The U.S. is facing a situation “worse than a recession,” as a result of rising global trade tensions and mounting U.S. debt, according to billionaire hedge fund manager Ray Dalio.

In a recent interview with NBC‘s Meet the Press, the founder of Bridgewater Associates warned of a “a breaking down of the monetary order,” and “profound changes in the world order,” if current financial, economic, and trade challenges are not effectively managed by the administration.

Why It Matters

President Donald Trump‘s trade agenda—and retaliation against this from China—has already led certain economists and officials to warn of potentially serious disruptions to global trade and an economic downturn in America’s near future.

However, Dalio suggested that this could combine with more long-standing economic challenges for a more severe, more global, crisis. He compared the current situation to the 1930s, and said that trade disputes and rising powers rivaling the U.S. could bring down global economic and geopolitical structures in a way not witnessed since the end of World War II.

What To Know

Dalio has frequently issued warnings about the potentially disastrous consequences of America’s rising national debt, which currently stands at $36.2 trillion according to the Treasury Department. In February, he said that excessive borrowing caused by the rising debt could result in a “death spiral” for the U.S. economy.

In his April 13 interview, Dalio said that Congress should commit to reducing the budget deficit to the equivalent of 3 percent of gross domestic product (GDP), down from the current level of around 6.3 percent, per the St. Louis Fed. He said that this ongoing issue had now combined with global trade disputes and domestic political conflicts for a new threat to the world order and America’s dominant position within it.

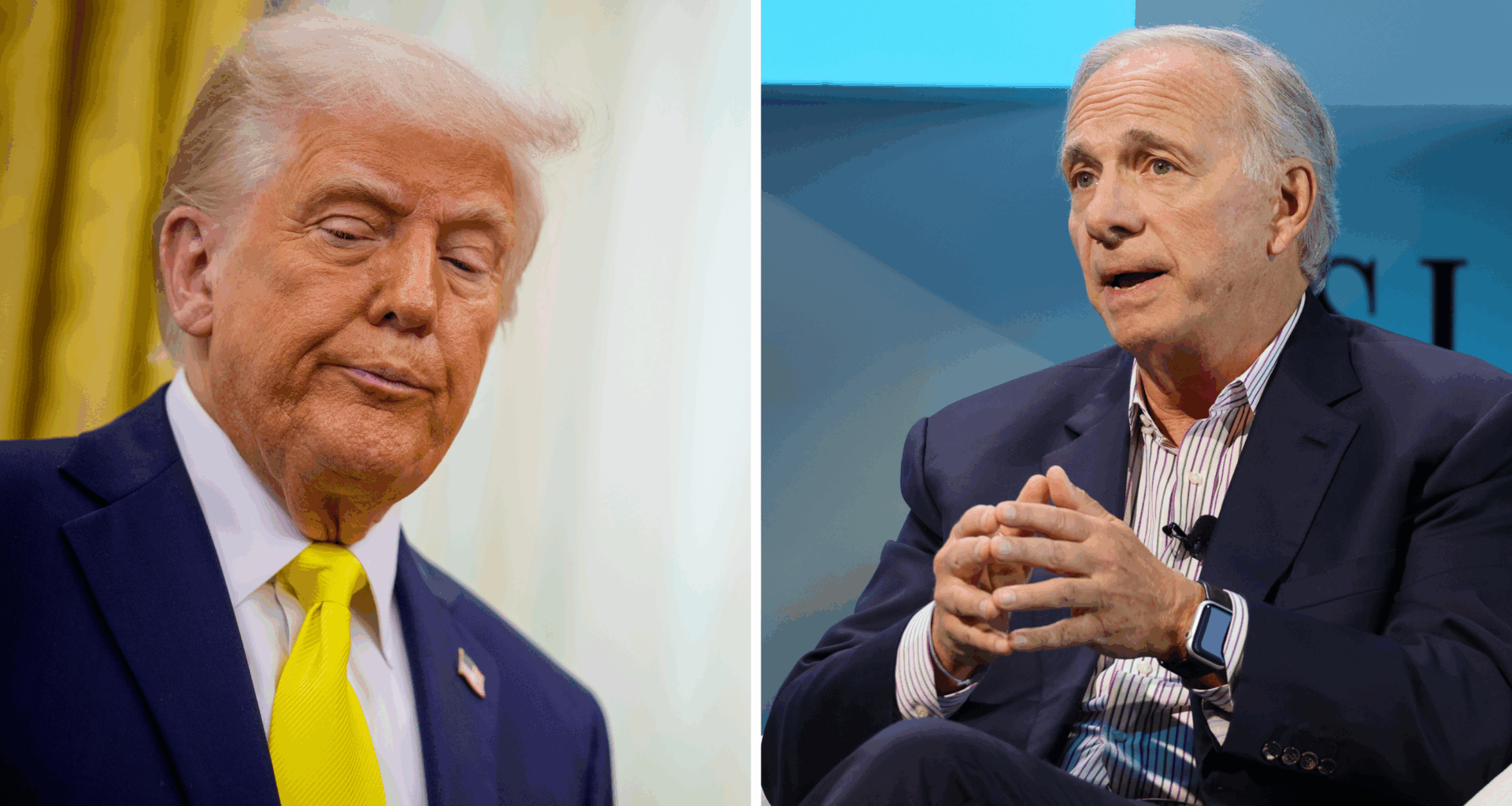

Split image of U.S. President Donald Trump, left, and Ray Dalio, founder of Bridgewater Associates.

Split image of U.S. President Donald Trump, left, and Ray Dalio, founder of Bridgewater Associates.

Andrew Harnik / Dia Dipasupil/Getty Images

He cited the “very disruptive” way in which Trump had imposed tariffs on America’s trading partners as adding to this political uncertainty, and the emergence of a “rising power” challenging U.S. hegemony, an apparent reference to China.

Trump’s tariff policies have been implemented in an occasionally abrupt and sporadic manner. Days after announcing a baseline 10-percent tariff on all imports, and reciprocal tariffs of varying rates on dozens of America’s trading partners, Trump said that reciprocal tariffs would be postponed for 90 days, with the exception of China.

Tariffs on Chinese imports have been raised to 145 percent, in response to Beijing’s refusal to remove its own retaliatory tariffs on U.S. imports. China has recently increased its own on U.S. goods to 125 percent, and vowed to fight against what it dubs “unilateral bullying” by the U.S.

What People Are Saying

Ray Dalio, speaking with Meet the Press host Kristen Welker on April 13, said: “I think that right now we are at a decision-making point and very close to a recession, and I’m worried about something worse than a recession if this isn’t handled well.”

“Such times are very much like the 1930s. I’ve studied history, and history repeats over and over again,” Dalio added. “If you take tariffs, if you take debt, and the rising power challenging an existing power, and those factors—those changes in the orders, the systems—are very, very disruptive. How that’s handled could produce something that’s much worse than a recession, or it can be handled well.”

In a recent post to X, formerly Twitter, Dalio urged the U.S. to negotiate a “win-win” agreement with China which would involve “a deal that appreciates the [Chinese currency] RMB against the dollar, achieved by the Chinese selling dollar assets while also easing their fiscal and monetary policies to stimulate their demand.”

Robert Hormats, former under Secretary of State for Economic Growth, Energy, and the Environment, wrote in Fortune: “During the [2008] crisis, there was impressive, trustful cooperation between the U.S. and China. But with the intensifying trade war and various other confrontations between the two, attaining that again is likely to be far more problematic—if not impossible.

“And tariff-related frictions between the U.S. and its key allies—among the world’s largest market economies—have undermined and in some cases virtually destroyed the mutual trust that has been so critical in resolving issues in the past. Intense trade disputes will make cooperation among them to deal with a new financial crisis far more difficult.”

Economist Torsten Slok, in a Monday appearance on CNBC, said that there will “absolutely” be a recession in 2025 if tariffs “stay at these levels.”

What Happens Next?

During the 90-day pause on reciprocal tariffs, announced by Trump on April 9, the administration said that it will be holding trade talks with certain countries that are hoping to negotiate down their duties. As part of these negotiations, the White House has reportedly requested that countries limit their economic dealings with China, to which Beijing has promised to respond with “countermeasures.”