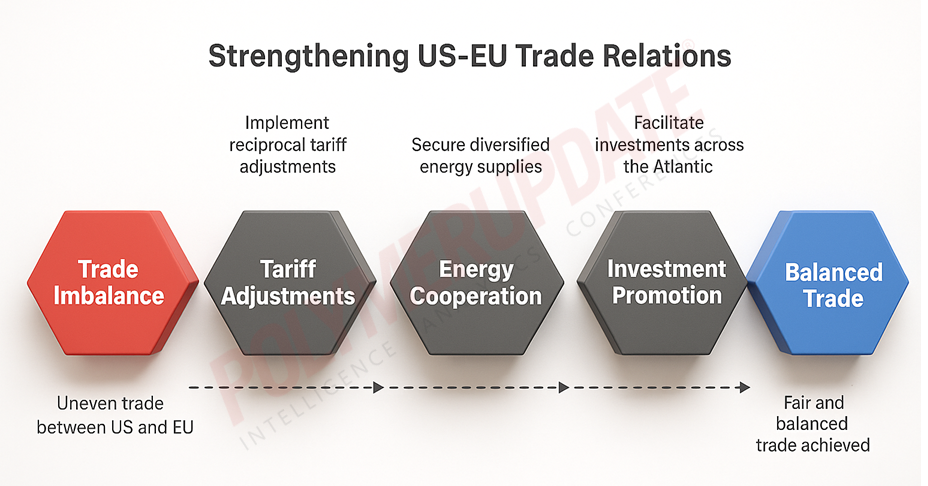

The United States and the European Union have signed an Agreement on Reciprocal, Fair, and Balanced Trade to place their trade and investment relationship on a stronger footing and reinvigorate economic re-industrialisation. As announced earlier, EU merchandise exports will face a 15 percent tariff in the US market, while American goods will enjoy free market access within the European Union. Titled the Framework Agreement on Reciprocal, Fair, and Balanced Trade, the deal between the two trade partners—among the largest globally—was announced on Thursday.

A joint US-EU statement issued the same day highlighted the European Union’s acknowledgement of US concerns and the partners’ shared commitment to addressing trade imbalances and unlocking the full potential of their combined economic strength. Reached four weeks ago in Scotland, the Framework Agreement is seen as the first step in a process that could be expanded over time to cover additional areas, improve market access, and deepen trade and investment ties.

A joint US-EU statement issued the same day highlighted the European Union’s acknowledgement of US concerns and the partners’ shared commitment to addressing trade imbalances and unlocking the full potential of their combined economic strength. Reached four weeks ago in Scotland, the Framework Agreement is seen as the first step in a process that could be expanded over time to cover additional areas, improve market access, and deepen trade and investment ties.

Carsten Brzeski, Global Head of Macro at ING Economics, commented, “This Framework Agreement on ‘Reciprocal, Fair, and Balanced Trade’ is not a legally enforceable treaty but rather a clarification of the handshake deal between US President Donald Trump and European Commission President Ursula von der Leyen. It confirms key elements such as a 15 percent US tariff on most European goods, Europe’s intention to reduce or eliminate certain tariffs on US goods, increased European purchases of US energy, and greater EU investment in the US.”

Objectives of the agreement

Through this agreement, the European Union intends to eliminate tariffs on all US industrial goods and provide preferential market access for a wide range of US seafood and agricultural products, including tree nuts, dairy, fresh and processed fruits and vegetables, processed foods, planting seeds, soybean oil, and pork and bison meat. The European Union will immediately take the necessary steps to extend the Joint Statement of the United States and the European Union on a Tariff Agreement.

The United States, in turn, commits to apply the higher of either the US Most Favoured Nation (MFN) tariff rate or a tariff rate of 15 percent—comprising the MFN tariff and a reciprocal tariff—on originating goods of the European Union. Effective September 1, 2025, the United States will apply only the MFN tariff to several EU products, including non-substitutable natural resources (such as cork), all aircraft and aircraft parts, generic pharmaceuticals and their ingredients, and chemical precursors. Both sides also agreed to consider additional sectors and products important to their economies and value chains for potential inclusion in the 15 percent tariff category.

The United States and the European Union further committed to cooperate on ensuring secure, reliable, and diversified energy supplies, including by addressing non-tariff barriers that might restrict bilateral energy trade. As part of this effort, the EU intends to procure US liquefied natural gas, oil, and nuclear energy products, with an expected offtake valued at US$ 750 billion through 2028.

A relief for Europe

For Europe, it is a relief that pharmaceuticals and semiconductors are included in this group, sparing them from even higher tariffs. The situation with cars is more complex: they will only be moved into the 15 percent tariff category (down from the current 27.5 percent) once Europe fulfils its commitment to lower tariffs on US goods. This conditionality is just one example of the agreement’s ambiguity, leaving room for both interpretation and potential escalation.

Other elements, such as Europe’s “intentions” (rather than firm commitments) to reduce tariffs, purchase more US energy, and increase investment in the US, also lack binding force. One notable example is the EU’s stated plan to “substantially increase procurement of military and defence equipment from the United States, with the support and facilitation of the US government.”

Investments

The United States and the European Union share one of the world’s largest economic relationships, underpinned by mutual investment stocks exceeding US$ 5 trillion, and intend to further promote and facilitate investments on both sides of the Atlantic. In this context, European companies are expected to invest an additional US$ 600 billion across strategic sectors in the United States through 2028.

The European Union also plans to substantially increase its procurement of military and defence equipment from the United States, with the support and facilitation of the US government. This commitment reflects a shared strategic priority to deepen transatlantic defence industrial cooperation, strengthen NATO interoperability, and ensure that European allies are equipped with the most advanced and reliable defence technologies available.

Damage control for Europe

In summary, the Framework Agreement reinforces the impression formed after the Scotland deal: the only real upside for Europe is that the outcome could have been worse, and that there is now at least some clarity. However, this clarity remains fragile and could quickly dissipate. The agreement contains numerous provisions that may spark future tensions and escalation. The implementation, monitoring, and enforcement of many of the stated intentions remain unclear.

In 2024, the EU reported a €198.2 billion (approximately US$ 236 billion) trade surplus with the US, driven by €531.6 billion in exports to the US and €333.4 billion in imports from the US. This marked a significant shift, with the US reporting a trade deficit of US$ 235.6 billion. The overall balance reflected a €198.2 billion surplus in goods, offset by a €108.6 billion deficit in services, resulting in a smaller combined surplus.

The Framework Agreement ultimately serves as a painful reminder of Europe’s dependency on the US—more so than the reverse. It is difficult to call this a deal when it reads more like a document of damage control for Europe.

DILIP KUMAR JHA

Editor

dilip.jha@polymerupdate.com