Key Takeaways

MemeCore [M], Pump.fun [PUMP], and Zcash [ZEC] led the week with sharp price surges. In contrast, Conflux [CFX], Pi [PI], and Cronos [CRO] saw significant declines.

This week, the market was marked by headline-grabbing corporate drama.

The biggest corporate drama came as MicroStrategy [MSTR] was snubbed from S&P500 inclusion. Despite eligibility, the committee instead picked Robinhood, sending MSTR down nearly 3%.

Amid this fallout, sparking debate over Wall Street’s discomfort with Bitcoin-centric balance sheets, a few utility-driven launchpad projects gained the most traction.

Weekly winners

MemeCore [M] — September starts with a new all-time high

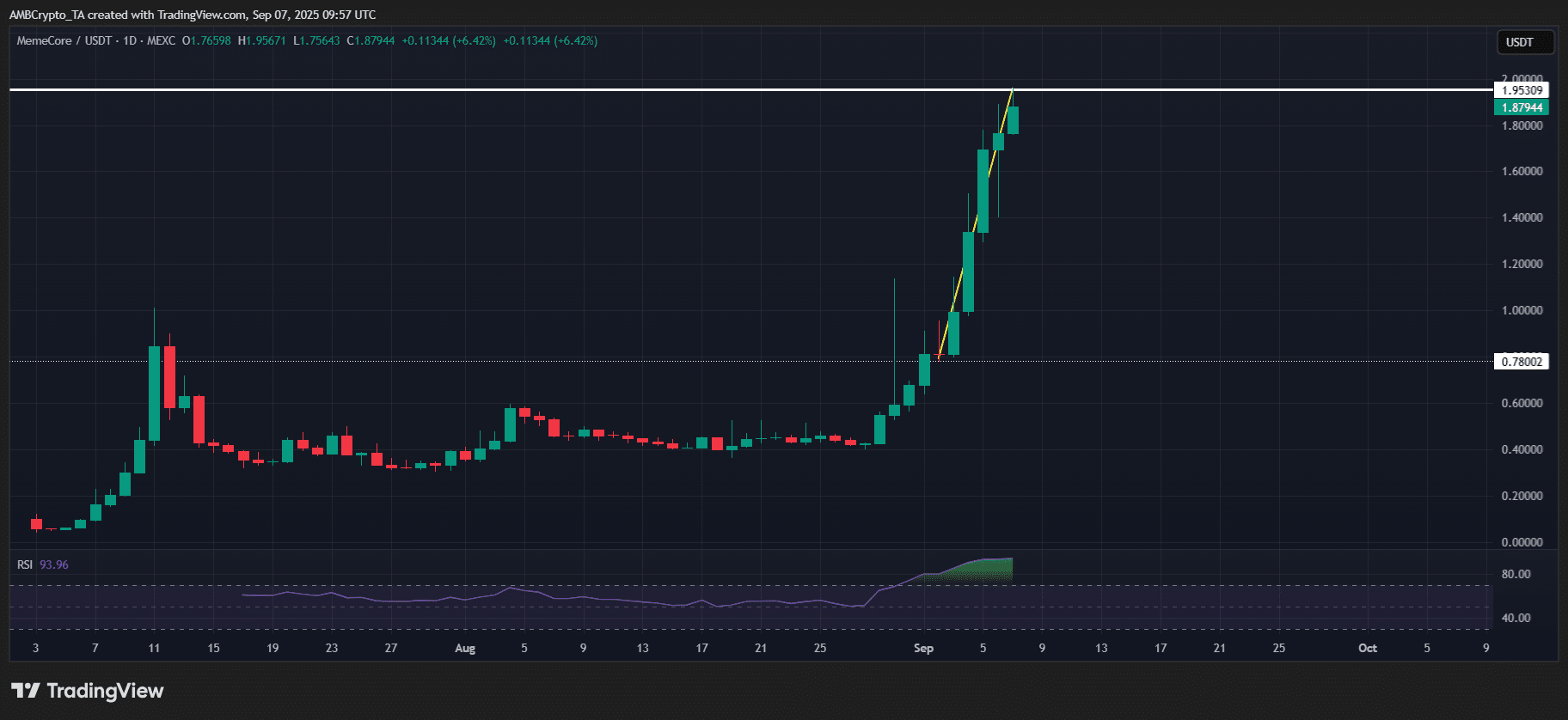

MemeCore [M] topped this week’s gainers chart with a staggering 170%+ rally from its $0.67 open, marking its biggest weekly run since the 570% surge following its early-July launch.

What’s more, the chart shows solid buying support underneath.

M kicked off September by breaking out of last week’s 52% run off $0.47, RSI was hot, but it still ripped 19.5% in a single day, showing bulls were stacking at the local top.

Source: TradingView (M/USDT)

The result? Three back-to-back 20%+ sessions shoved M through key resistance and tapped $1, with FOMO keeping the tape hot. Sure, the RSI is screaming above 90, signaling seriously overbought conditions.

However, that hasn’t slowed the buyers. If bulls keep stacking at dips and chasing momentum, $2 isn’t out of reach next week, especially if short-term traders continue to pile in and FOMO stays alive.

Pump.fun [PUMP] — DeFi token broke through multi-month resistance

Pump.fun [PUMP] grabbed second place on the weekly gainers.

It ripped 40%+ from $0.03, marking its biggest weekly spike since launch. The week kicked off with PUMP pushing against the $0.04 resistance it failed to crack a month ago, making this week’s move even cleaner.

On-chain, dominance is back and revenue is back to Q3 levels, so the fundamentals are solid. Technically, it’s chilling at $0.049, testing resistance and giving bears a run for their money.

But if bulls keep stacking and chasing, this could be a classic bear trap, with PUMP ready to blow past resistance and extend the rally next week.

Zcash [ZEC] — Privacy-focused cryptocurrency saw bulls take control

Zcash [ZEC] took third spot on the weekly gainers, up 16%. The week kicked off around $40, then ZEC broke past $47.17 resistance to hit a quarterly high.

But most of the move came on the 2nd of September. So, this was more hype-driven than real accumulation. Intraday, it’s down 1.7% to $46.62, showing some profit-taking.

On the weekly chart, though, ZEC’s holding up. Despite short-term pressure, it posted three higher highs in August, meaning the bid is soaking up selling.

If this pattern holds, a quick shakeout next week could flush weak hands and set up a base for a bounce past $50, potentially hitting that level by mid-to-late September.

Other notable winners

Outside the majors, altcoin rockets stole the spotlight this week.

Collector Crypt (CARDS) led the charge with a 643% surge, followed by TDCCP (TDCCP), which climbed 210%, and Jelly-My-Jelly (JELLY JELLY), rallying 153% to round out the leaderboard.

Weekly losers

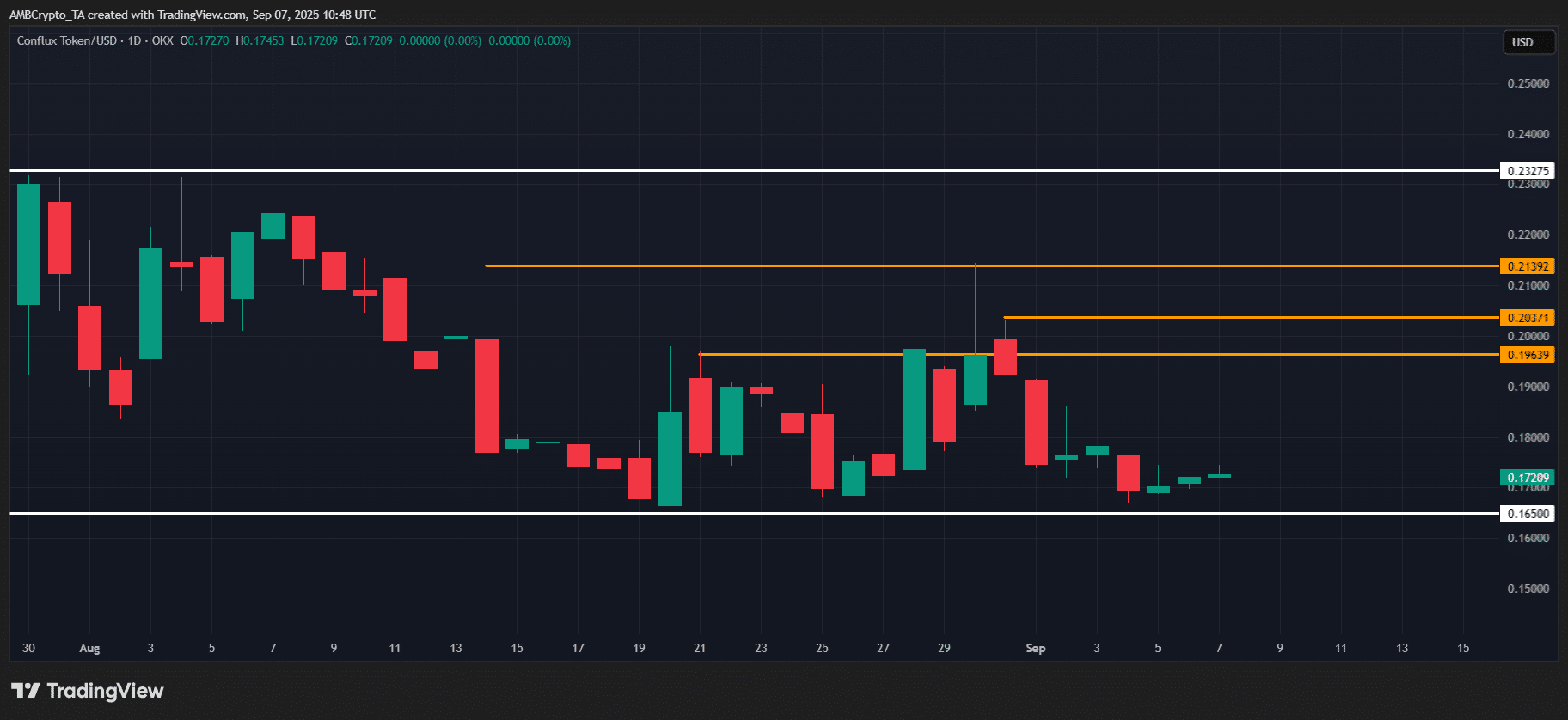

Conflux [CFX] — Smart contract platform broke its two-week bullish streak

Conflux [CFX] was this week’s worst performer, slipping 10.57% from its $0.19 open, showing bulls couldn’t push past resistance after a roughly 12% rally over the past two weeks.

In short, CFX broke its two-week bullish streak, marking its third failed attempt to crack $0.20 since mid-August.

On the bright side, though, each breakdown held $0.15 support, showing the bid underneath remains solid and buyers are still stepping in.

Source: TradingView (CFX/USDT)

This is a key divergence. Bulls aren’t giving up, but unless bids start stacking near $0.20, the next push could fail, keeping Conflux trapped in a volatility loop, but not in a bearish trap.

Pi [PI] — Utility token pulled back to a deeper low

Pi [PI] was the second-biggest loser this week.

The altcoin slipped 3.57% from its $0.35 open. On the daily chart, it’s consolidating, which can sometimes set up a rebound, but the weekly picture tells a different story.

Since its mid-May pullback, bulls tried three times to push higher, but each attempt failed, triggering liquidity sweeps that dragged PI deeper. The latest blow? $0.34 support cracked, making PI a high-risk tape for now.

Cronos [CRO] — Crypto.com token is hovering at a key inflection point

Cronos [CRO] landed as the third-biggest loser this week.

After a strong 89% rally in August, the altcoin is showing signs of cooling. On the weekly chart, $0.30 is acting as a solid resistance, while on the daily, CRO retraced to $0.25 and has been consolidating.

According to AMBCrypto, it sets up a classic bear trap.

If bids keep stacking around $0.25, we could see a tight volatility squeeze, with price coiling as bears run out of steam. That could set CRO up for a clean bullish breakout toward $0.50 next week.

Other notable losers

In the broader market, downside volatility hit hard.

Block (BLOCK) led the losers with a 60% drop, followed by Camp Network (CAMP), down 47%, and Dolomite (DOLO), which slipped 37% as momentum sharply cooled.

Conclusion

This week was a rollercoaster. Big pumps, sharp dips, and nonstop action. As always, stay sharp, do your own research, and trade smart.

Next: From Bitcoin hoarder to Billionaire: Michael Saylor cracks Bloomberg 500 list