A parent in Northern Ireland has been told to wait six months before their child benefit application is processed.

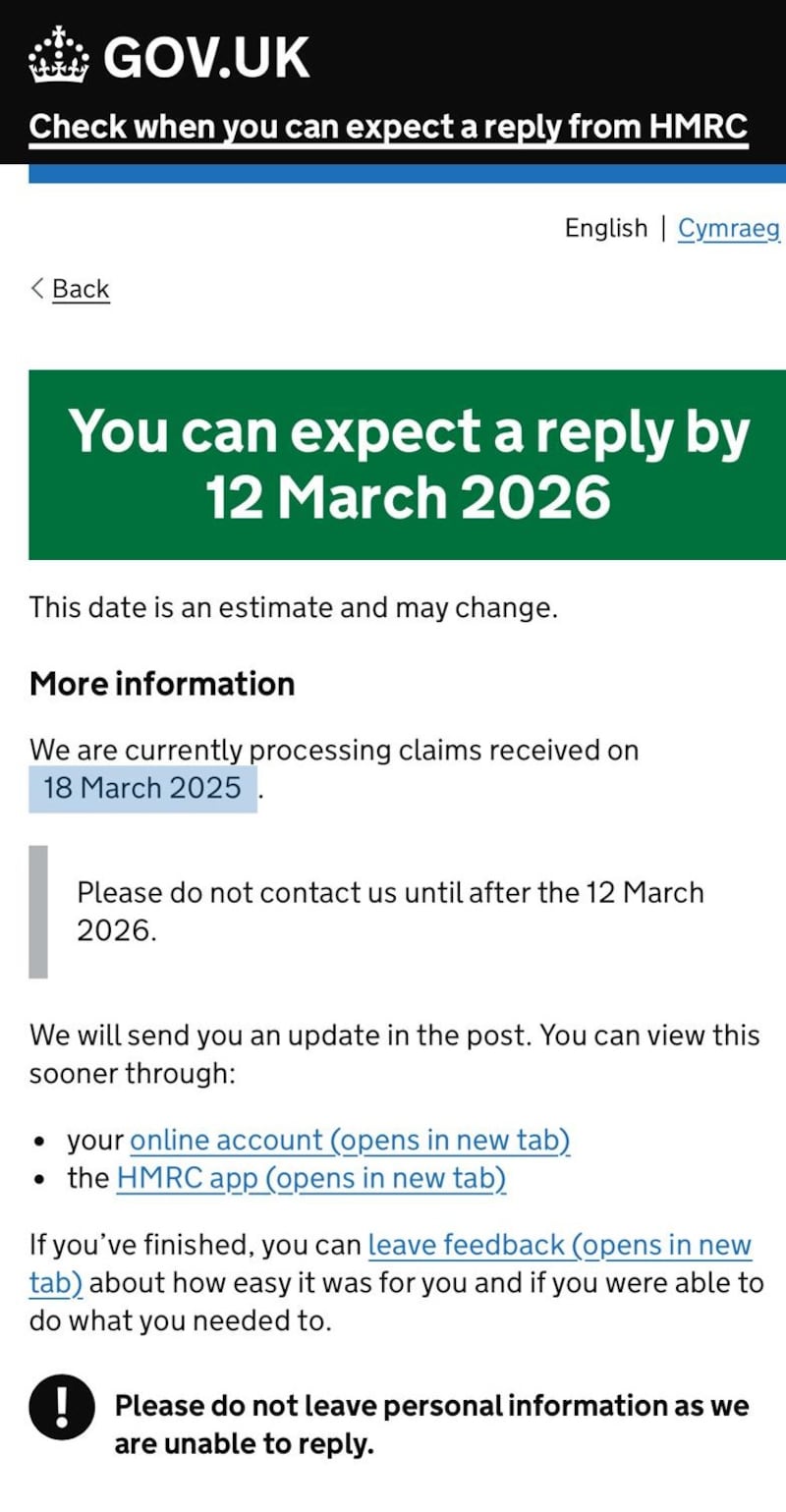

When checking the progress of their application with HMRC online, the parent was given a reply date of March 12 next year.

Families in Northern Ireland eligible for Child Benefit are entitled to £26.05 a week for their first or only child, equating to £1,354.60 a year.

For each additional child, the weekly rate is £17.25 or £897 per year.

The benefit is typically paid every four weeks into a bank account and there is no limit on the number of children parents can claim for.

If claimants or their partner earn between £60,000 and £80,000, the higher earner will be subject to a High Income Child Benefit Charge, with families able to use the online Child Benefit tax calculator.

One parent in Northern Ireland was told they would need to wait until March for a reply on their application.

One parent in Northern Ireland was told they would need to wait until March for a reply on their application.

Responding, an HMRC spokesperson said: “Online claims can be processed in as little as three days and are backdated to the date they were made as a minimum.”

The ‘Where’s My Reply tool’ on GOV.UK reflects the longest time people can expect to wait.

HMRC added that an error with the tool had caused the timescales to be wrong but this has now been fixed.

In a separate development this week, MPs in Westminster backed the first stage of legislation to scrap the two-child benefit cap.

While phrased in the same way, this is different to child benefits as it applies to the limit for low-income families claiming Universal Credit or Tax Credits – meaning in most cases they cannot claim for more than two children.

Introduced by a previous Conservative Government in 2015, the motion was introduced by the SNP’s Kirsty Blackman who called the policy “cruel.”

Northern Ireland MPs backing the vote included the SDLP’s Claire Hanna and Colum Eastwood, Ulster Unionist Robin Swann, the DUP’s Jim Shannon and TUV leader Jim Allister.