Instability of Gupta empire casts shadow over Newport

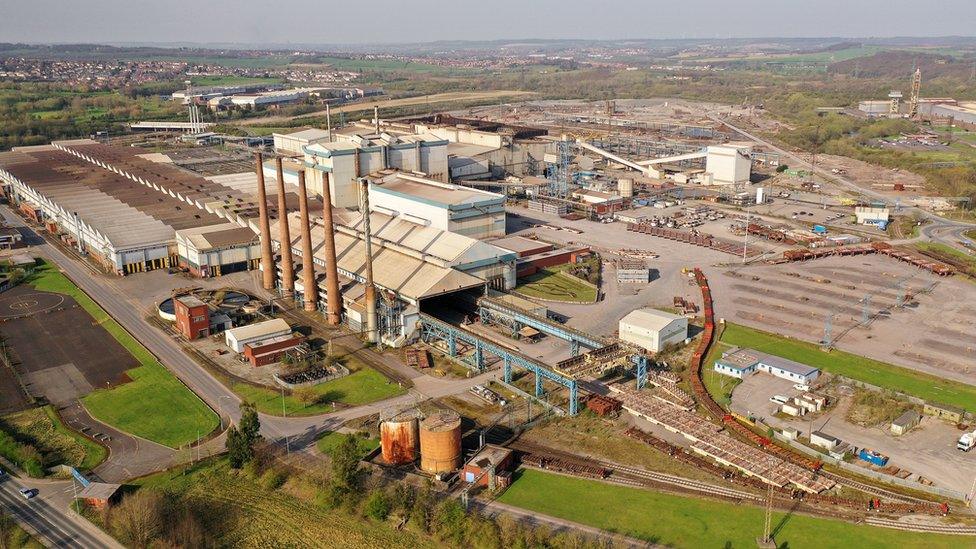

THE COLLAPSE of Liberty Steel’s major operations in South Yorkshire has intensified concerns about the long-term future of the UK’s steel industry — with growing scrutiny now falling on the company’s Welsh site in Newport.

Liberty’s Speciality Steel UK (SSUK) business, which includes plants in Rotherham and Stocksbridge, was placed into compulsory liquidation last week. The UK Government has stepped in to take over operations temporarily, securing 1,450 jobs and attempting to stabilise supply chains in the aerospace, energy, and defence sectors.

While Liberty’s Newport site has not been affected directly and remains operational, it is part of the wider GFG Alliance, the international conglomerate owned by Sanjeev Gupta. The group has faced significant financial strain since the collapse of its main backer, Greensill Capital, in 2021, and is currently the subject of an ongoing Serious Fraud Office investigation.

The Herald understands that Newport continues to produce hot-rolled coil, a key material used in construction and manufacturing. However, the instability across the group has prompted unions and industry watchers to warn of potential knock-on effects in Wales should further restructuring or asset sales occur.

Port Talbot transition looms

The uncertainty comes at a time of major change for Welsh steel. Tata Steel has already closed both of its blast furnaces at Port Talbot as part of its move to electric arc furnace technology. Although £1.3 billion in public funding has been committed to support the transition, and £80 million has been allocated for retraining and business support, the closures mark the end of primary steelmaking at the site — a capability that has existed in Port Talbot for over 70 years.

In a speech to the Welsh Labour Conference on June 28, Secretary of State for Wales Jo Stevens defended the government’s handling of the transition, highlighting the investment package and a new £11.8 million joint fund with Tata to stimulate job creation. She described the reforms as essential for securing a “bright, long-term future” for steel communities in Port Talbot, Llanwern and Trostre.

But industry analysts and union leaders continue to express concern that the UK is losing too much too fast — especially when it comes to its ability to make steel from raw materials rather than recycled scrap.

Is the UK still self-sufficient?

With Liberty Steel’s collapse adding to the list of recent setbacks, serious questions are being raised about the UK’s strategic independence in steel production. The government is now financially supporting four of the country’s six largest steelmakers and has passed emergency legislation to intervene in the industry.

However, now that Port Talbot’s blast furnaces have closes, the UK is now left with no large-scale primary steelmaking capacity. This, critics argue, has left the country vulnerable in the event of global supply chain shocks, conflict, or major infrastructure demand.

The Newport site remains stable — for now — but its future is increasingly tied to the fortunes of the wider GFG group. Unless long-term certainty is restored across the sector, the UK risks not only further job losses but the erosion of a vital national industry.

What next for Liberty Steel and UK industry?

Reports suggest that Sanjeev Gupta is preparing a “pre-pack” administration deal to regain control of Speciality Steel UK (SSUK) following its liquidation. One proposal under consideration includes placing the business into a trust for his children — a move intended to reassure investors and secure the unit’s future. Talks are ongoing as administrators seek a viable solution to restart operations.

Labour MP Sarah Champion has described the liquidation process as “full of hollow promises” and warned that Liberty Steel is too strategically important to be allowed to fail. “I am confident the government will do all in their power to let it flourish,” she said.

GMB National Officer Charlotte Brumpton-Childs also weighed in, calling the collapse “another tragedy for UK steel” and blaming “years of chronic mismanagement” by Liberty’s leadership. She urged the government to step in, as it previously did with British Steel, to safeguard remaining jobs and production capacity.

With instability spreading across the sector, industry leaders are urging the government to produce a long-term industrial strategy. A comprehensive plan is expected to be unveiled later this year, which may include further support drawn from the £2.5 billion National Wealth Fund.