Bitcoin’s market conditions appear to have cooled after weeks of heated trading, with on-chain data pointing to a transition into consolidation.

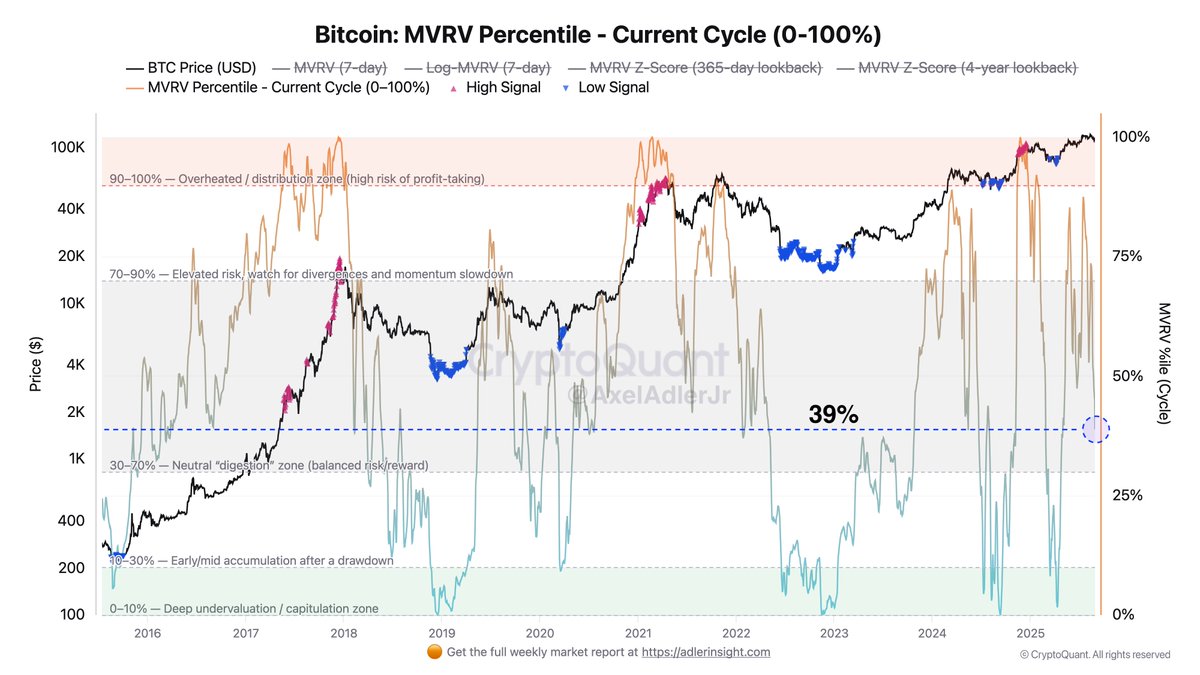

Analyst Axel Adler Jr highlighted that the cycle and volatility-adjusted MVRV (Market Value to Realized Value) has now fallen to 39%, moving closer to a neutral zone.

What the MVRV metric shows

The MVRV is a widely watched indicator that measures how much unrealized profit or loss investors are holding relative to Bitcoin’s realized value. A reading closer to 100% historically signals overheated markets, where profit-taking risks are high. A reading near 0% indicates capitulation, where most investors are underwater and selling pressure has already been exhausted.

At the current 39%, Bitcoin is sitting comfortably between these extremes. According to Adler, this suggests that the market is no longer overheating but also hasn’t dipped into conditions of panic selling. Instead, the environment reflects a risk/reward balance closer to neutral, with neither strong bullish nor bearish signals being generated by the metric.

Why this matters now

In past cycles, Bitcoin rallies often pushed MVRV above 70–90%, creating overheated conditions followed by sharp corrections. Conversely, deep bear markets dragged the metric below 20%, offering prime accumulation opportunities.

Today’s reading implies that Bitcoin may be entering a consolidation phase, allowing the market to absorb previous volatility before the next decisive move. For traders, this means fewer extremes and potentially less short-term risk of either a major breakdown or a runaway rally.

The bigger picture

While neutral readings often frustrate short-term speculators looking for explosive moves, they have historically laid the groundwork for stronger, more sustainable long-term trends. With MVRV neither flashing danger nor signaling capitulation, Bitcoin’s price action may remain range-bound until new catalysts emerge.

Kosta has been working in the crypto industry for over 4 years. He strives to present different perspectives on a given topic and enjoys the sector for its transparency and dynamism. In his work, he focuses on balanced coverage of events and developments in the crypto space, providing information to his readers from a neutral perspective.