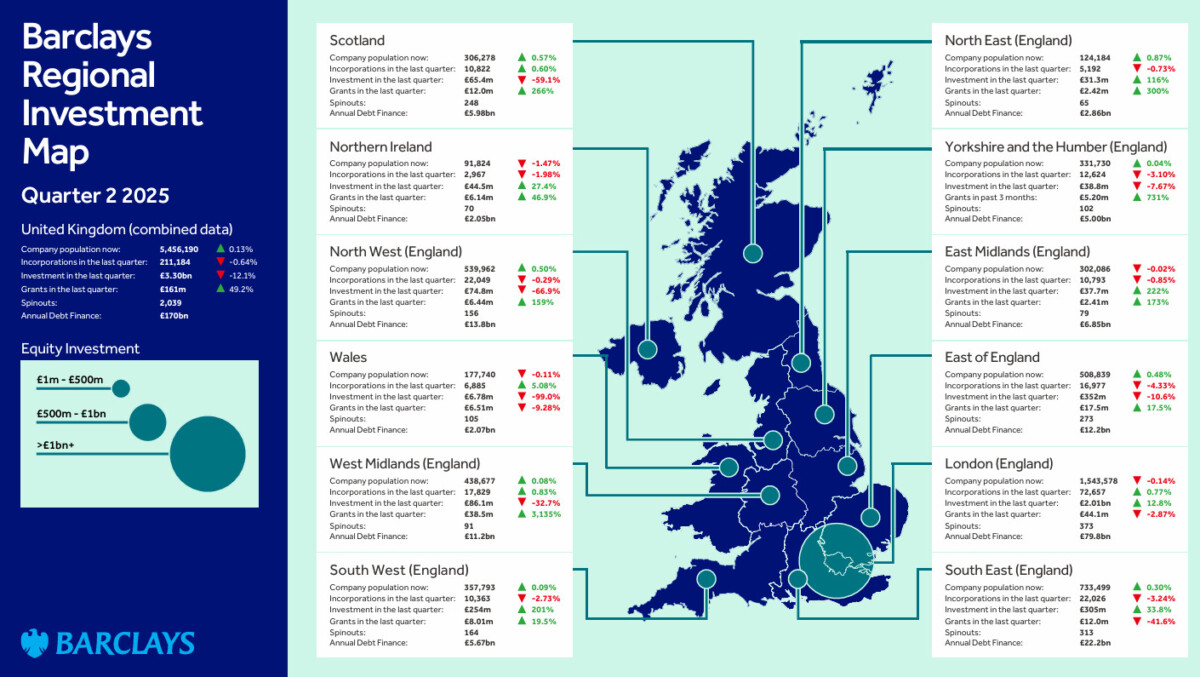

The number of UK corporations has grown from 5.45m in Q1 to 5.46m in Q2, benefitting from rising equity investments and a strong performance among university spinouts, according to the Barclays Regional Investment Map, which provides insights into UK company funding and growth.

This 0.1% rise, follows the seasonal surge seen in the first quarter, despite the volume of new incorporations – 211k – slowing slightly by 0.6% from the 213k new businesses in Q1, according to the analysis by Barclays Eagle Labs and Beauhurst.

Spinout strongholds anchor UK research innovation

London and the South East are the country’s top spinout hubs, home to a combined 686 (373 in London and 313 in the South East), owing to a powerhouse of world-renowned universities and specialist investment support.

Analysis of the last five years shows this figure has remained steady despite a turbulent economic climate, with the UK spinout ecosystem expanding 7.9% since 2020, from 1,907 to 2,039. The South West has seen the biggest rise in spinout activity by 20.6% in the last five years, followed by the East of England at 17.2% growth.

Beyond the ‘golden triangle’ of London, Oxford and Cambridge, Scotland is the UK’s most prolific spin-out region reporting 248 active ventures. Key institutions such as the University of Edinburgh, the University of Glasgow, and the University of Strathclyde, which specialise in AI, photonics, and energy systems research, contribute to putting Scotland on the spin-out map.

Source: Barclays

Barclays new University Founders proposition, launching this month, supports students via ecosystem connectivity, free learning platforms, access to mentoring and investor connectivity. As part of Barclays’ Innovation Banking proposition, equity-backed ventures are also able to benefit from a fast-tracked onboarding process and dedicated Relationship Manager support, in order to continue to support the growing University ecosystem.

Equity surge powers business momentum

Substantial equity investment provided a boost to some regional economies in Q2. The UK average equity investment rose by 28.1%, with the East Midlands (up 222.4%) the South West (up 200.5%) and the North East (up 115.8%) all benefitting from significant injections of funding.

London companies attracted the greatest amount of funding, at £2.01 billion, up 12.8% from the previous quarter. Six of Q2’s 10 largest equity deals were secured in the Capital, including £393 million by wealth management platform FNZ, bringing the cumulative fundraising to £1.43 billion since 2005.

At the other end of the scale Wales saw the biggest decrease in equity investment, which fell -99.0%, followed by the North West (-66.9%) and Scotland (-59.1%).

Grant funding also accelerated across the UK. Nationally, grant volumes rose from £108 million in Q1 to £161 million in Q2, driven in part by the West Midlands, where grant awards soared by 3,135% – from £1.19 million to £38.5 million.

Yorkshire and the Humber experienced a 730.7% leap in grant funding, and the East Midlands saw volumes grow by 172.8% to £2.41 million. The South West was further supported by a 19.5% increase in grant funding to £8.01 million, with 34 awards made.

Wales leads regional new business growth

Of the UK’s 12 regions, four saw an increase in the number of general incorporations in the second quarter of 2025. Wales had the largest growth with a 5.1% jump, followed by the West Midlands (0.8%), London (0.8%), and Scotland (0.6%). London accounted for 28.3% of all active and dormant UK companies.

Recommended reading

Abdul Qureshi, MD, Business Banking at Barclays said: “The UK business landscape continues to demonstrate resilience, with the number of active companies reaching 5.46 million and university spinout activity thriving, particularly in London, the South East, and Scotland.

“Through robust public and private investment, and specialist support for innovation, we’re seeing ground-breaking ideas rapidly moving from the lab to the marketplace, especially in fields such as AI, photonics, and energy.

“You can feel the momentum building around university spinouts lately, especially in places like London, the South East, and Scotland. These new ventures are turning academic ideas into real-world innovations at pace, moving groundbreaking research from the lab straight into the marketplace.

“It’s an inspiring time for anyone involved in higher education or entrepreneurship, with collaboration and fresh thinking opening up new opportunities across the UK.”

Related