The poor state of telecoms infrastructure in rural towns; the readily available cheap accommodation in a city like Bordeaux without a booking: the lack of young people in many villages and the steady stream of 50pc discount sales in shops. It all pointed to an economy that is struggling and even – to use the technical term – “on its uppers”.

Just how on its uppers it may be was presented in stark terms by its own finance minister during the week when he suggested that he couldn’t rule out calling in the IMF if the state doesn’t get its budget deficit and €3.3 trillion national debt under control.

Perhaps the government was hamming up the crisis to draw attention to the scale of the problem.

Ministers in the minority government have been trying to develop a new budget but with limited success.

Attempts to increase the retirement age have met huge resistance. It is currently 62 and six months for those born before 1968 and there are plans for it to move to 64.

Bordeaux in France is still beautiful but definitely on its uppers if discount sales and cheap hotels are anything to go by. Photo: Tim Graham/Getty

The French government has even talked about culling a few bank holidays to save money – again possibly to try and convey how serious the situation is. France is borrowing close to €500m per day to meet its needs.

It is about €3.3bn per week and it has seen its borrowing costs increase as investors become more wary of the government’s ability to get necessary reforms over the line.

The UK is not in a dissimilar position having borrowed £407m (€471m) per day to meet its needs in the year to March.

The British state is now spending over £100bn per year financing its national debt, as British chancellor Rachel Reeves tries to plug a possible £50bn hole in the public finances.

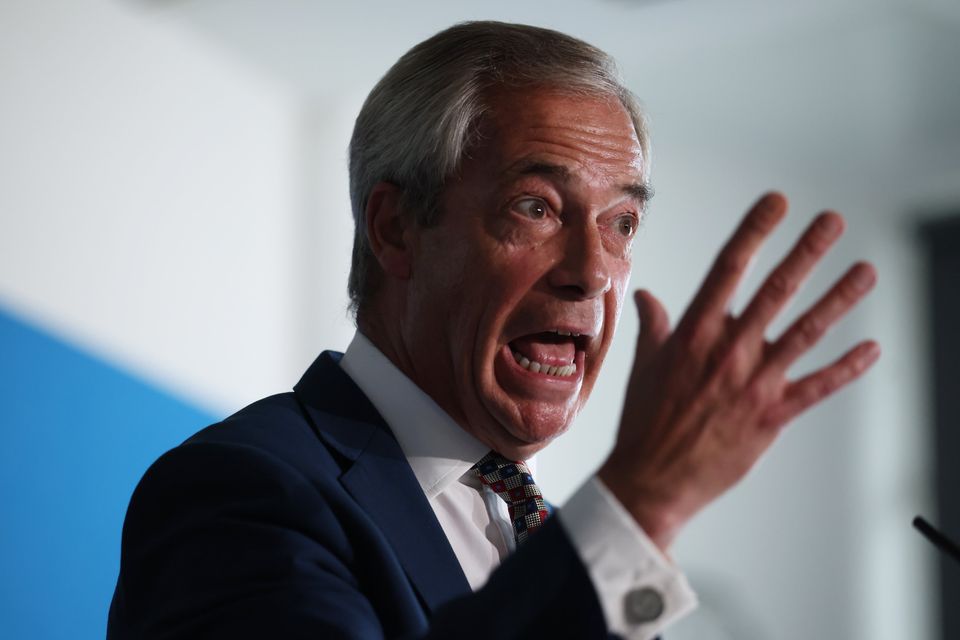

The problem for both countries isn’t so much about money as the politics around making tough financial decisions. Nigel Farage’s Reform Party in the UK is waiting in the wings for the Labour government to drop the ball.

Meanwhile, the Tories are full of faux anger about the state of the government’s finances having brought the public finances to this point with Brexit, populism and recklessness.

Former British prime minister Liz Truss described the UK economy as in a “doom loop” – and she should know.

French prime minister Francois Bayrou is expected to lose a confidence vote on September 8 over a budget and debt reduction plan. Photo: Getty

Bayrou has framed the vote in terms of whether people want to vote for “chaos or responsibility”.

Could France trigger a new eurozone debt crisis? It is a question many have asked while most dismiss the idea that it would seek financial assistance from the IMF.

The European Central Bank, led by former French finance minister Christine Lagarde, is a more likely route to stability.

If the currency requires the stabilising influence of the ECB, there are no guarantees there won’t be a renewed focus on who else is living beyond their means.

The UK, now completely outside the EU “family” could find itself in a very tough, isolated situation too.

In Ireland, the situation is more nuanced. We are like the family that has won the lottery and is lashing through winnings at a speed of noughts. Yes, we can afford it because of the windfall.

But at this rate the windfall won’t last forever.

The overall numbers do look somewhat reassuring for Ireland. We tend not to use GDP as a guide, although analysts and investors still often do. Our debt- to-GDP ratio is running at around 38pc, compared to France on 116pc, the UK on 103pc and Italy on 137pc.

Using the more realistic guide of GNI, which discards some of the distorting impact of investment flows from multinationals, our national debt is running at about 65pc of GNI. This puts us close to the very conservative and bankable Germans.

Former British prime minister Liz Truss described the UK economy as in a ‘doom loop’ – and she should know. Photo: Getty

Perhaps a more meaningful figure is the national debt as a percentage of government revenues, because debt must be financed from what the Government takes in, not the total activity in the economy.

Ireland’s debt-to-general government revenue is 153pc, while in France it is 223pc; the UK is on 247pc and Italy is on 287pc.

Our debt profile is good with low interest rates and long repayment schedules thanks to the excellent job the NTMA has done.

These figures go completely pear-shaped if our economy falters because of Trump tariffs, an external shock like a euro debt crisis, or tax changes in the likes of the US.

Our ratio of debt-to-general-government revenue would get shot to pieces if the corporate tax receipts begin to decline.

Things are still going very well. But perhaps we are like the kid who has just learned to ride a bike. As long as he keeps up his speed he can show off and say “look no hands”. But he still hasn’t figured out the brakes yet.

Trump forces whiskey distillers to look to India

The jury is still out on the scale of impact Donald Trump’s tariffs will have on the Irish whiskey industry. Full year results from Jameson maker, Pernod Ricard, show a level of resilience for a brand the company has built up over 30 years.

Nigel Farage’s Reform Party in the UK is waiting in the wings for the Labour government to drop the ball. Above, Farage on stage during the Reform UK Deportations Policy Announcement on August 26. Photo: Getty

Jameson net sales rose by 3pc in very uncertain times. But a key figure was missing. What were the volume sales of Jameson to the US market? This would tell us how much product they shifted and whether they had to discount to sell it.

The other big imponderable is the impact of stockpiling of whiskey in the US ahead of Trump’s tariffs. Next year’s sales figures will be much clearer on that score for the entire industry.

As the biggest Irish whiskey brand, Jameson is better placed to weather the storm than much smaller distillers. If Jameson catches a cold, some newer small operations are heading for pneumonia.

A bright light on the horizon with real opportunity is the Jameson performance in India. It is now the biggest imported spirits brand there, and India is Jameson’s second biggest market by sales volume. Perhaps other Irish whiskeys can follow suit.

Another big question is why isn’t the world’s most valuable company not really invested here?

Ireland’s decent figures go completely pear shaped if our economy falters because of Trump tariffs, an external shock like a euro debt crisis

AI chip maker Nvidia this week consolidated its position as the world’s biggest company by market value and at $4.4 trillion (€3.76trn).

It is now $1 trillion ahead of Apple Inc. It is a little troubling for Ireland that Nvidia has no real employment or investment presence here.

When you look at the top-10 biggest companies in the world by market cap, almost all of them have a reasonable investment here except obvious one like Berkshire Hathaway (which invests in other firms) and WalMart which is very America focused.

Meta, Alphabet, Apple, Ely Lilly and JP Morgan have invested a lot in Ireland. Tesla and Nvidia are the two that stick out. Nvidia has distribution deals for its products and it has partnered with a quantum computing company in Dublin, called Equal1, founded by Californian Dirk Leipold.

The huge presence of chipmaker Intel here, should not have been a barrier to investment but an incentive given the wider eco-system it has created. We may have missed a trick.