DEMI Fund founder Danielle Shoots speaks at an event in 2023. (BusinessDen file)

A venture capital firm backed by Denver taxpayers, which endured a public breakup with the city last year, has missed a deadline to submit an audited financial statement to the city.

What was submitted instead, according to a prominent local investor, is “laughable.”

“You would expect more from an eighth grade intern than what this fund provided,” said Justin Borus, who founded Denver-based Ibex Investors in 2003 and manages around $1 billion in investments. “If an eighth grade intern did that work, they’d be fired.”

DEMI Fund, a VC firm founded by Danielle Shoots in 2022, was tapped by Denver that year to use a portion of the city’s marijuana sales tax revenue to support local startups owned by women and minorities, sometimes through grants but other times through direct investments. The contract was expected to involve $15 million over three years, and the plan was to roll any returns into more fledgling businesses.

But last year, DEMI sued the city over the arrangement, saying Denver stopped paying invoices after sending a combined $6.7 million over to the fund. The two parties ultimately settled. Shoots was paid for outstanding invoices, and both sides agreed no more funds would be sent to DEMI.

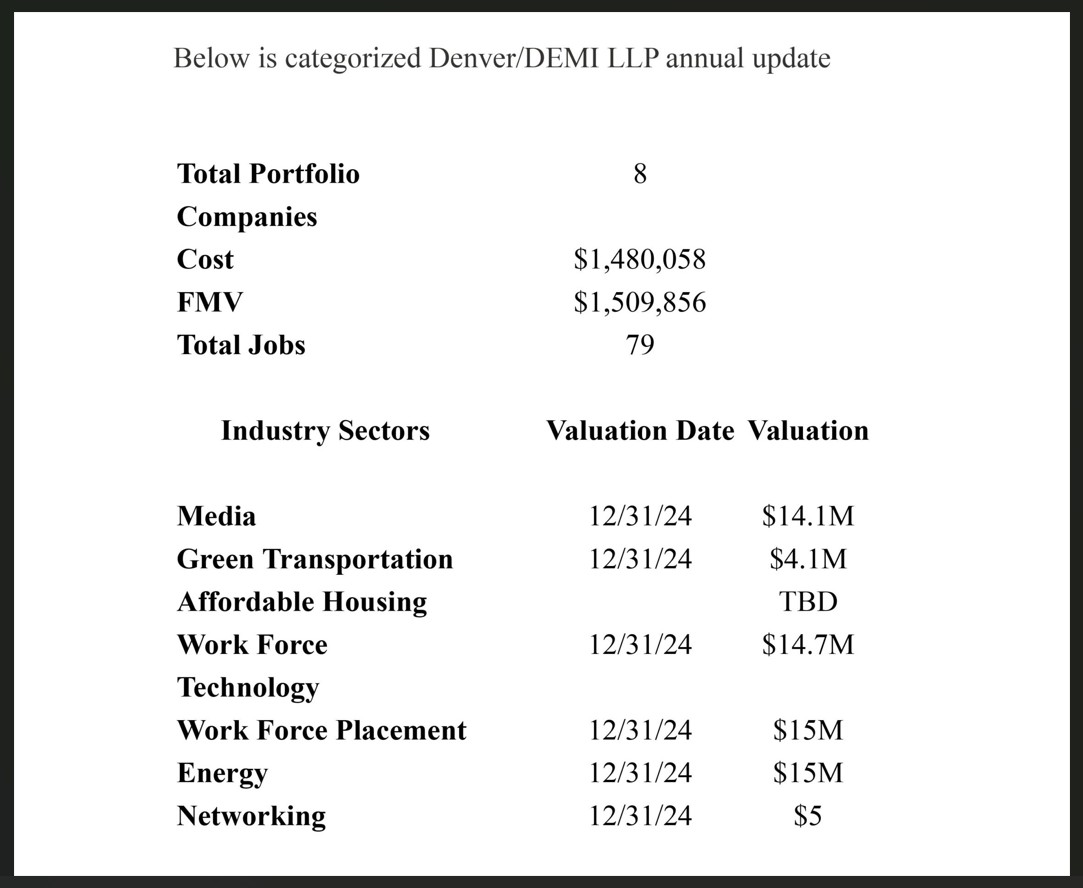

By that point, $1.48 million of city dollars had been invested in several startups through DEMI’s venture arm, according to documents the fund submitted to Denver. That means taxpayers own small portions of the companies and those investments need to be monitored.

The settlement agreement, obtained by BusinessDen through a public records request, specifically said a copy of DEMI’s audited financial statements had to be sent to Denver by the end of July.

But the document Denver received last month from DEMI was not an audited statement, Shoots confirmed to BusinessDen.

Instead, it simply said the $1.48 million Denver had invested was worth $1.51 million at the end of 2024. It didn’t identify companies, but rather assigned valuations to industry categories — like “Media” and “Green Transportation” — without explaining how many companies were within that category.

One category, “Networking,” was assigned a valuation of just $5 — presumably an error. The “Affordable Housing” category was said to be worth “TBD.”

Mark Goodman, who now runs DEMI Fund, declined to answer specific questions from BusinessDen, saying he could not do so without violating confidentiality agreements. Other DEMI employees and members of the investment committee did not respond to requests for comment.

Denver doesn’t want to talk about the investments or the submitted document either.

Adeeb Khan, the head of Denver’s Department of Economic Development and Opportunity, did not respond to requests for comment. Amy Bernabe-Jimenes, a spokeswoman for DEDO, declined to answer specific questions.

“The DEMI Fund and the City of Denver reached a settlement agreement in July 2024 that terminated the contractual relationships and obligations between the two entities,” she said in an email.

Justin Borus

The contract with DEMI began under Mayor Michael Hancock. It was terminated under Mayor Mike Johnston.

Borus, the local venture capitalist, said the document submitted in July was nothing like a typical VC report.

“I don’t even know what I’m looking at,” he said.

“You should have a binder of info and be overwhelmed with the level of detail on what the fund is providing. This is a total breakdown from a communications standpoint by the fund. This is highly unusual,” he added.

Several other VC firms reached by BusinessDen also said their reports provide more financial information or, at the least, the names of the companies the fund is invested in.

The entirety of DEMI Fund’s “annual update” sent to Denver last month, which BusinessDen obtained through a public records request. Per a settlement agreement, DEMI was supposed to provide an “audited financial statement.” (Public records)

One company says DEMI no longer is involved

The document submitted last month indicates Denver dollars were invested in eight companies. But a more detailed one Shoots previously provided to BusinessDen stated that 10 companies received investments with city dollars from August 2022 to July 2023, DEMI’s first year.

The reason for the difference is unclear. One portfolio company — Interview IA and its hiring software — acquired fellow DEMI beneficiary Gritly in early 2024. It now operates under one name, Talentbloom. But that deal would have reduced the company count by just one.

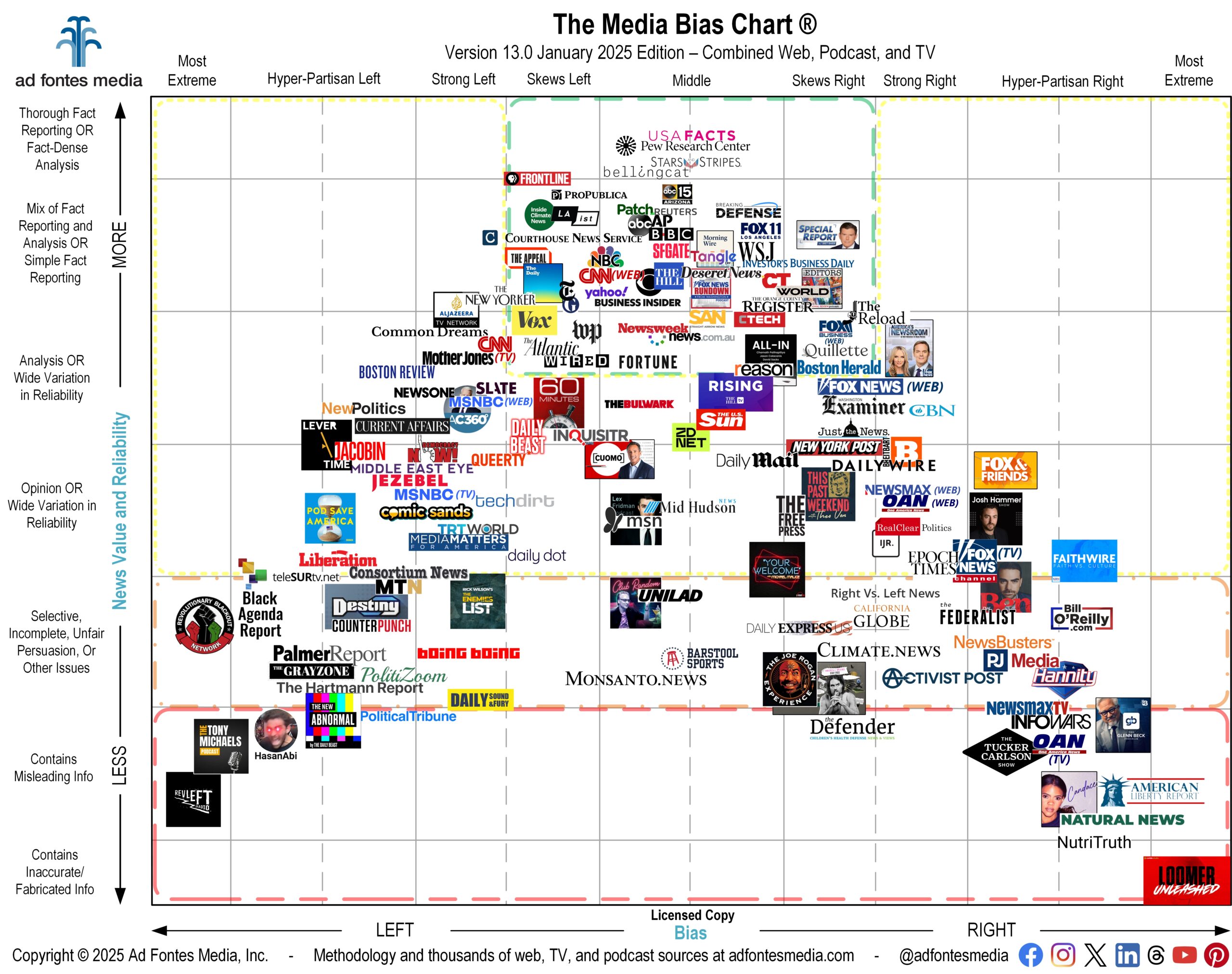

One company Denver invested in is Ad Fontes Media, which rates news outlets on reliability and political bias. Founder and CEO Vanessa Otero told BusinessDen she hasn’t heard from Goodman or other representatives of DEMI since February. That was when she last gave the fund financial information, including revenue, which Otero said is tracking to double this year.

“Danielle and Mark were always big believers in what we do,” she said, noting that DEMI was part of a $4 million round that closed in early 2024. “It’s very difficult to raise funds in general and even more with just female founding teams.”

Otero said DEMI reps initially came to board meetings fairly regularly as observers, although the fund did not have a board seat. Since DEMI and Denver settled last summer, she said no fund representative has attended. Nor has anyone from Denver.

The company’s other two institutional investors, including the local firm Stout Street Capital, have seats and attend consistently, she added.

“Everybody that starts a company and raises funds knows that things can change really quickly, especially over the course of five years,” she said. “I miss it, but it’s not going to impact the ultimate success of my company.”

Ad Fontes is known for its media bias chart, which ranks news outlets based on reliability and their political leanings. (Courtesy Ad Fontes)

Otero said Ad Fontes accounts for the entirety of the $14.1 million valuation assigned to the “Media” category in the July document. That number is based on the round that closed in 2024, she said.

Ibex’s Borus said he updates his investors on the value of their investments quarterly and bases the figure on the company’s most recent financials, not just the valuation assigned to its most recent capital raise.

Other previously named portfolio companies did not respond to multiple requests for comment from BusinessDen.

“We hope to provide the city a return on their investment,” Otero said.

State entity also broke off deal with DEMI

Denver wasn’t the only public entity that funded DEMI.

In 2022, the firm was tapped to invest $7.1 million by the Colorado Venture Capital Authority, a little-known state entity that has worked with VC firms to invest state and federal money since 2005.

That relationship also ended prematurely — a fact that hasn’t previously been reported. VCA spokeswoman Sonya Guram told BusinessDen that the two sides broke off the agreement in July 2024 due to a “no-fault” provision.

It appears to be the first time that any one of the VCA’s nine venture relationships ended early. Guram declined to answer specific questions but said that DEMI and the VCA’s board of directors are “working together to dissolve” the fund.

According to the VCA’s 2024 annual report, DEMI received $1.7 million from the fund and invested $970,544 of that into an unspecified number of startups.

DEMI also raised money from private investors like Bank of America and Xcel Energy.

DEMI founder: Denver shouldn’t have spent tax dollars this way

A source familiar with DEMI’s operations told BusinessDen that DEMI is operating but not making new investments. The source said Goodman and investors are working to transfer assets to a new management team sometime in the near future. The hope is for the mission of supporting women- and minority-owned startups to carry on, according to the source.

Mark Goodman

The source said Shoots has had little to no involvement with DEMI in the past year and signed over her personal ownership stake in the fund, something managers typically have, to Goodman several months ago.

When asked specific questions about the July document, Shoots declined to answer, texting that she has “been out of the day to day and now, legally removed for a long time.”

Shoots told BusinessDen in a text that she has since moved out of Denver and has “no plan to work for as long as I can afford it.”

Shoots said that government and venture capital make for a messy marriage, mostly because of the need for transparency in the former and the largely unregulated nature of the latter.

“I do not believe this city should have ever nor can they spend tax payer money this way,” Shoots said in a later text. “Same for the state.”