Just a few carefully chosen, yet hardly definitive words from US Federal Reserve chair Jerome Powell was enough to snap a five-day losing streak on Wall Street and add more than a trillion dollars to the value of global markets.

Speaking at the annual Jackson Hole central bank gabfest in Wyoming, Mr Powell said the Fed may “adjust its policy stance” and immediately buy orders hit trading screens in a blaze of green.

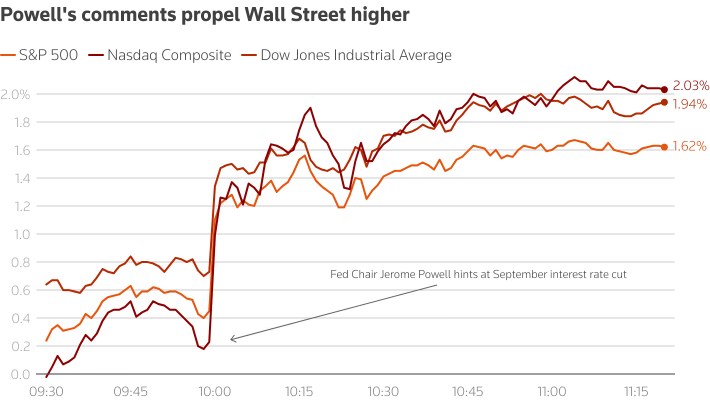

The blue-chip Dow gained 1.9% to beat its previous record close from way back in December last year.

After five days of losses, the S&P 500 jumped 1.5% and the tech-centric Nasdaq also rebounded, gaining 1.9%.

The rate sensitive small cap Russell 2000 surged more than 4% to its highest level this year.

Wall Street indices response to Powell comments (LSEG, Reuters)

Wall Street indices response to Powell comments (LSEG, Reuters)

Friday night futures trading on the ASX 200 points to a 0.9% rise this morning.

Mr Powell’s comments have been taken as a pre-cursor to a September rate cut, with traders shortening the betting from a 74% chance of a cut before his speech to a 90% chance after it.

“Given Powell’s surprisingly dovish comments, it makes sense that both stocks and bonds are up significantly today,” Facet chief investment officer Tom Graff told Reuters.

“However, looking over the next couple months, rate cuts alone won’t be enough to sustain strength in stocks.

“The rate cuts will have to ‘work’ in the sense that the economy regains momentum,” Mr Graff added.

The increased likelihood of rate cuts and an overall solid reporting season prompted investment banking giant UBS to raise its S&P 500 annual target for the second time in two months.

UBS raised its target to 6,600 points from 6,200, implying an upside of 2% to the index’s last close at 6,467.

However, one of the biggest market movers of the day had little to do with rates or results, rather the ongoing piecemeal intervention of the White House in companies of interest to it.

Chip maker Intel jumped 5.5% on news that the US government would take a 10% — or roughly $US10 billion — stake in it, after President Trump has previously said its CEO should be sacked.

European markets also gained on Mr Powell’s comments.

The broad continental Eurostoxx 50 rose 0.4% to a five-month high and less than 1% off a record close.

UBS was a bit more “neutral” on European equities, lowering its earnings growth estimate for the area this year to -3% from 0%.

US Treasury yields predictably keeled over on Mr Powell’s comments, while the US dollar tumbled around 1% against the basket of currencies of its major trading partners.

The Australian dollar jumped 1.1% to just under 65 US cents.

Gold also rebounded 1.1% to $US3,374/ounce.

On the energy market, Brent Crude nudged higher by less than 0.1% to $US76.73/barrel