Manchester United have released their Q4 results for the 2024-25 financial year, showcasing club-record revenues despite a woeful season on the pitch.

In the first full campaign under the leadership of Sir Jim Ratcliffe following his £1.25bn part-takeover, Man United finished 15th in the Premier League and, after losing to Tottenham in the Europa League final, ending the season without silverware or the promise of European football in 2025-26.

It was a turbulent 12 months off the pitch too. Ineos set in motion a sweeping redundancy programme, announced plans to build a new 100,000-seater stadium, and stoked talk of a potential breach of Profit and Sustainability Rules (PSR).

Unlike nearly all of their contemporaries, fans get an almost real-time window into United’s finances by virtue of the club being listed on the New York Stock Exchange, where businesses are required to file interim statements every three months.

Photo by Plumb Images/Leicester City FC via Getty Images

Photo by Plumb Images/Leicester City FC via Getty Images

Incidentally, a decree from US president Donald Trump may mean this is soon no longer the case.

But for the time being at least, supporters are able to pore over the accounts in forensic detail once every quarter, providing a more immediate and deeper indication as to the resources at the disposal of Ruben Amorim and the rest of the sporting department, as well as commercial performance at Old Trafford.

And the latest figures direct from New York make encouraging reading.

As they projected in their last interim report, United’s Q4 results, released today, show that the club generated record revenues of £666.5m for 2024-25.

That narrowly surpassed their previous record of £662m in 2023-24. Significantly, however, that was a season in which United competed in the lucrative Champions League, unlike last season.

Perhaps most significantly, United’s latest set of results forecasts revenue of £640-660m for 2025-26. That is despite the club having no revenue from UEFA at all.

Photo by Wolverhampton Wanderers FC/Wolves via Getty Images

Photo by Wolverhampton Wanderers FC/Wolves via Getty Images

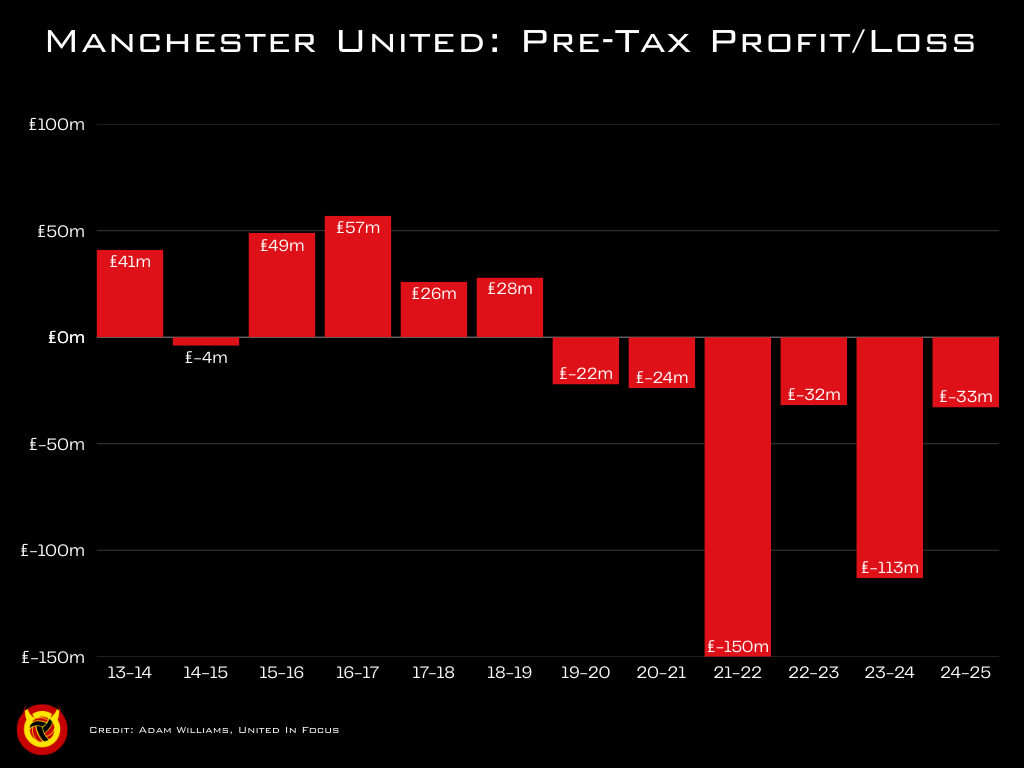

United’s bottom line showed a relatively modest loss of £33m for the financial year, a significant improvement on the £131m over the same period in 2023-24.

The fall-off in media income from the Champions League was offset by new club-records in matchday and commercial categories, which generated £333m and £160m respectively.

United benefited from an uptick in sponsorship income from the front-of-shirt partnership with Qualcomm’s Snapdragon brand, while stadium income increased due to a greater volume of matches, rising general admission prices and an increased emphasis on premium and hospitality ticketing.

EBITDA (which stands for earnings before interest, tax, depreciation and amortisation, and is a key metric used to evaluate the underlying health of a business) stood at £183m, the third-highest in the club’s history.

Wages – which encompass both players and staff – totalled £313m, a decrease of over £50m year-on-year. That was attributed to the absence of Champions League football, as well as the mass job cuts enacted by Ratcliffe and his enforcers in M16.

Amortisation – which is how football clubs account for transfer fees over a player’s contract term – stood at £196m, a small increase of 3.3 per cent on 2023-24.

“As we settle into the 2025/26 season, we are working hard to improve the club in all areas,” said United CEO Omar Berrada, commenting on the results.

“On the field, we are pleased with the additions we have made to our men’s and women’s first team squads over the summer, as we build for the long-term. Off the field, we are emerging from a period of structural and leadership change with a refreshed, streamlined organisation equipped to deliver on our sporting and commercial objectives.

“We are also investing to upgrade our infrastructure, including completion of the £50m redevelopment of our men’s first team building at Carrington, on time and on budget, following prior investment in our women’s team facilities, to create a world-class environment for our players and staff. Meanwhile, planning continues to meet our ambition of developing a new stadium at Old Trafford as part of a transformational regeneration of the surrounding community.

“To have generated record revenues during such a challenging year for the club demonstrates the resilience which is a hallmark of Manchester United. Our commercial business remains strong as we continue to deliver appealing products and experiences for our fans, and best-in-class value to our partners. As we start to feel the benefits of our cost-reduction programme, there is significant potential for improved financial performance, which will, in turn, support our overriding priority: success on the pitch.”

More analysis from United in Focus to follow…

- Follow GRV Media’s Head of Football Finance and Governance Content @Adam___Williams on X for all the latest Man United business news and analysis.

What do United’s 2024-25 finances mean for PSR?

The swing from a £133m loss to a far more respectable £33m means United’s PSR position is greatly improved compared to this time last year.

What’s more, the £133m figure translated into a much smaller loss at Red Football Limited, a subsidiary company based on which the Premier League calculates United’s PSR position.

The same will go for the £33m loss in 2024-25, which may actually swing to a positive result once PSR-exempt expenses like infrastructure, youth, women’s team and community investment are excluded.

Man United profit and loss

Man United profit and loss

Credit: Adam Williams/United in Focus/GRV Media

Under the Premier League’s rules, United are allowed to lose up to £105m over a rolling three-year period, with those allowable costs factored in. The 2024-25 accounts show that PSR is of little concern this time around.

United are not subject to UEFA’s equivalent financial rules this season. European football’s governing body has a lower loss limit, as well as a Squad Cost ratio rule.

The Red Devils will be paying close attention to the latter element of the rules, however, in anticipation of playing in Europe again.

Under UEFA’s rules, clubs are allowed to spend no more than 70 per cent of revenue plus profit on player sales on player and manager wages, transfers and agents’ fees.