1h agoTue 2 Sep 2025 at 9:46pmMarket snapshot

- ASX futures: -0.4% to 8,843 points

- ASX 200 (Tuesday close): -0.3% to 8,901 points

- Australian dollar: -0.7% to 65.1 US cents

- Wall Street: Dow Jones (-0.6%), S&P 500 (-0.7%), Nasdaq (-0.8%)

- Europe: FTSE (-0.9%), DAX (-2.3%), Stoxx 600 (-1.5%)

- Spot gold: +1.6% to $US3,532/ounce

- Oil (Brent crude): +1.4% to $US69.10/barrel

- Iron ore: +0.8% to $US102.50/tonne

- Bitcoin: +2.1% to $US111,499

Prices current around 7:15am AEST

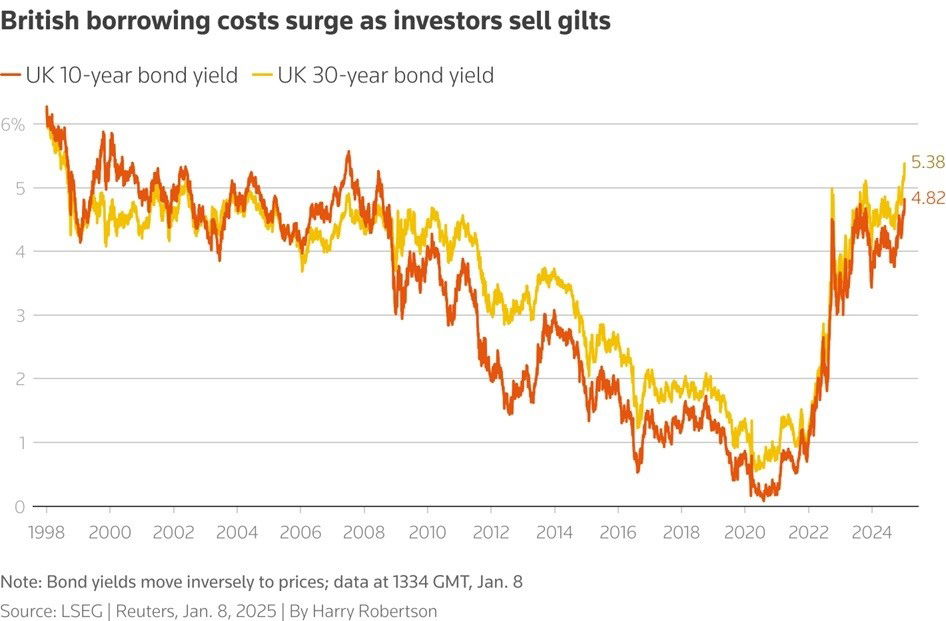

21m agoTue 2 Sep 2025 at 11:09pmUK government’s borrowing costs surge to highest since 1998 after bond sell-of

It hasn’t been a great day for Britain, either, after a sell-off across the UK bond market dragged prices lower.

This also had the effect of pushing the British government’s borrowing costs to a 26-year high.

(The price of a bond and the yield — or return it pays — move in opposite directions).

Thirty-year gilt yields rose by more than 13 basis points to 5.68%, their highest level since 1998.

Meanwhile, the UK’s 10-year gilt yield rose as high as 4.821%, its highest since 2008.

(Basically, ‘gilt’ is the British word for ‘bonds’. The government borrows money by selling gilts. But investors are demanding a higher interest rate because they’re getting nervous about the growing risks of lending to the government).

The UK government’s borrowing costs are at their highest since 1998.

The UK government’s borrowing costs are at their highest since 1998.

It’s partly because of lower expectations that the Bank of England will continue slashing interest rates, and extra borrowing from Kier Starmer’s government ahead of his latest budget being unveiled. (Investors get a bit anxious when government debt swells).

This also led to the British pound falling more than 1.2% to $US1.23, its weakest level since April.

Here’s what ANZ economists Brian Martin and Daniel Hynes wrote about this development in a note to clients:

“Concerns about the fiscal outlook are weighing on the gilt market.

“One of the fiscal rules that the Chancellor upholds is the ‘current budget rule’, wherein the government’s day-to-day spending is to be met via revenues over the forecast horizon.

“Ahead of the autumn budget (likely to be tabled in November), there are concerns that the government’s fiscal headroom has narrowed.

“At the time of the spring statement, the fiscal headroom was pegged around GBP9.9 billion. Like a vicious cycle, a sharp rise in gilt yields, if sustained, raises government borrowing costs on future new issuance of term debt, thereby raising government spending and eroding fiscal headroom.”

39m agoTue 2 Sep 2025 at 10:51pm

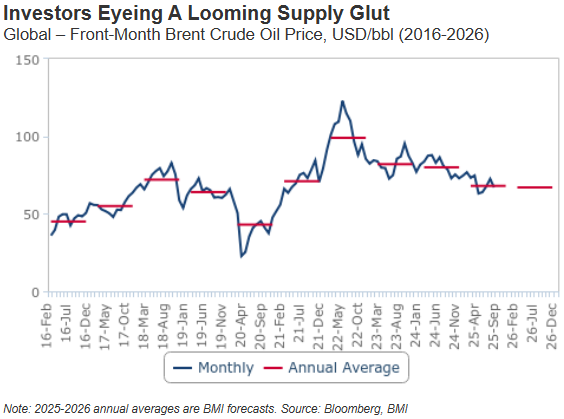

BMI forecasts easing oil prices this year and next

BMI, a research unit of Fitch Solutions, has just released its latest forecasts for the key global Brent crude oil price.

Brent crude is the oil price we report, because multiple analysts have told us it most closely reflects global prices, whereas West Texas crude is a very US-specific price, affected more by local factors.

The good news for motorists is that BMI expects oil prices to fall, rather than rise, over the coming year or so.

“We are leaving our Brent crude oil price forecast unchanged at an annual average of USD68/bbl in 2025 and USD67/bbl in 2026,” the BMI analysts noted.

Brent crude oil forecast for 2025 and 2026 (BMI)

Brent crude oil forecast for 2025 and 2026 (BMI)

“Meeting our price target requires a rest-of-year average of around USD63/bbl, significantly below the USD70/bbl average seen in the year to date.

“The front-month contract is currently trading at around USD67/bbl, and we anticipate price declines in Q4, as supply rises and robustly outpaces demand.

“Fundamental market weakness will spill over into the new year, before softening production growth and an acceleration in global economic activity support a partial recovery in Brent in H2 2026.”

58m agoTue 2 Sep 2025 at 10:32pmA weaker US greenback could push the Aussie dollar even higher, says NAB currency strategist

It’s been quite a bad year for the US dollar, which has lost almost 10% of its value since the year began.

On the flip side, the weaker greenback has helped to push the Australian dollar higher (up 5% since January).

NAB’s senior FX strategist, Rodrigo Catril, predicts the local currency could reach 68 US cents by the end of the year (its highest level since September 2024).

Currently, it’s sitting at 65.2 US cents, so it still has a lot of distance to cover.

The Business host Kirsten Aiken quizzed him about the latest in currency markets. You can listen here:

Loading…1h agoTue 2 Sep 2025 at 10:18pmABS expected to confirm sluggish growth for Australia’s economy

Later this morning, the Bureau of Statistics (ABS) will provide its latest figures on how the economy is performing.

Australia’s economy is likely to have expanded by around 0.5% over the June quarter, and by 1.6% over the year, according to a poll of economists conducted by Reuters (some of the slowest growth rates in a while).

NAB’s senior FX strategist Rodrigo Catril is, however, a little more negative than the consensus.

“NAB leaves its Q2 GDP forecast unchanged at 0.3% qoq and 1.4% yoy, below the RBA’s August Statement on Monetary Policy forecast of 0.5%/1.6%,” Mr Catril wrote in a note to clients.

“The outlook is supported by firmer consumer momentum, as evidenced by strength in consumer-facing real total sales and solid growth in travel imports, but public demand remains a drag after being a key support through 2024.”

We’ll let you know about the GDP (gross domestic product) figures after the ABS publishes them at 11:30am AEST — and we’ll break down what it says about Australia’s economic health. Stay tuned!

1h agoTue 2 Sep 2025 at 9:47pmShare prices go wild during volatile ASX earnings season

The Australian share market has experienced its most volatile reporting season.

It was marked by huge gains (and falls) in the share price of Australia’s biggest companies, including Commonwealth Bank, CSL, Woolworths, James Hardie and Qantas after those companies reported their financial results.

Some market analysts say the ASX is overvalued and if earnings don’t improve significantly, it could lead to a “reality check” at some point.

By that, they mean a “correction” or significant falls on the market. Though it’s impossible to predict when that might happen (it could be a while)!

Here’s my latest story on The Business. It’s well worth your time (in my humble opinion).

Loading…1h agoTue 2 Sep 2025 at 9:46pmASX to slip, Wall Street falls after US court rules against Trump tariffs

Good morning and welcome to the ABC’s finance blog! I’ll be your guide for the next few hours.

The local share market is expected to open modestly lower, with ASX futures pointing to a 0.4% fall in morning trade.

The Australian dollar is also feeling the gloom, after slipping 0.7% to 65.1 US cents.

It comes after a downbeat session on Wall Street, which reacted badly to news on Friday (local time) that a US appeals court had found most of Donald Trump’s global tariffs to be illegal.

The U.S. Court of Appeals for the Federal Circuit (in a 7-4 ruling) decided that only Congress has the power to apply sweeping import taxes.

Unsurprisingly, the US President decried the judgment as “Highly Partisan” and said he would file an appeal to the Supreme Court.

The Dow Jones index fell 0.6% to 45,296 points, while the S&P 500 dropped 0.7%, to 6,416 points and the Nasdaq Composite lost 0.8%, to 21,280 points.

Another sign of investor nervousness could be seen in the price of gold, which hit a new record high.

The precious metal’s spot price surged 1.6% to $US3,532 an ounce.

Anyway, sit tight, drink some coffee (or tea) and I’ll have more updates for you shortly.