After failing to break past the 24,700-mark on Tuesday, the Nifty 50 rebounded on Wednesday in a range-bound session, ending the day 131 points higher at 24,631.

The index opened strong and maintained a steady upward move through most of the session. However, 24,700 continues to act as a key resistance.

Gains were led by pharma, metal, and auto stocks, with Hero MotoCorp topping the chart as buying interest in auto counters continued ahead of the festive season.

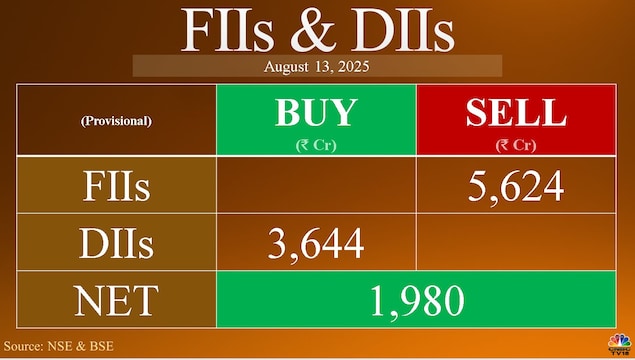

Meanwhile, foreign investors were net sellers in the cash market on Wednesday, while domestic investors were net buyers.

HDFC Securities’ Nagaraj Shetti said the short-term trend remains positive, and a decisive move above 24,700 could pave the way for a rally towards 25,000. Immediate support is seen at 24,465.

LKP Securities’ Rupak De said that Nifty’s close at a multi-day high signals improving sentiment despite tariff-related concerns. The daily RSI has turned positive after days of indecision, raising the chances of a breakout above 24,700. A move above this level could take the index to 25,200 in the short term, while support lies at 24,337.

According to SAMCO Securities’ Om Mehra, support is placed at 24,520 and 24,450. The index may continue oscillating within a broader range in the next session, but a buy-on-dip approach is likely to work if it sustains above the resistance zone.

The Nifty Bank index ended at 55,181.45, up 0.25%, after swinging between 55,340.05 and 55,026.95. The index is still locked in a narrow range as Bollinger Bands contract, suggesting uneven price moves ahead, Mehra said.

Support lies in the 54,950-55,000 range, where the 100-SMA is placed. However, the index remains capped below the 9-EMA, 20-SMA, and 50-SMA, all sloping downwards. Momentum indicators are showing slight improvement, with RSI climbing above 40 and MACD flattening, hinting at early signs of recovery.

On the hourly chart, Nifty Bank is trying to form a base. A close above 55,350-55,450 could open the way for more upside. For now, 55,050-54,950 remains the immediate support, followed by 54,700 on further weakness. The outlook stays mildly positive as long as the 100-SMA holds.