Key Takeaways

BTC’s overall demand has declined from over 170K BTC to 50K BTC in August. Despite the short-term macro risks, speculators have upped bets on $120K-$130K price target.

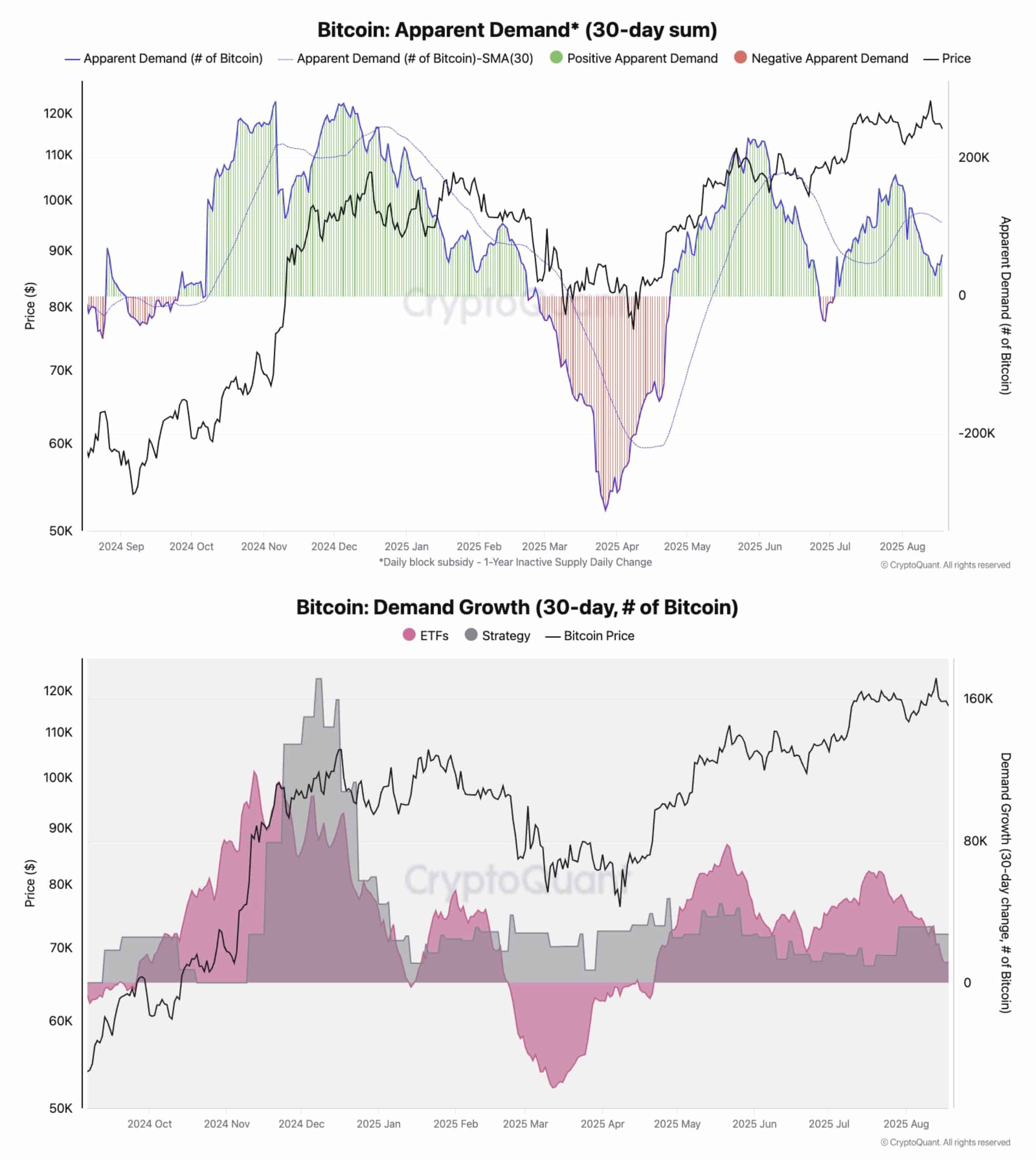

Bitcoin’s [BTC] overall demand from ETF complex and treasury firms has dropped sharply, further accelerating the recent pullback from $124K to $112.5K.

According to Julio Moreno, CryptoQuant’s Head of Research, the demand slowdown was primarily behind the price retracement.

Source: CryptoQuant

From over 170K BTC in early August, appetite declined more than threefold to 50K BTC at press time. However, analysts also warned of extra macro headwinds in the near term.

Powell’s stance, liquidity concerns

Expectations for September’s potential Fed rate cuts will come under renewed scrutiny ahead of Federal Reserve Chair Jerome Powell’s speech on the 22nd of August, at the Jackson Hole Symposium.

For his part, Wall Street analyst Tom Lee has projected that Powell will likely take a hawkish stance, but markets will rally afterwards.

At the same time, the potential dollar liquidity drain could also derail BTC bulls in the next few weeks, according to Coinbase’s Head of Research, David Duong. Delphi Digital also shared a similar cautious warning.

Duong argued that the U.S. Treasury will likely borrow more money (about $400B) from the markets, and could sour sentiment for BTC and crypto in the short-term. But he added,

“This explains why Bitcoin has lost trend alongside many equity names. But we think the path forward looks clearer in September.”

Source: X

Will BTC’s $110K support hold?

This begs the question — Will the $110K support crack ahead of these macro pressures?

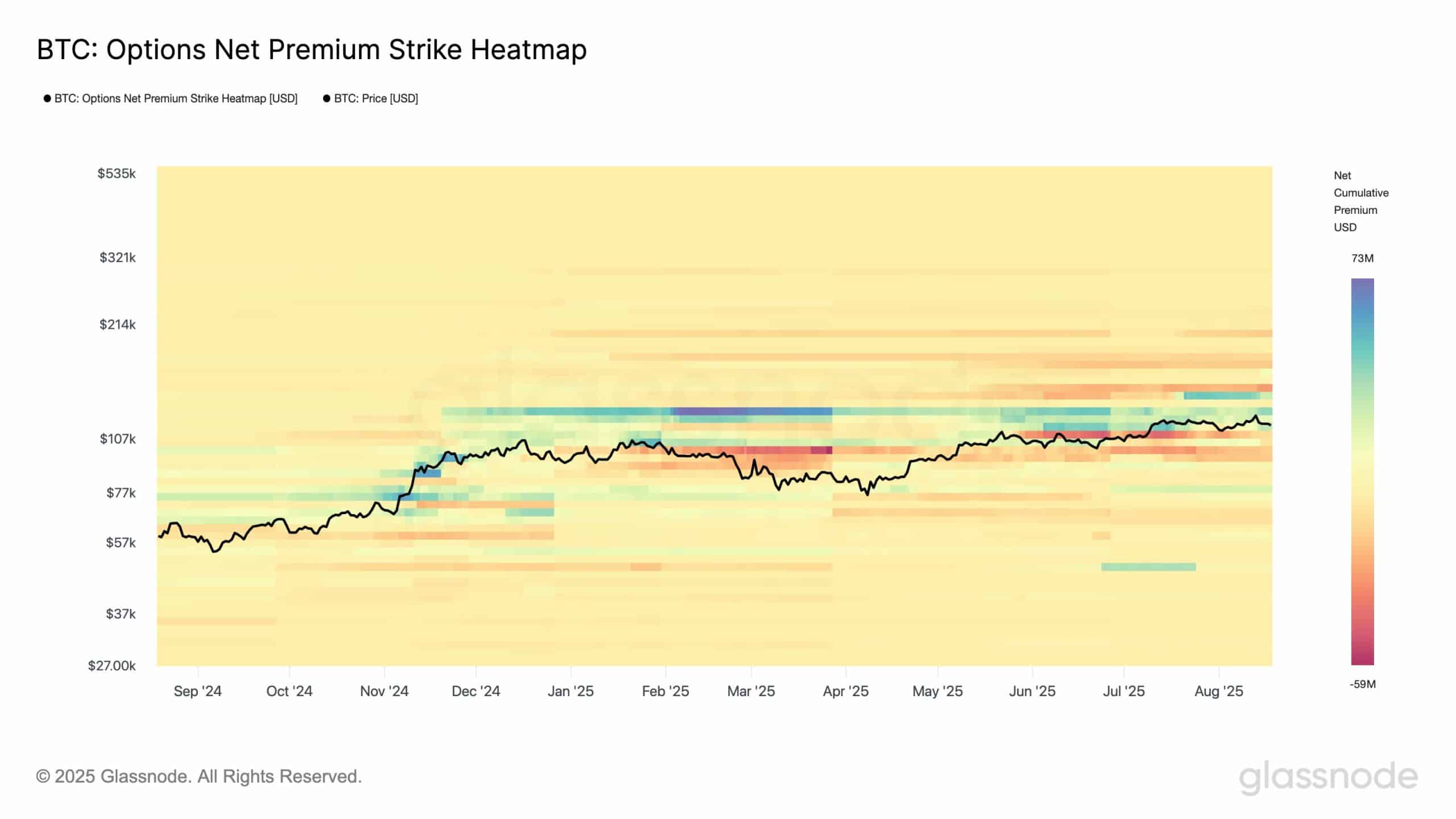

Well, Options traders were making a contrarian bet. Notably, Options market positioning has hit record highs, according to Glassnode.

In fact, speculators scooped more calls (bullish bets) targeting $120K-$130K, marking it as a key upside target.

Source: Glassnode

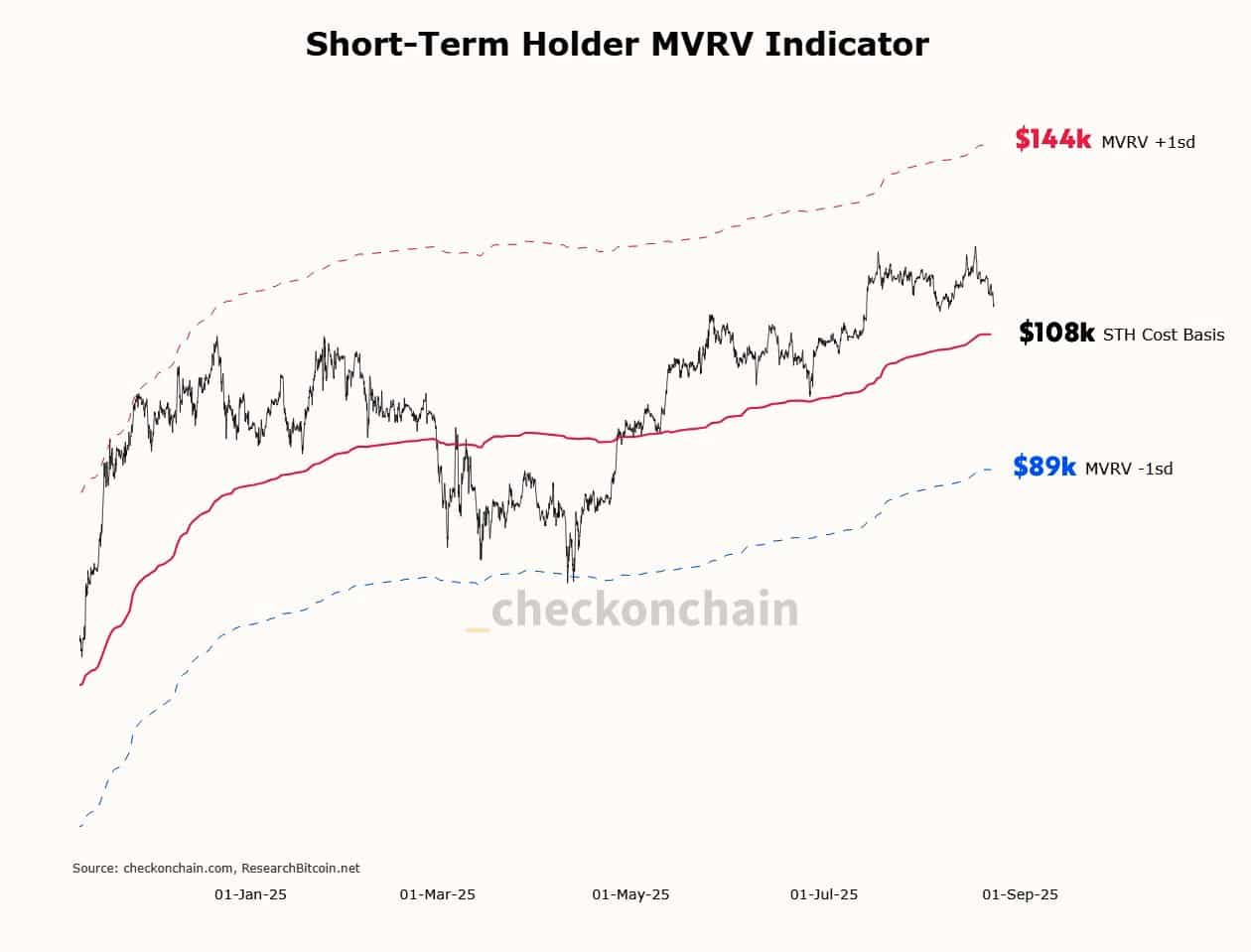

That said, any further downside risk could be accelerated if the BTC clears the Short-Term Holder (STH) Cost Basis of $108K.

This level has acted as a key support and resistance level in the past. Hence, if $110K support fails, it could be the next level to watch for a potential rebound in light of the above macro pressures.

Source: Checkonchain

Overall, bulls, especially on the Options side, viewed the recent pullback as an opportunity for a discounted grab for a potential rally to a new peak.

Whether they’ll withstand or succumb to macro pressures remains to be seen.

Next: $64.4M Bitcoin sale stirs fear of short-term BTC price dip – Explained