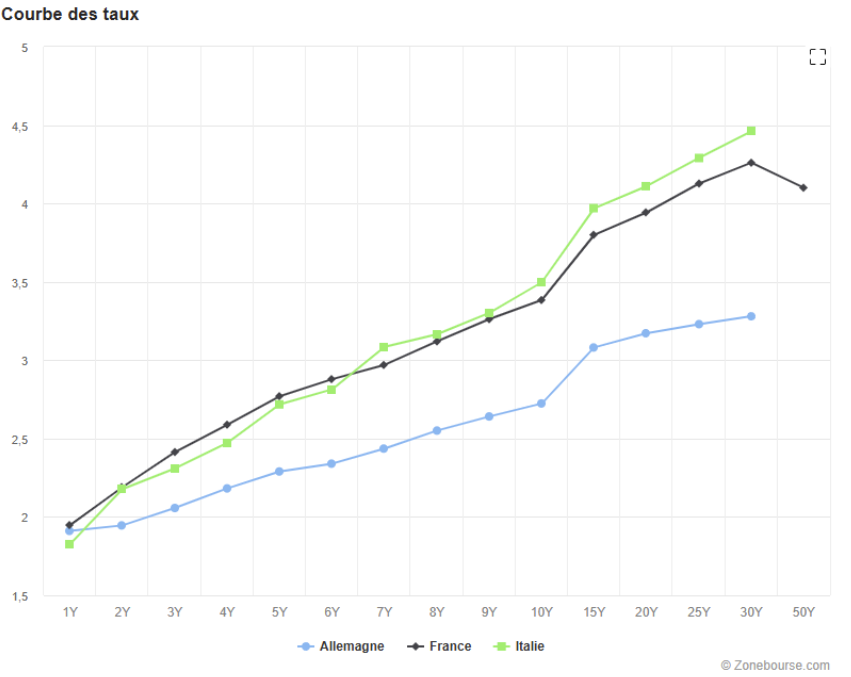

Just a month ago, we were talking here about the end of the historic spread on short-term maturities between Italy and France. Now we are back with a slightly more alarming observation: the end of the spread between 10-year bonds. And Giorgia Meloni does not intend to stop there: she is now targeting Germany.

For a long time, Europe has been divided into a “hard core” of stable borrowers and a more fragile “periphery.” This distinction now seems outdated.

Already, Italian 5-year debt is trading at a lower rate than France’s. And the same movement is happening in the long term.

Two dynamics are intertwined: the ongoing deterioration of France’s public finances and increased market confidence in the policies of Giorgia Meloni and her government. Meloni’s leadership is seen as a stabilizing force. With a stronger euro, investors looking for a European haven or fleeing the dollar have a new protégé.

Admittedly, Italy has a higher debt-to-GDP ratio and France has stronger growth. But investors view their trajectories very differently. French Prime Minister François Bayrou’s attempt to present a budget recovery plan was not enough to reassure the markets. The French political scene, which has been unstable for over a year, is a cause for concern. Without a majority, ambitious proposals for a return to a balanced budget are likely to remain dead letters.

Conversely, the coalition led by Fratelli d’Italia (Brothers of Italy) enjoys a solid majority. And the Italian government is working to bring its deficit back to the European target of 3%. It has fallen from 4.3% of GDP to 2.8% in one year. In France, the hope is to return to below 3% within four years – a trajectory considered too slow by the markets but, above all, difficult to achieve.

Italy-France spread on 10-year rates (Source: World Government Bonds)

Until 2022, it seemed normal for Italy to borrow at a rate 1 point higher than France. This paradigm is now shifting. At the end of 2023, Giorgia Meloni’s rise to power initially unsettled the markets. Her right-wing stance and aggressive tone initially aroused mistrust. The ongoing political instability in France and Italy’s economic reforms then made the slope increasingly steep.

Perhaps we should wait and see what happens when Italy catches up with Germany on these same deadlines, with the spread below 0.9% for the first time since 2010.