- The EUR/USD weekly forecast has turned bullish after the Fed Chair left dovish remarks regarding rate cuts.

- Positive Eurozone PMIs limited the downside for the Euro.

- Markets eye macro releases from both the Eurozone and the US next week.

The euro ended the week with a flurry of buying, with EUR/USD breaking through the 1.1700 level after dropping to 1.1583 during the week. The late rally came as a result of a steep decline in the US dollar after Fed Chair Powell delivered a dovish speech at Jackson Hole. He confirmed the first rate cut in September and introduced a new policy of flexible inflation targeting. As traders began to price in a new easing cycle, the momentum in the dollar broke, correcting it to a more neutral ground.

–Are you interested in learning more about crypto robots? Check our detailed guide-

The European side of the story also helped the bulls. Flash PMI data in August indicated that the Eurozone economy is gaining momentum, as the Composite PMI 51.1 was the highest in 15 months. Output in the manufacturing sector rose to a three-year peak, adding to evidence of a gradual healing of the economy as a whole.

The inflation reading held in line with anticipations, with the harmonized index of consumer prices (HICP) at 2& and the core number at 2.3% that demonstrates a sense of stability. But Germany is again a restraint on the outlook as revised Q2 GDP contracted 0.3% and Producer Prices were weak, underscoring structural challenges in Europe.

Economic strength among the dollar was first seen on the Antipodean-Asian front with upbeat weekly PMI figures, especially with a manufacturing resurge in the US. The data initially supported greenback, but the pivot by Powell dwarfed the data and engendered a sharp turnaround in it. The markets are already pricing a near-certain September rate cut, with more talk of additional easing later on in the current year.

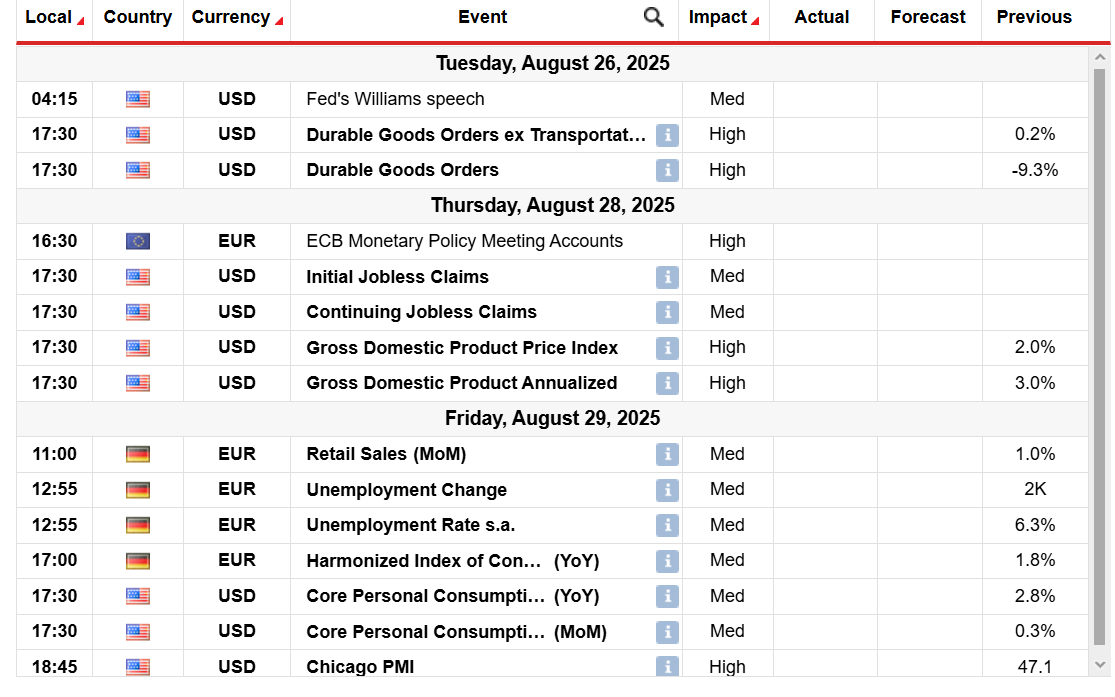

Going forward, the main events to monitor are macro releases that may either back up this dovish belief or dispute it. In the US, Durable Goods Orders on Tuesday, Q2 GDP revision on Thursday, and the July Core PCE Price Index on Friday are on the radar. A downside PCE print would see the dollar extend its losses and push EUR/USD higher, with the inverse being true in the event of a stronger-than-expected data point.

In Europe, Germany will be in the limelight as the August IFO Business Climate survey, July Retail Sales, and preliminary HICP inflation are reported. Positive German data would be a boost to the euro, although further softness will limit rallies. Furthermore, the Economic Sentiment Indicator will also give a wider picture of the recovery in the EU.

EUR/USD weekly technical forecast: Bulls eying 1.1800

The daily chart for EUR/USD shows a bullish bias as the price broke above the confluence of 20- and 50-day MA near 1.1650. The pair marked highs near 1.1745, where it saw a mild profit-taking. If the upside persists, the pair needs to find acceptance above the 1.1750 resistance. The next key level emerges at 1.1800.

–Are you interested in learning more about buying Dogecoin? Check our detailed guide-

On the flip side, the 100-day MA near 1.1483 marks a key support for the pair ahead of 1.1400 (round number). However, the daily RSI has sharply moved above the 50.0 level, suggesting the path of least resistance lies on the upside.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.