A large number of people aged 40 to 75 have no savings, leaving them increasingly vulnerable to poverty in retirement, research shows

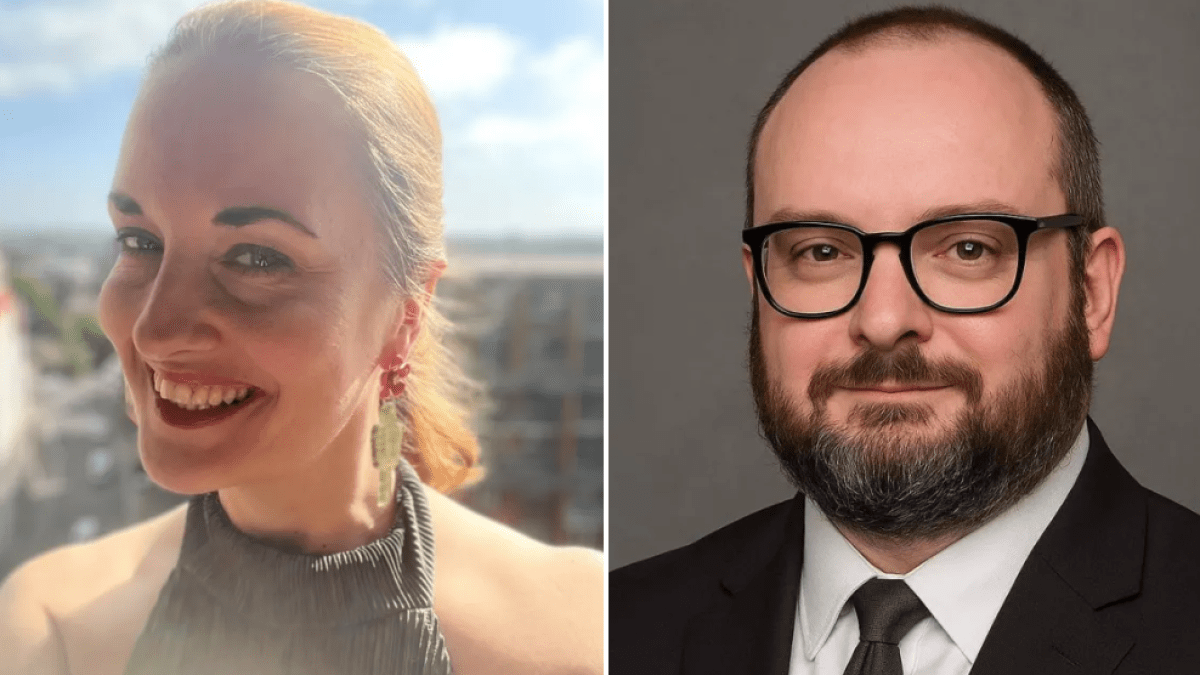

Sara-Louise Ackrill often thinks about retirement, but, like millions across the UK, she doesn’t see how it will be financially possible.

The 47-year-old, from East London, has no savings, no property, no car, and no investments.

She runs a consultancy focused on neurodiversity and became an author earlier this year.

Each month, she pays herself £4,000 – enough to cover rent and bills – but doesn’t feel able to contribute to a pension.

Speaking to The i Paper, she said: “I have autism and ADHD, and I lose a lot of money to the disability tax.

“People with long term health conditions can spend hundreds more a month just for being the way they are. For example, a sudden loss of energy when I’m in the city could mean an unbudgeted £60 taxi home.”

Despite now earning more than she ever did in her previous roles in hospitality and therapy, saving still feels out of reach.

She added: “I often think about retirement but I’m not in a position to do anything about it.

“Starting my business has been amazing but it wasn’t a get rich quick scheme. Being an author doesn’t help much on the financial side of things either.

“I have always thought I might retire in Asia. I don’t think the UK has much respect for older people, but it would be nice to have the option. I don’t see how I will be able to.”

Ms Ackrill is not alone. According to the Department for Work and Pensions (DWP), 38 per cent of UK adults aged 40 to 75 have no savings, and a further 20 per cent have less than £15,000.

A quarter of people in this group have no private pension, with those on lower incomes, renters, and individuals with long-term limiting health conditions the least likely to have one.

She recently consulted a financial adviser, which has offered some optimism.

Ms Ackrill added: “The financial health meeting I had was really good and we spoke about what I could put aside each month.

“In reality though, things like unexpected vet bills, birthdays, occasional treats, will eat into the disposable income I do have.”

‘My pension’s worth less than a year’s wage’

Antony Davies, 43, from Wales, shares similar concerns. Despite working in the charity sector for over two decades, he has no substantial pension or retirement fund.

He said: “Charity roles are generally low-paid compared to equivalent private-sector positions and rarely include bonuses or significant benefits.

“Redundancy a few years ago meant a sudden loss of stability, and a lack of local third-sector opportunities pushed me into retail work, which is also low-paid.

“Rising living costs, periods of ill health, and day-to-day expenses have made saving difficult.

“I do have a small workplace pension that’s currently worth very little, and a modest amount in ISAs meant as an emergency buffer rather than a dedicated retirement fund.”

He has only started thinking seriously about retirement in the past couple of years and recognises the benefits of starting earlier.

Mr Davies, who is a fellow of the Royal Society of Arts (FRSA), author, historian, and political commentator, said: “In total, the combined value of my workplace pension isn’t even equivalent to a single year’s wage. At best, it’s a modest supplement rather than a solution.

“What I earn now covers essentials, mortgage and household bills, food, and transport, with very little left over.

“I try to put a small amount into ISAs when I can, but that’s for unexpected expenses.

“Any surplus is usually absorbed by rising costs or one-off essentials such as plumbing repairs or appliance replacements.

“Careful budgeting is second nature, but it leaves little room to plan far ahead.”