Huge amounts of public funds flowing into European defence contracts are enriching a small group of military firms. But less well known is that Israeli defence contractors are also tapping the unprecedented Nato spending spree.

By any measure, the pledge by Nato members to rearm their militaries by increasing their spending on defence to 5% of national economic output is big news.

Russia’s invasion of Ukraine in 2022 led to the largest western European countries pouring billions into all types of military kit either for export or to bolster their own national militaries.

New orders for anti-drone missiles, space defence communications, and battlefield military land vehicles are regular items on the business news.

There is also the spending by European governments on Elon Musk and his Starlink broadband satellite business and on the Peter Thiel-founded Palantir and its military and mass surveillance operations.

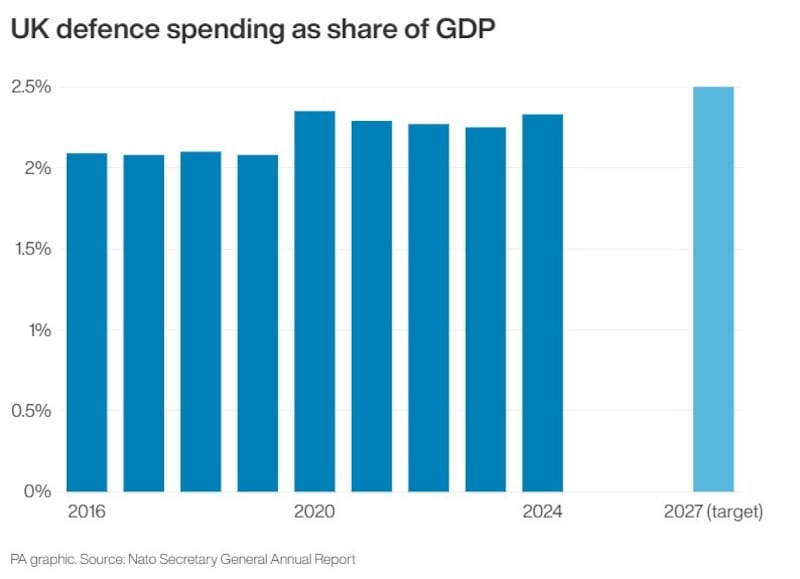

This comes as President Donald Trump’s refusal for the US to bankroll Nato’s rearmament plans has put more pressure on the public finances of low-growth economies from Britain to France and Germany.

In contrast, it’s a boom time for Europe’s national defence corporate champions and their shareholders.

The Thales missile factory in east Belfast (David Young/PA)

The Thales missile factory in east Belfast (David Young/PA)

The roster of Europe’s big defence companies includes Britain’s BAE Systems; France’s Thales – which owns the Belfast missile-making factory – and Italy’s Leonardo.

And once little known by most in this part of the world, Germany’s self-proclaimed global champion Rheinmetall is now vying to be among Europe’s most valuable defence companies.

“Boom at Rheinmetall,” the Dusseldorf-based company hailed an order book worth €55bn that has been boosted by significant contracts from the German armed forces and the British Army.

Or, as Rheinmetall puts it, “embedding Britain’s defence capabilities within Rheinmetall’s expanding global production network, the UK is gaining not only the firepower to meet today’s needs but also the industrial resilience to shape the battlefields of tomorrow”.

Stock market investors have rewarded the German artillery maker. Following a 300% surge in the share price, the company is now valued at €88bn.

Shares in BAE, which is hugely exposed to defence contracts, have soared 52% for a stock market valuation of £59bn (€68bn). Reporting global sales of £14.6bn at the half-year stage, the company’s huge military backlog of orders was worth over £75bn by the summer.

Thales, whose 83,000 workforce includes the Belfast plant which it plans to expand to more than 900 people, has tapped a 67% surge in its shares for a market valuation of €52bn (£45.4bn).

(Press Association Images)

(Press Association Images)

Meanwhile, following Nato government orders for its combat aircraft and helicopters, Italy-based Leonardo is now valued at over €29bn (£25.3bn), and Sweden’s Saab, which started making fighter jets in the 1930s, is worth €27bn (£23.6bn).

Saab’s financial reports show the company exports to many parts of the world, including generating significant sales growth this year from what it terms “undisclosed countries”. Its shares climbed last week to a record high after Nato countries warned Russia over incursions into their airspace, and President Trump said Nato should shoot down Russian fighters if similar flights were to happen again.

Less obviously, civilian plane manufacturers such as the US-based Boeing and Europe’s Airbus generate a significant slice of their global revenues from military contracts, according to data compiled by the Stockholm International Peace Research Institute, or Sipri.

Stock market analysts are now increasingly monitoring the recent record military spending, giving the same attention to defence firms they once lavished on the latest iterations of the iPhone from Apple, one of the world’s most valuable companies.

S&P Global has a stock market index that tracks stock market-listed companies with the most exposure to defence spending.

“As geopolitical risk, national security, and autonomy come into focus, defence is becoming a major talking point for global investors,” says the credit ratings firm.

In 2019, the five largest constituents of the S&P defence index were BAE Systems, Rolls-Royce, Safran, Thales, and Airbus. Reflecting the recent defence spending by Germany and Italy, the top five on the S&P tracking index this year featured Rheinmetall, BAE, Leonardo, Thales, and Rolls-Royce.

Rearmament news continues to flow. Ahead of the recent visit by President Trump, the British government heralded defence spending by US firms, including Palantir, as part of plans for a wider bunch of American tech investments in the country.

In recent weeks, Denmark struck its biggest ever defence deal to buy €7.7bn (£6.7bn) worth of equipment from manufacturers in France, Italy, Norway, and Germany.

Thales was reportedly seeking to secure more air defence deals after the Danish government passed on buying the US-made Patriot system.

And reports on Germany rebuilding its creaking 1960s-era bridges on the autobahn network are depressingly peppered with references to Berlin’s drive to invest because the country is also a major provider of military kit to Nato.

Once fiscally-prudent, Germany nonetheless now plans to spend around €25bn (£21.8bn) a year for the next few years on its military from a special public fund.

Europe’s accelerating spending is providing a bonanza for Israeli military equipment manufacturers (HO/AP)

Europe’s accelerating spending is providing a bonanza for Israeli military equipment manufacturers (HO/AP)

But much less discussed is that Europe’s accelerating spending is providing a bonanza for Israeli military equipment manufacturers.

Even as some European countries appear reluctantly to inch toward imposing limited trade sanctions in response to Israel’s genocide in Gaza, governments and militaries from London to Berlin continue to shower orders on Israeli defence companies.

Europe buys over half of the $15bn (€12.7bn) defence equipment Israel exports, with Germany two years ago having signed a €4bn deal to buy air defence systems from the country.

“European armies are the biggest customers of Israeli-made weapons and defence systems, buying $8bn worth last year, or just over half of exports, and demand is only likely to grow,” Bloomberg has reported.

However, wider dividends for national economies from the spending splurge is hard to detect. Europe’s military manufacturing powers, like Britain, may tap a limited and short-lived boost, but defence spending will likely only put more pressure on the country’s fragile finances.

For smaller countries like Ireland, there are arguably no benefits at all.

Analysts note that in Britain, most spending departments, including schools, environment and rural affairs, and culture and media, face frozen or reduced budgets, when inflation is taken into account.

The only exceptions to the tight spending budgets are the ring-fenced areas of defence and health.

UK Industry Minister Sarah Jones was pictured at the Thales plant in Belfast with military hardware hoisted on her shoulder, but the benefits of rearmament for rousing moribund manufacturing in Britain and across Europe are still hard to ascertain.

In a recent commentary, Capital Economics in London said Poland has increased spending on defence more than any other Nato country, but its reliance on imports amid “structural weaknesses in Poland’s military-industrial complex” will likely mean the country will tap only a small boost to economic growth for some time.

A wider view on the defence spending spree is provided by Sipri, the Stockholm International Peace Research Institute.

“World military expenditure reached $2,718bn in 2024, an increase of 9.4% in real terms from 2023 and the steepest year-on-year rise since at least the end of the cold war,” Sipri said in an updated report in April.

Eamon Quinn

Eamon Quinn

“Military spending increased in all world regions, with particularly rapid growth in both Europe and the Middle East.

The top five military spenders—the US, China, Russia, Germany and India—accounted for 60% of the global total, with combined spending of $1,635bn,” according to the Swedish institute.

We live in troubled times.