While the farming sector may be the one economic bright spot at present, it isn’t stopping some provincial areas from suffering heavy job losses, new data shows.

Stats NZ’s business employment data for the June quarter, released on Tuesday, showed the number of filled jobs dropped 10,000 in three months, and 50,000 fewer jobs than in December 2023.

Construction lost 2315 jobs in the quarter, or 1.3%. Accommodation and food services was down 1.2% or 1869 jobs, and administrative and support services was down 1.4% or 1337 jobs.

Since December 2023, there are 16,000 fewer filled jobs in construction, 8700 fewer in manufacturing and 6000 fewer in retail.

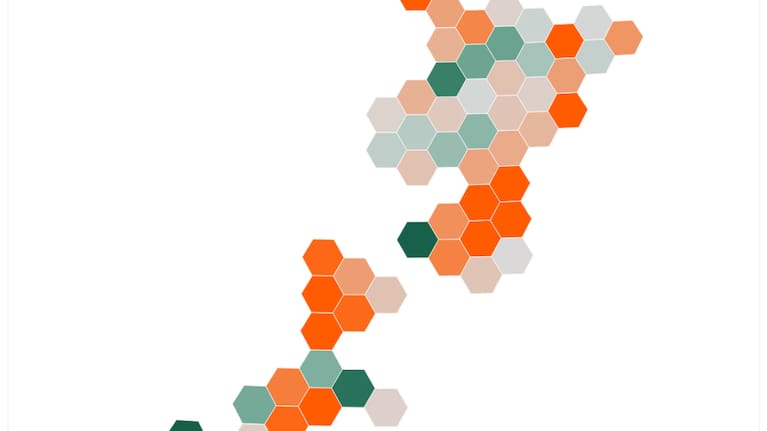

In the quarter, Auckland lost 4828 jobs, Wellington 1342, Hawke’s Bay 837 and Waikato 709.

Kaipara District lost 10.44% of its jobs compared to the same quarter a year earlier, Horowhenua 10.78% , Gore 9.5% and Upper Hutt 9.31%.

Hamilton gained 2%, Queenstown 4.59% and Porirua 4.56%.

Shamubeel Eaqub, chief economist at Simplicity, said the loss of jobs in smaller provincial centres was a surprise because other data indicated that rural economies were doing well on the back of strong commodity prices.

Ashburton, for example, had a strong dairy sector but also lost 6.7% of its filled jobs year-on-year.

Mike Jones, chief economist at BNZ, said strength in provincial areas might still be to come.

“I think that the broader sentiment within rural and agricultural-focused regions and sectors is still one of caution, where clearly there’s some good cash flows going into those parts of the economy, but they’re not necessarily being invested and spent just yet.

“So that may well be a thematic that starts to show up over the coming 12 months, with the labour market generally being that lagging indicator of what’s before in terms of activity in the economy.”

He said forecasts were still for more weakness in the labour market.

“We just finalised our second quarter GDP pick, it looks pretty ugly at a half-a-percent decline. I think until such time as the economy finds its feet, it’s going to be difficult to really be confident about the bottom for the labour market.”

He said the recovery was taking longer than expected.

“It’s probably just reflecting that stop-start fragile nature of the economic recovery, when we seem to be just coming out the other side of a stumble in the second quarter.

“And for each one of these setbacks that you get, it just delays the timing for when you might think about the labour market starting to pick up again. So it’s increasingly looking like a story for the first half of next year rather than perhaps the later stages of this year.”

He said sectors such as construction and manufacturing had been at the vanguard of the slowdown and were still suffering.

Infometrics chief executive Brad Olsen said the data showed about 11,000 jobs were lost in the quarter on a seasonal basis.

“That fall in construction employment really is mirrored by the lower activity recorded in some of the other stats as well. You had a $720 million fall in construction sales. You can sort of see that across a number of measures. The decline in construction dragged down a number of other industries, particularly a few of the more major manufacturing industries.

“The likes of non-metallic mineral product manufacturing, sales in that industry were down 4.9%. That’s what supplies the glass and bricks, the concrete, all of that sort of stuff into the sector.

“Metal product manufacturing sales were down 5.1%. That’s where your framing, your reinforcing, your roofing and similar comes from. And your wood and paper product manufacturing was down 3.2%. And that’s where, again, your joinery, your frame and trusses and similar have come from.

“So, you know, quite a decline in construction flowing out into other parts of the economy. In terms of the other jobs that declined, you saw some further job declines coming through in the likes of accommodation and food services and administrative and support services. That’s partly down, at least, to the fact that, again, businesses are still finding that conditions have been troubling and challenging and so therefore haven’t been looking to go out for as much support.”

He said construction could still have some further job losses to come but other industries might start to see improvement before too long.

“The June quarter really did sort of present a bit of a setback to overall economic recovery. I think that’s consistent with the fact that once tariffs were announced at the start of the month, that sort of did, you know, have a bit of a chilling effect to put a lot of investment and hiring decisions apparently on ice. But partial indicators for the quarter we’re in at the moment, the September quarter, does look like there’s been a little bit more of a bounce back from those lower levels.”

He said it was likely that the economy was past the low point of activity and while momentum stalled in the June quarter, it would start to flow through again.

“But it is going to be still a bit of a slow, hard slog.”