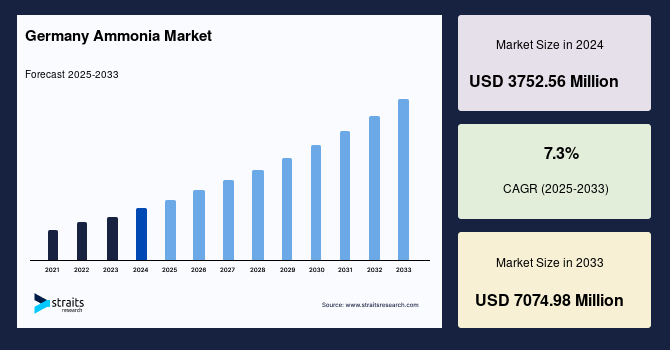

Germany Ammonia Market Size

The Germany ammonia market size was valued at USD 3752.56 million in 2024 and is projected to grow from USD 4026.50 million in 2025 to USD 7074.98 million by 2033, growing at a CAGR of 7.3% during 2025–2033. The market growth is driven by sustained agricultural fertiliser demand, rising industrial use in refrigeration and chemicals, and new investment in green ammonia infrastructure to support hydrogen and sustainability goals.

Germany Ammonia Market Trends

Green Ammonia Integration into Energy Strategy

As Germany pushes forward its climate agenda, green ammonia, generated from renewable hydrogen, is gaining traction, especially for industrial decarbonization and long-term energy storage. Research groups like Forschungszentrum Jülich and TU Munich, working with Linde Engineering, have developed a load-flexible green ammonia plant blueprint capable of adjusting production in real-time to match variable renewable supply, boosting cost-efficiency and grid compatibility by mid-2025. This innovation paves the way for scalable green ammonia projects, supporting Germany’s goal of 10 GW domestic electrolyzer capacity by 2030.

Hydrogen Infrastructure Builds as Ammonia Demand Evolves

Germany’s hydrogen backbone is being rapidly developed, with it infrastructure to handle ammonia as a hydrogen carrier. The Federal Network Agency has approved plans for a 9,040 km hydrogen grid, partly converted from existing gas pipelines, set for completion by 2032. Additionally, Uniper’s Wilhelmshaven terminal is being upgraded into a clean ammonia/hydrogen import hub with up to 600 GWh storage by 2030. As hydrogen and ammonia sectors converge, infrastructure investments enhance ammonia’s utility and market relevance beyond fertilisers. Companies like RWE and Air Liquide are also exploring co-location opportunities for hydrogen and ammonia facilities, enabling ammonia to play a pivotal role in Germany’s import, conversion, and distribution of clean hydrogen, especially for hard-to-abate sectors like steel and chemicals.

Germany Ammonia Market Growth Factors

Robust Demand from Agricultural and Industrial End Users

Germany remains a major consumer of ammonia for both fertilisers and industrial processes. Fertiliser applications comprise over 50% of ammonia use, particularly in grain and oilseed production in regions like Lower Saxony and North Rhine-Westphalia. Meanwhile, ammonia serves as a refrigerant and feedstock in chemical and textile manufacturing. Economic recovery, emphasis on food security, and industrial output collectively support steady domestic consumption, providing a stable foundation for market expansion. In the industrial segment, companies are also investing in low-carbon ammonia alternatives to meet tightening emissions regulations under Germany’s national climate law, thereby adding momentum to domestic ammonia demand.

Government Led Hydrogen Strategy Driving Green Ammonia Projects

Germany’s updated National Hydrogen Strategy (2023) targets 10 GW of electrolyzer capacity by 2030, backed by around 9 billion Euros in funding to decarbonize heavy industries and build ammonia-linked infrastructure. Clean ammonia is seen as a practical vector for hydrogen storage and export. Collaborative R&D efforts, such as load-flexible ammonia designs, and key projects like Uniper’s hydrogen terminal reinforce government-backed momentum, opening pathways for ammonia beyond traditional uses. With export-import agreements already signed with countries like Egypt, Norway, and UAE, ammonia’s role as an energy vector is becoming institutionalized in Germany’s clean energy trade framework, widening its market base significantly.