Years before Amazon Web Services launched in March 2006, there were a slew of grid computing startups and incumbent system makers – and a few of them with deep supercomputing experience – that were hawking remotely accessible, utility-style computing on demand.

This nascent grid computing drove somewhere around $1 billion in sales worldwide in 2002, which was also the year that PC maker and server wannabe Gateway – remember them? – took the 8,000 display model PCs it had in its network of stores and lashed them into a computational grid called Gateway Processing On Demand, with a whopping 14 teraflops of aggregate performance. That peak performance of the Gateway grid, in theory, was on par with the 10.24 teraflops ASCI Q supercomputer at Los Alamos National Laboratory and the 12.29 teraflops ASCI White system at Lawrence Livermore National Laboratory, both of which were on the top of the Top 500 ranking of supercomputers in November 2002. In practice, the networking on the Gateway grid was too slow to run a lot of HPC applications, but was good for certain kinds calculations where the time to answer was not critical.

Other efforts like the Utility Data Center from Hewlett Packard in November 1999, Supercomputing On Demand from IBM in January 2003 and the Sun Grid from Sun Microsystems in February 2005 all predate the debut of Amazon Web Services, but it was the IT supplier arm of the online bookseller that gets credit as first mover. And we think this is the case because AWS EC2 compute and S3 object storage were easy to understand and use and because they were used for all kinds of real-world applications, not just HPC and data analytics work. AWS has made it easy, and everyone has had to play catch up since the Great Recession hit and cloud computing as we know it – virtualized compute, storage, and networking that can be turned on and off at will with metered pricing – started to become normal.

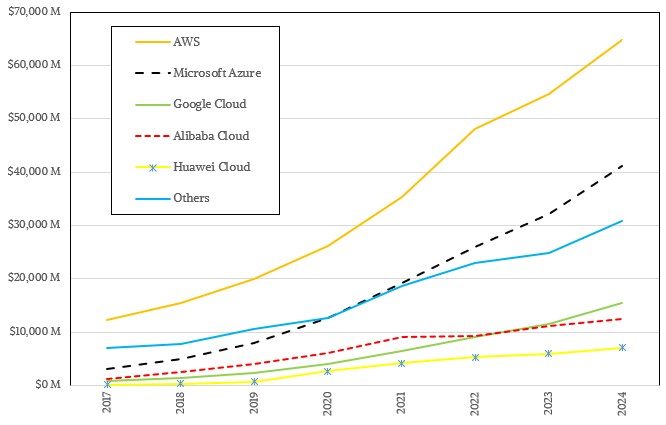

And the substantial lead that AWS built up still has it in the pole position among cloud builders, even though its share of the market has inevitably been shrinking by baby steps as Microsoft Azure, Google Cloud, Alibaba Cloud, Huawei Cloud, and the neocloud collectives are all, give or take a quarter or two here and there, outgrowing the cloud builder behemoth.

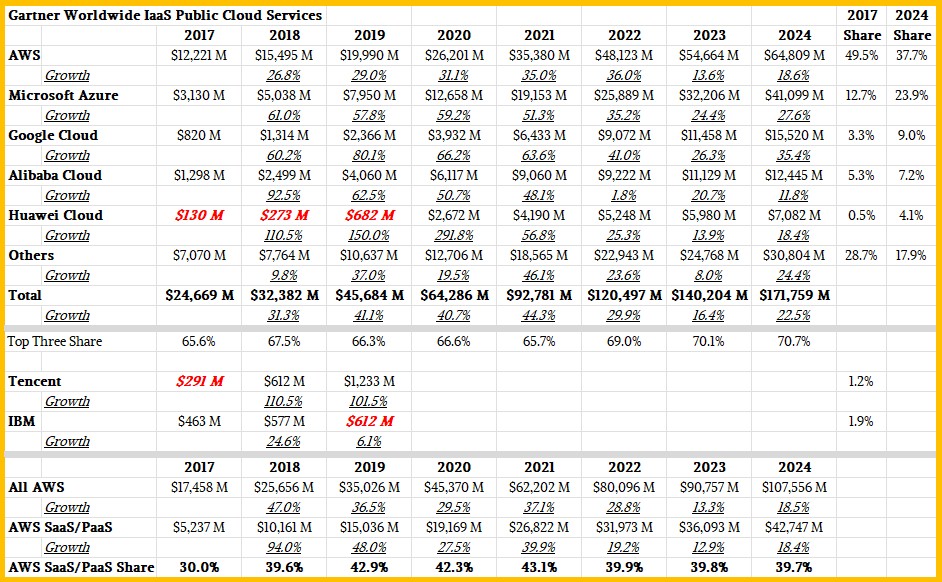

The market researchers at Gartner have just finishing casing sales of infrastructure as a service (IaaS) utility computing for 2024, and we took a gander at that and then went back into the Gartner archives and compiled all of the sales by cloud vendor going back to 2017.

As usual, Gartner compiles the revenues of the top five providers in any market and then lumps the others into an aptly named group called Others. We have estimated missing data, shown in bold red italics, as usual.

Here is the table we compiled from the public data from Gartner:

And here is a graphical representation of the revenues by vendor for those of you who like to think visually:

Remember this is just for IaaS, the renting of hardware capacity and does not include software and platform services that are sold separately.

Eight years ago, IBM and Tencent were large enough to make the top five and were for a while in a statistical tie – albeit with pretty modest revenues. Both have dropped below the radar and are not relegated to the Others bin. Alibaba Cloud has grown steadily, but a little more slowly than Google Cloud to be a solid number four, a position it will likely hold and that makes it the largest cloud builder in China.

It is not hard to imagine that Alibaba could eventually be about half as large as AWS, particularly as China’s economy grows and the gross domestic product between the North America plus a large portion of Europe is sized against China and other parts of Asia where Alibaba has a presence. US-based providers account for around three-quarters of cloud revenues in Europe. GDP was $20.2 trillion last year in the United States and $17.9 trillion in the European Union, with China at $18.7 trillion. If clouds stay largely indigenous, then AWS plus Azure plus Google Cloud should be around a third of global cloud IaaS spending (it is twice that portion) and China should be around a sixth of the pie, and the two big suppliers in China – Alibaba and Huawei – account for about 11.4 percent of global cloud revenues.

The US has a disproportional amount of cloud spending, and that is due in part to the GenAI boom but also to the immense amount of computing that the Western economies do in general.

It is illustrative to see the share losses of AWS as well as the share gains by the other players, which are shown in the right side of the table above. It will take a long time for Microsoft Azure to catch AWS, but it is not outside the realm of possibility. Microsoft Azure is growing faster than AWS, and Google Cloud is growing faster than that. But the cloud arm of the search engine giant has a long way to go to catch Microsoft much less Amazon. We do not think the market will naturally settle into a position where AWS, Microsoft Azure, and Google Cloud each get around 25 percent share of cloud IaaS spending and the rest of the vendors get the other 25 percent.

Just for fun, we used actual AWS revenues for the years shown and subtracted out the Gartner IaaS sales numbers for AWS to get a sense of how much platform as a service (PaaS) and software as a service (SaaS) revenues AWS has. Back in 2017, it looks like SaaS and PaaS only drove 30 percent of revenues, and it quickly jumped up above 43 percent over the ensuing years. Then, when the GenAI boom hit, AWS started renting very expensive GPU servers, and the balance shifted back towards hardware and is hovering around 40 percent of AWS revenues. This is lower than we have modeled in our AWS analysis, where we have PaaS and SaaS driving close to half of revenues before the AI boom, and a rate falling by a few points in the past several years thanks to GPU server spending due to GenAI.

Featuring highlights, analysis, and stories from the week directly from us to your inbox with nothing in between.

Subscribe now

Related Articles