Editor’s Note: The below was written prior to the current government shutdown. The US government shut down on October 1, 2025 after failed negotiations. Republicans wanted a “clean continuing resolution” until November 21, 2025; while Democrats sought compromises. Shutdowns are historically brief with little market impact, however, repeated shutdowns do erode global investor confidence. Short-term volatility is possible given deep political divisions, but it’s important to stay anchored to your long-term strategy. This shut down also could disrupt economic data releases which in turn could impact Federal Reserve decisions, which brings us to our regularly scheduled content.

When I was in college, I landed an internship at Scottrade, the discount online broker that was later acquired by TD Ameritrade in 2017. One of their perks was an employee savings account paying 5% on up to $5,000. At the time, rates were near zero, so I quickly moved my savings into that account. Around the same time, Facebook went public. And no, I didn’t buy shares since most of my cash was tied up earning that 5%.

For the past three years, money market funds and Certificates of Deposit (CDs) have been yielding 4-5% after the Federal Reserve began raising rates in 2022 to fight inflation. Investors piled in, and money market balances hit a record $7 trillion in the first half of 2025. It’s been an easy trade: virtually risk-free income in a world that hadn’t seen such yields since before the 2008 financial crisis.

But here’s the thing — while cash was earning that steady 4-5%, global equity markets delivered roughly 20% annualized returns over the same time period. The strong returns came despite two major geopolitical conflicts, persistent inflation, restrictive monetary policy, a banking crisis, the expansion of tariffs, and even election uncertainty. In other words, the world was far from calm, yet stocks surged. That’s the trap of “safe” returns: when something looks too good to pass up, it’s easy to forget about opportunity cost.

Despite higher interest rates and market volatility in the spring of this year, there has been a burst of activity in the IPO market. Year-to-date, newly-public companies have raised $32 billion, and bankers anticipate more deals on the horizon. I’m not suggesting you dump your cash into the next shiny tech IPO, but I am suggesting that the sweet spot for long-term investors usually lies somewhere between a savings account and a hot IPO.

That’s where thoughtful asset allocation comes in.

The Fed cut interest rates by 25 basis points in September, with more cuts expected this year and in 2026. Unlike mortgage rates, short-term instruments like savings accounts, CDs, and money market funds move almost in lockstep with the Fed. Those attractive 4-5% yields could be at risk. Historically, rate cutting cycles have lasted anywhere from 3 to 40 months, with the current one beginning in September 2024. Unlike the emergency cut rates seen during the pandemic, the Fed is now fine-tuning monetary policy to balance its dual mandate of maintaining price stability and promoting maximum employment. Under current economic conditions, it’s unlikely that rates will drop to 0%, but it’s very possible they could drop to a level where yield on cash is barely keeping up with inflation.

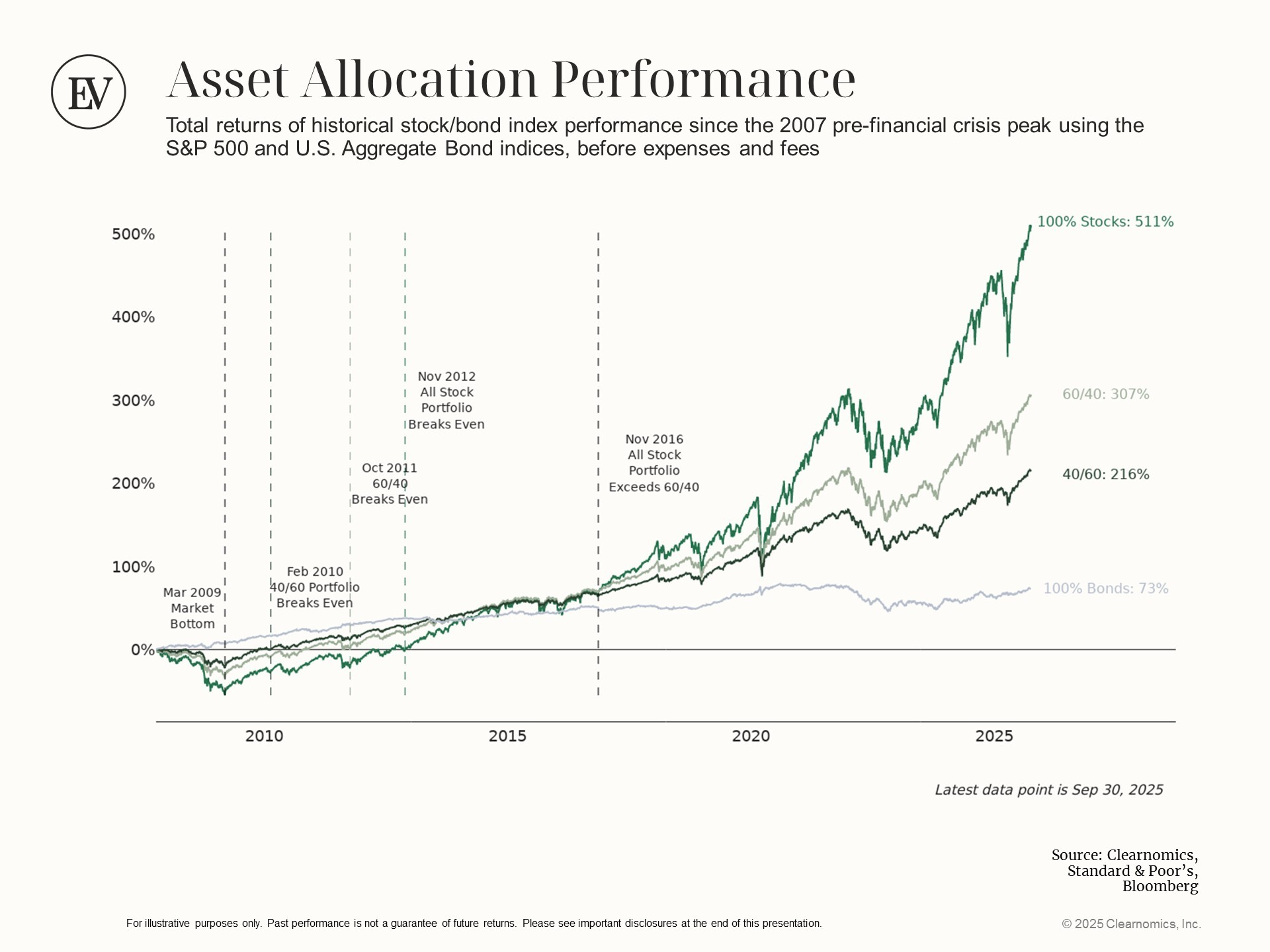

If you haven’t done it already, now is the time to check in with your financial advisor and revisit whether your cash is parked in the right place — or if it’s holding you back. The chart below illustrates the historical performance of various allocation strategies (ranging from conservative to aggressive) over the past 15 years. For most investors, the optimal allocation will be a blend of equities, bonds, alternatives, and cash — tailored to your goals, time horizon, and risk tolerance. There is no one-size-fits-all solution.

As for that Facebook IPO … I’ve never run the numbers on what $5,000 invested back then would be worth today, and honestly, I’d rather not. Even if I had bought the shares, I probably would have sold them years ago to pay off student loans, buy a car, cover wedding costs, or put a down payment on a house. And that’s the point: investments aren’t just numbers on a screen, they’re fuel for your real life.

The lesson? Whether it’s a 5% savings account or a fast-rising IPO, every financial decision carries an opportunity cost. The key is making sure your money is working in a way that reflects your priorities — not just today, but years down the road.