In the sun-drenched plazas of Madrid and the innovative hubs of Barcelona, Madrid, Valencia or Marbella is scripting a bold new chapter in the world of digital finance. Cryptocurrency has woven itself into the fabric of daily economic life in the EU nation, and adoption is rising on the back of a strong economy and evolving regulations.

Chainalysis places Spain firmly in the global top 30 for crypto engagement, where stablecoins and DeFi are reshaping transactions in Western Europe. Transaction volumes in the Spanish market exceeded €73 billion between July 2023 and June 2024 — a figure even higher than the €60 billion estimate previously cited — according to Market Data Forecast’s recent report. Analysts expect even more growth ahead as DeFi and stablecoins gain traction across Western Europe.

What’s driving this crypto drive amongst Spaniards? Let’s find out.

The Pulse of Crypto Holders in Spain

Spaniards are embracing cryptocurrency with the same passion that they bring to their famous festivals. Early 2025 market projections suggest the crypto boom in Spain is only getting started.

According to Statista, Spain’s digital currency market is forecast to generate about $1.3 billion in revenue this year (with an average revenue per user of $54.30), then surge at a compound annual growth rate (CAGR) of 85.27 percent to roughly $2.4 billion next year.

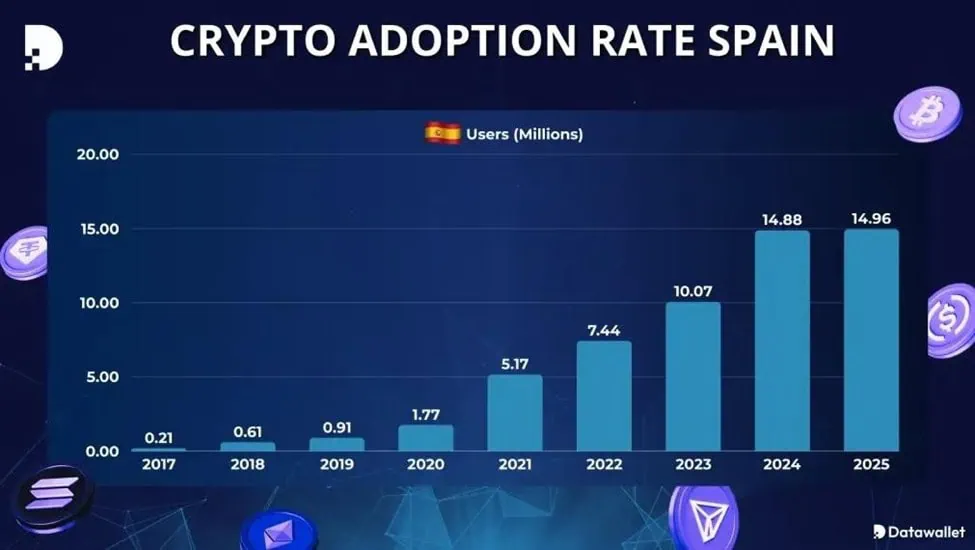

Those projections also predict that Spain’s crypto user base will surge from nearly 15 million (roughly 32 percent of the population) this year to about 25.14 million in 2026. Likewise, user penetration is estimated to rise from 50.97 percent to 53.08 percent over the same period.

Source: Datawallet

Europe as a whole shows a similar trend, with ownership climbing to 8.9 percent. Awareness levels in Spain are high too, with around 27.7 percent of the population familiar with crypto, according to TGM Research, which surveyed over 800 Spaniards. Many see it as a hedge against inflation and financial uncertainty.

Compared to the global ownership rate of 6.8 percent, Spain is ahead of the curve, making digital assets a mainstream part of financial conversations.

Who are Spain’s crypto adopters? Think of young professionals in Valencia who code by day and trade by night, or families in Andalusia sending remittances more efficiently. For investors, understanding these users is crucial.

The typical Spanish crypto holder is young and informed. Current data shows that about 12 percent of adults in Spain own crypto-assets, with 13 percent of men and 10 percent of women reporting ownership. This shows that female participation is also substantial.

Ownership is most prevalent among young people aged 18 to 24, underscoring cryptocurrency’s appeal to digitally native and financially aware cohorts.

Spaniards view crypto as “the currency of the future.” But beyond speculation, some use it to protect against euro volatility, send money to Latin America via digital asset channels, and even buy property.

Spain’s crypto market is a mix of homegrown talent and international heavyweights. Bit2Me, founded in Madrid in 2014, stands out thanks to its easy-to-use platform and wide range of assets.

Global names like Binance, Kraken, Crypto.com, OKX, Bitpanda, CEX.io, Coinbase, and eToro are also well-rooted in Spain, offering liquidity, euro gateways, and social trading features.

Meanwhile, BBVA has already stepped into the game just last month, offering Bitcoin and Ether trading to clients. For investors, this ecosystem provides multiple on-ramps — whether through regulated banks, exchanges, or peer-to-peer networks.

Institutions are no longer sitting on the sidelines either. Globally, analysts expect around $60 billion of institutional inflows in crypto this year, a trend that could amplify returns for aligned investors.

BBVA is at the forefront locally, recommending up to 3-7 percent portfolio allocation to crypto for affluent clients and introducing trading services, per a statement by the Head of Digital and Blockchain Solutions at BBVA Switzerland, Philippe Meyer.

Admittedly, hurdles exist — for gains above €300,000, capital gains taxes can reach 28 percent, while activity like mining, staking, and salaries are subject to higher “general income” tax rates as high as 47 percent. Anti-money laundering (AML) rules are strict. However, with fintech investments aiming for €35 billion, the institutional footprint is only set to expand.

DEVELOPING: Spain now requires strict reporting on cash withdrawals over €3,000.

This is another reminder that your money isn’t really yours.

Might be a good time to hold some Bitcoin. pic.twitter.com/B80Tuh1qSK

— Simply Bitcoin (@SimplyBitcoinTV) May 11, 2025

What’s Driving the Crypto Hunger?

Spain’s crypto story is shaped by both history and geography. From pioneering explorers centuries ago to today’s fintech startups, the country has always embraced bold transitions.

Its Eurozone stability and ties to Latin America give Spain an edge, with digital remittance flows to the region topping $70 billion just two years ago, projected to grow by 51 percent this year, per a Mastercard report.

Bloomberg reported that Banco Santander, Spain’s largest bank, is experimenting with blockchain to improve cross-border payments with plans to offer stablecoin and crypto assets to its retail majority. Beyond trading, applications are spreading into NFTs, DeFi, and real estate, especially in tech-forward hubs like Barcelona.

Spain is leading in regulations, aligning with the EU’s Markets in Crypto Assets (MiCA) framework to build trust while encouraging innovation — vital for investor confidence. Existing licenses will lapse by December this year, introducing MiCA’s standardized rules for crypto providers under National Stock Market Commission (CNMV) and Bank of Spain oversight.

For taxation purposes, cryptocurrency in Spain isn’t treated like money, but as an asset. That means any gains get taxed as investment income. On top of that, the eighth amendment of the Directive on Administrative Cooperation in Direct Taxation (DAC8) has added extra layers of transparency to clamp down on shady activity.

Spain hasn’t stopped there. It’s also rolled out stablecoin guidelines, creating a framework that mixes safety with room for innovation. Spain is aiming at being a secure but forward-thinking place for crypto investment, and is influencing peers across Europe and Latin America by sharing regulatory expertise.

Spain Approves First Tokenization License, Leading European Financial Innovation

Key Takeaways:

🟢 Spain’s CNMV @CNMV_MEDIOS was granted the first tokenization license, a milestone for Real-world Asset (RWA) tokenization.🟢 Ursus-3 Capital @Ursus3Capital, in partnership with… pic.twitter.com/18KI6hPhjx

— Blubird (@blubird_app) December 10, 2024

Crypto Culture, Spanish Flavor

Spain’s crypto story started small, but today it’s grown into a buzzing ecosystem. Millions of users are involved. Homegrown platforms like Bit2Me are leading the charge, while MiCA regulation sets the rules of the road.

The result? A market that appears to be well structured and full of opportunity. Institutions are stepping in, startups keep experimenting, and the pace of innovation is quickening. Spain has moved on from merely keeping up with Europe’s digital shift and is now helping steer it.

For investors, it’s a rare blend: cultural vibrancy paired with financial promise, in the world of crypto that never stands still.

#Crypto #Blockchain #DigitalAssets #DeFi #Turkey

Author: Ayanfe Fakunle

The editorial team at #DisruptionBanking has taken all precautions to ensure that no persons or organizations have been adversely affected or offered any sort of financial advice in this article. This article is most definitely not financial advice.

See Also:

The Rise in Popularity of Crypto in Turkey: When Fiat Fails | Disruption Banking

The Rise in Popularity of Crypto in the Netherlands | Disruption Banking

Why Does BBVA Have so Many Millionaires? | Disruption Banking