We all know the economy ain’t what it used to be.

Paramount

Americans are routinely living paycheck to paycheck, and for many, home ownership has become a pipe dream. We also all know that young people have inherited this economy from generations that, in many ways, had it much easier. But if you had to guess, what would you think the minimum wage would have to be to have the same home-buying power as it would have in the 1970s for baby boomers?

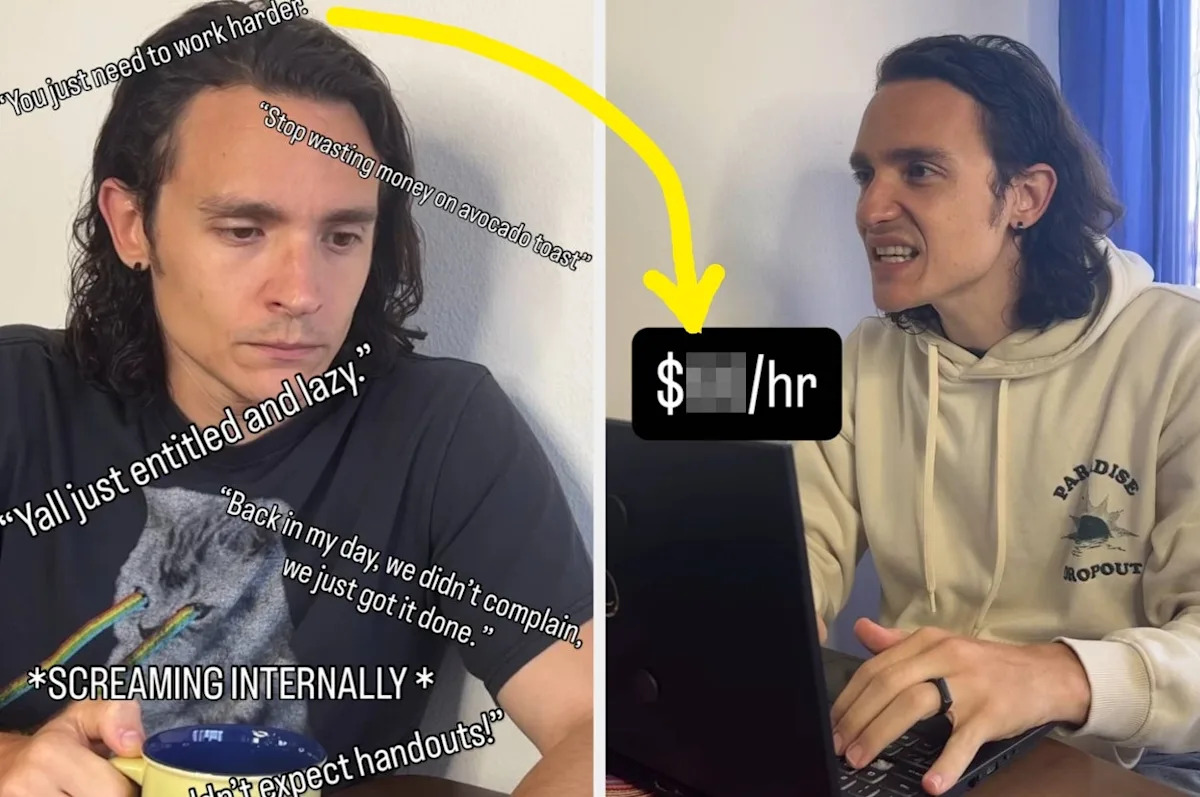

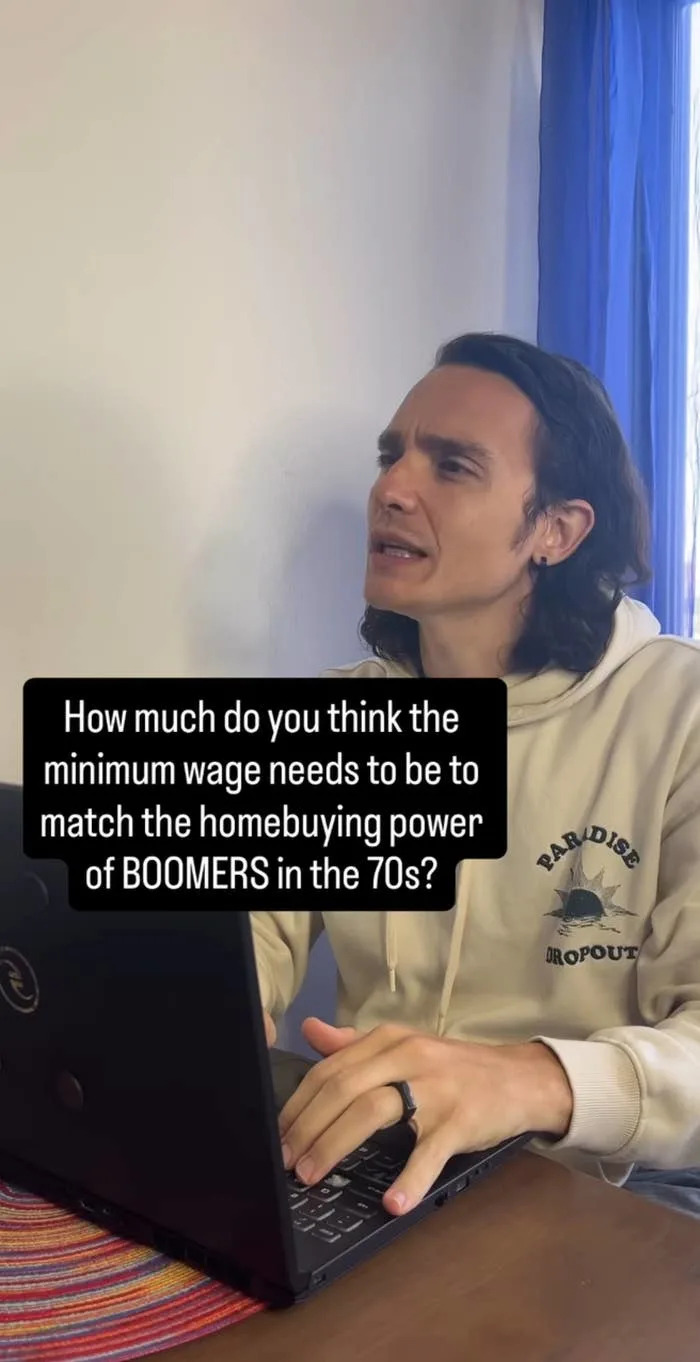

Actor and social media creator Chris Marrone recently made a video asking and answering that very thing.

He first guesses $25 an hour.

Nope.

How about $30 an hour?

Still no. The big reveal?

That’s right, 66 American dollars per hour. The federal minimum wage currently sits at $7.25 per hour. The highest minimum wage in the country is in Washington, DC, where workers must be paid at least $17.95 per hour as of this July.

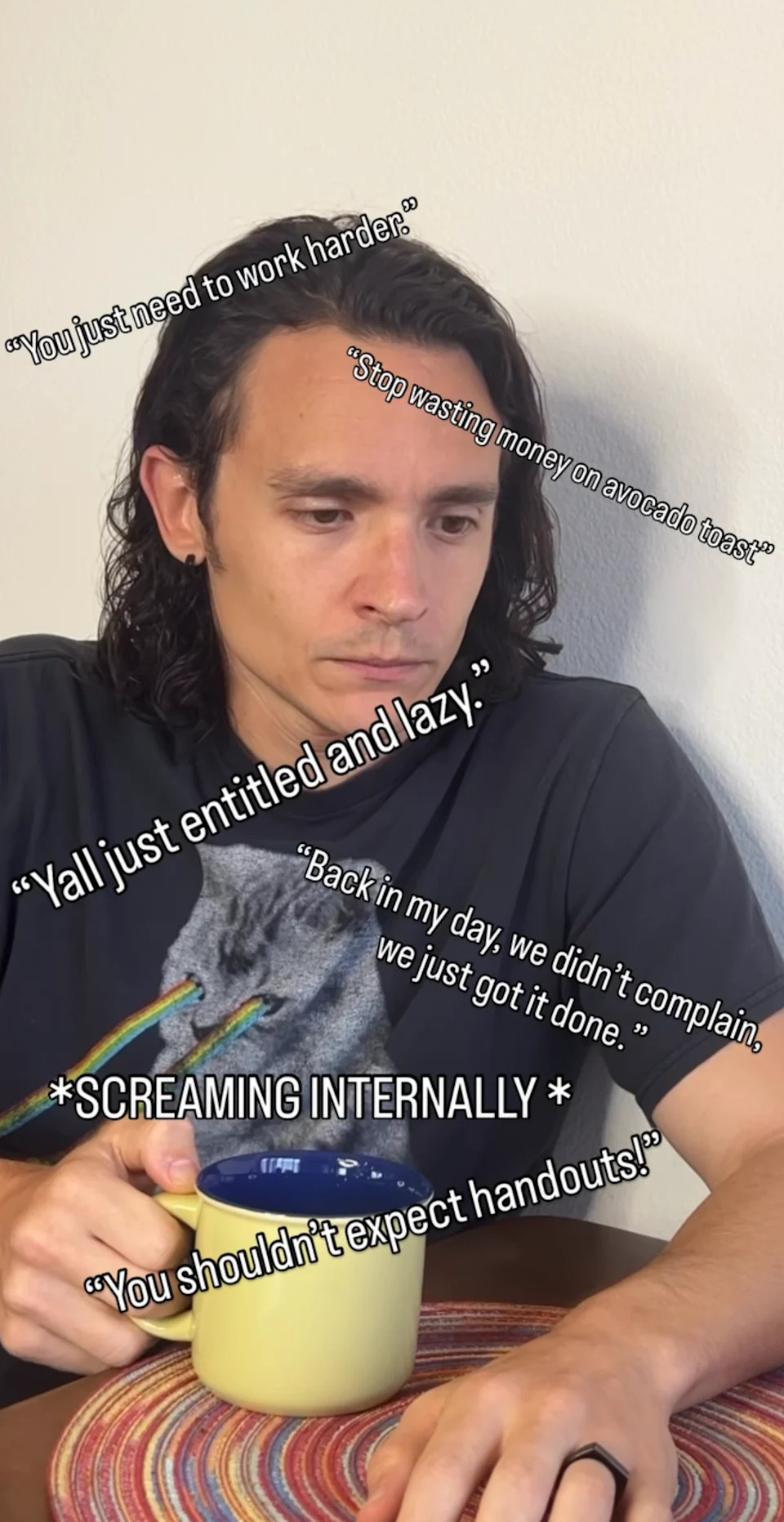

In the video, Chris is confronted with this knowledge, along with many of the generational comments that younger Americans often receive from older ones — things like “You just need to work harder” and “You shouldn’t expect handouts.”

Now, Chris’s video isn’t to suggest that minimum wage, at any point in its history, allowed people to buy homes outright. Rather, he told BuzzFeed, he wanted to highlight the ways in which “wages have decoupled from cost of living, housing prices, and broader economic growth over the last few decades.”

“The original purpose of the minimum wage was to ensure that even low-wage workers could participate meaningfully in the economy. Not just survive, but live with dignity,” he said.

People had a lot to say in the comments of Chris’s video, and none of it was particularly uplifting. “i just want to be able to afford a DOG,” this person wrote.

Someone else said that this reality is a very likely answer to the question of the declining birth rate in the US.

“I fought hard for $47/hour and its still not enough,” another commenter said.

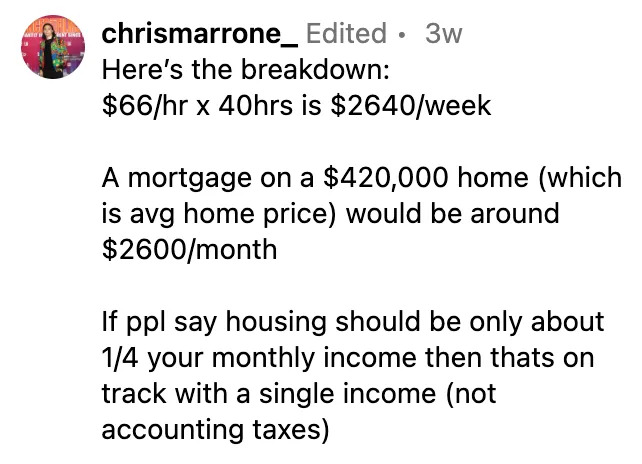

BuzzFeed asked financial analyst Stephen Kates, CFP, of the personal finance tool Bankrate, for some clarity on the figures discussed in the video. Here’s the math that Chris used for his video:

Kates said that math is correct. And while it’s not reasonable to expect a single minimum-wage earner to be able to afford an average home in the US, he said, housing “clearly isn’t” affordable for “most Americans.”

He added that “it is more reasonable to expect that someone earning an average income should be able to afford an average home. Unfortunately, that’s not the case today. The average household income is still insufficient to afford a typical mortgage using the 25% of gross income guideline. We see this reflected in the fact that the average age of first-time homebuyers continues to rise.”

Stellalevi / Getty Images

Kates told BuzzFeed that two major challenges face prospective first-time homebuyers today: the down payment and the monthly mortgage payment.

“Coming up with a down payment is difficult, especially given how quickly home prices have risen. Many buyers are treading water, even as their savings grow, because rising prices require increasingly large down payments. Even if a buyer qualifies for a loan with less than 20% down, the added cost of mortgage insurance increases the monthly payment,” he said.

Overall? “Buying a home, especially a single-family home, is increasingly limited to households with high incomes,” Kates said.

Jinda Noipho / Getty Images

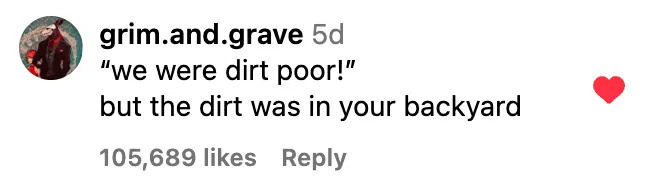

Chris said that by his calculations, even someone working a minimum wage job in the 70s “could buy a median-priced home outright in 7 years,” assuming every penny went toward the home. If we applied this to today, it would take nearly four times longer based on current wages and home prices. “Math for simplicity’s sake shows how egregious this is, and often the younger generations get blamed or are told ‘work harder,'” he said.

Kates doesn’t completely agree that wages have decoupled from the cost of living, namely “because our lifestyles today are very different than in past decades.” However, he agrees that home ownership is nowhere near as attainable as it used to be for the average American. He also added that “We have significantly underbuilt housing over the past few decades, with the shortfall becoming acute” following the 2008 financial crisis, another issue driving up demand (and therefore prices).

Here’s a small sampling of the rest of the comments on Chris’s video that show we’re all in this together…barely scraping by, that is.

What do you think? Sound off in the comments.