty Images

Fans associate certain eras in their history with particular sponsors. And when Liverpool supporters look back on the Standard Chartered era, it will be with great fondness.

It’s a quirk of modern football that supporters can have an emotional reaction to the logo of a multinational banking giant – but that is by design, not by accident. Standard Chartered have paid to be associated with an elite team, with all the trappings of prestige, global exposure, and tribal loyalty that come with it. That doesn’t come cheap.

The latest iteration of the Standard Chartered deal, which has now been active since 2010, is worth in excess of £50m per year to Liverpool. When it was first signed 15 years ago by Tom Hicks and George Gillett’s regime, the headline figure was around £20m. Like everything FSG have touched at Anfield, the front-of-shirt sponsorship has turned to gold.

Every Liverpool sponsor

Under the ownership’s self-funding model, commercial income is reinvested in Arne Slot, Richard Hughes and Michael Edwards’ playing budget. So when Fenway Sports Group next come to negotiate with Standard Chartered, it will be a seismic moment.

The partnership was last renewed in 2022 and is valid until the end of the 2026-27 season. That is the blink of an eye for FSG, who like to model revenue and other financial metrics several years in advance.

The two parties therefore will already be in negotiations. And while the agreement has been an unequivocal success for both, Liverpool will have options aplenty besides the London-headquartered bank. If they got a significantly better offer, they would take it.

But how likely is that? And what might the financial impact?

Liverpool entitled to ‘ask for more money’ from Standard Chartered

Much of Standard Chartered’s business is in East Asia, and Liverpool’s visit to Japan and Hong Kong this summer reflected that.

The brand lent its name to the Standard Chartered Trophy, which saw Slot’s team beaten by 4-2 AC Milan in late July, for example.

“As the main club partner of Liverpool Football Club and the main sponsor of the Standard Chartered Trophy – Hong Kong, we are thrilled to bring the Reds back to Asia this July,” said Mary Huen, CEO of Standard Chartered’s Hong Kong office.

New season. New kit. Same ambition and determination to succeed.

As Main Club Partner of @LFC, we welcome the launch of their new 2025/26 season kit, developed with @adidasfootball.

The club has concluded its pre-season Summer Tour in Hong Kong and Japan, and is preparing for… pic.twitter.com/s34bRhrpox

— Standard Chartered (@StanChart) August 1, 2025

View Tweet

“At Standard Chartered, partnerships are in our DNA. We are therefore delighted to present this event with our long-term partner Liverpool FC – one of the world’s most successful football clubs – in our bank’s hugely important market, Hong Kong.

“This will offer local fans of the Reds, including our clients and colleagues, the extraordinary experience of watching the game in person. We look forward to seeing a full Kai Tak Stadium cheering on Arne Slot and the team.”

These are the kinds of tie-ins which sponsors are increasingly looking for in order to justify the soaring value of partnering with a club like Liverpool. See also: the Standard Chartered-branded Player of the Month award, half-time penalty shootout, and Reds Roundtable series.

“Standard Chartered have been beneficiaries of Liverpool’s success over the course of the last decade,” says Liverpool University football finance lecturer Kieran Maguire, speaking exclusively to TBR Football.

“With Liverpool being extremely popular in Asia, you can see the benefits for both parties if the relationship is extended. I’m sure Standard Chartered would like to have a long-term relationship reinforced, so it really comes down to an issue of price.

“Liverpool know they can extract maximum value from their brand going forwards, and Standard Chartered have to decide whether they can meet the asking price that Liverpool will easily be able to generate from other interested parties.

“On the back of the success they have had to date, they can ask for more money than in the previous set of negotiations. I don’t think there’s any doubt about that.”

FSG could extract £16m extra revenue per year from sponsor

So how much are Liverpool’s front-of-shirt rights worth, whether it is to Standard Chartered or a fresh partner?

According to the insights firm The Sponsor, Liverpool’s £50m-a-year deal could actually fetch closer to £66m. Over a minimum deal length of three years, that’s £198m, up from £150m in the current term.

Of course, the £50m headline figure should probably be taken with a pinch of salt. Liverpool tend to be conservative when it comes to projecting the value of their sponsorships. And in actuality, any deal would likely run for significantly longer than three years.

In 2024-25, for example, it’s likely that performance-related bonuses and other step-ups will have been activated and taken the value of the deal beyond £50m.

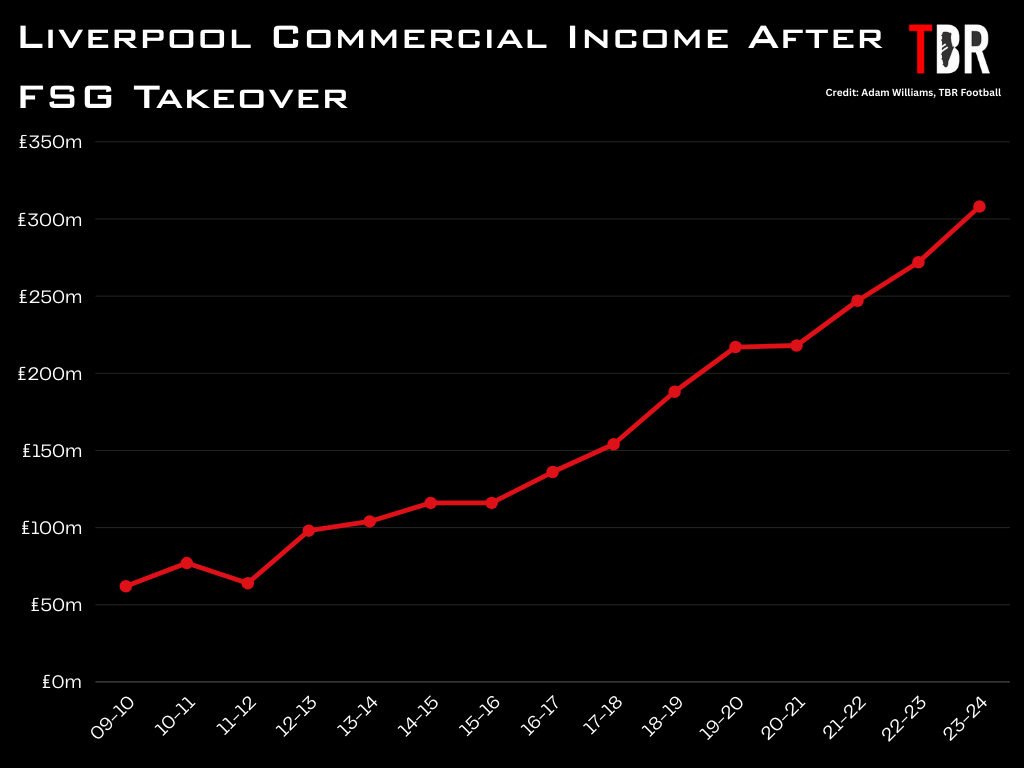

In total, Liverpool’s commercial income in the last financial year was £308m.

Liverpool commercial income after FSG takeover

Liverpool commercial income after FSG takeover

Credit: Adam Williams/TBR Football/GRV Media

In the Premier League, that was only bested by Manchester City, while Paris Saint-Germain, Barcelona, Real Madrid and Bayern Munich were slightly higher at the global level.

With TV income generally plateauing across the industry, owners are looking to maintain their competitive advantage with cash from sponsorship, retail and events.