2h agoThu 2 Oct 2025 at 12:17amMarket snapshop

- ASX 200: +0.5% to 8,890 points (live values below)

- Australian dollar: flat at 66.10 US cents

- Wall Street: S&P500 +0.3%, Dow +0.1%, Nasdaq +0.4%

- Europe: Dax +1.0%, FTSE +1.0%, Eurostoxx +1.2%

- Spot gold: -0.2% at $US3,857/ounce

- Brent crude: +0.3% to $US 65.57/barrel

- Iron ore: flat at $US103.68/tonne

- Bitcoin: +1.4% at $US119,306

Prices current around 10:15am AEST

Live updates on the major ASX indices:

27m agoThu 2 Oct 2025 at 2:30amAustralians continue to open their wallets

Australian consumers, emboldened by falling interest rates and rising wages, have continued to open their wallets with household spending up again in August.

While the 0.1% increase in the ABS Household Spending Indicator was modest, it follows strong gains in June and July.

Household spending is up 1% across the quarter and 5% over the year.

“While growth was sluggish in August, Australian households are spending a lot more than they did a year ago,” Indeed’s Australia Pacific economist said Callam Pickering said.

“Cost-of-living pressures have eased over the past year, reflecting lower interest rates and inflation, which has effectively stimulated spending on goods and services.”

The August figure was bolstered by increased spending on services which offset a decline in spending on goods.

Mr Pickering noted Australians may also be on a bit of a health-kick.

“Spending on health services has increased by 8% over the past year, with spending on alcohol & tobacco down a whopping 18.5%.

“Reduced spending on alcohol & tobacco has subtracted around 0.9 percentage points from annual household spending growth.”

43m agoThu 2 Oct 2025 at 2:14amAustralia’s trade surplus narrows as gold exports dry up

Australia held on to it trade surplus in August, but only just.

The surplus came in at $1.8 billion, the narrowest it has been since 2018 and well down on the $5 billion forecast.

An almost 8% decline in exports drove the result and that was largely due to the volatile non-monetary gold exports delivering far fewer riches than previous months.

Imports rose 3.2% over the month, led by a 5.8% in consumption good.

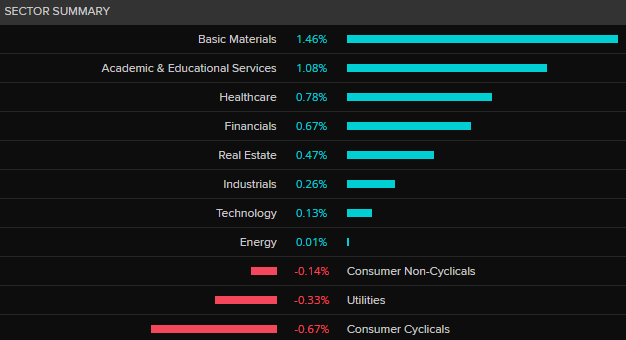

53m agoThu 2 Oct 2025 at 2:05amASX 200 up 1.2% heading into afternoon session

The ASX has continued to power ahead after a strong start to the session.

At midday (AEST), the ASX is up 1.2% to 8,957 points.

ASX 200 today (LSEG, ASX)

ASX 200 today (LSEG, ASX)

The materials/mining sector leads the way, with the ASX 300 metals and mining sector is up 2.4%, while the financial sector is up 1.5%.

ASX 200 by sector (LSEG, ASX)1h agoThu 2 Oct 2025 at 1:45amAustralia “well positioned” to navigate global uncertainty: RBA

ASX 200 by sector (LSEG, ASX)1h agoThu 2 Oct 2025 at 1:45amAustralia “well positioned” to navigate global uncertainty: RBA

The Reserve Bank says Australia’s financial system remains well positioned to navigate a period of elevated global uncertainty.

In its bi-annual Financial Stability Review, the RBA gave the banking system a tick of good health and said most households were not only keeping up with repayments but had built up saving buffers.

Here are the FSR’s key findings:

The RBA views the largest risks to financial stability as coming from abroad:

- High and rising government debt levels in major economies.

- Stretched asset valuations and leverage in global markets.

- Heightened geopolitical and operational risks.

However, the RBA finds that Australian households, businesses and banks are well placed to weather most shocks:

- Most households with mortgages are keeping up with repayments and have built savings buffers.

- Many businesses have established financial buffers.

- Australian banks continue to maintain high levels of capital and liquidity, positioning them to support the economy through potential disruptions.

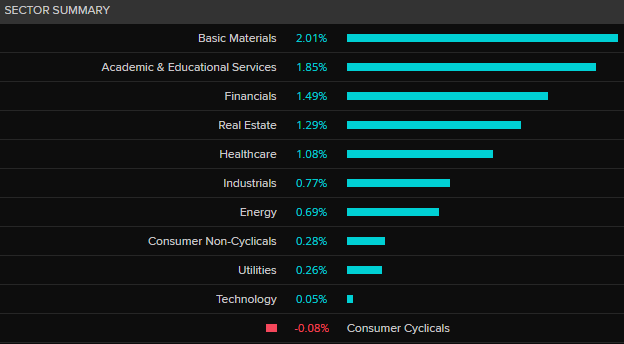

1h agoThu 2 Oct 2025 at 12:59amASX 200 up 0.6% in early trade supported by miners and property

The ASX has followed Wall Street’s lead higher this morning, after the solid gains in the US overnight.

At 10:30am AEST, the ASX 200 was up 0.6% to 8,898 points.

Basic materials/miners led the gains, while there has been demand for real estate trusts and healthcare stocks with CSL (+2.9%) benefiting from the general lift in pharma stocks in the US and Europe.

Retailers, discretionary and non-discretionary, are having a tougher time.

ASX 200 by sector (LSEG, ASX)

ASX 200 by sector (LSEG, ASX)

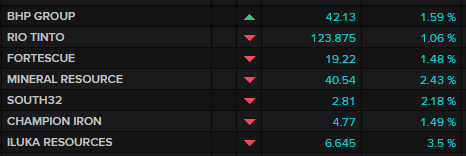

The miners have benefits from an improvement in manufacturing data in China and higher demand for their products.

BHP appears to have shrugged off fears about a Chinese boycott to open 1.6% higher.

ASX major miners (LSEG, ASX)

ASX major miners (LSEG, ASX)

The banks are all higher, led by Judo (+1.9%) and ANZ (+1.1%).

ASX banks (LSEG, ASX)

ASX banks (LSEG, ASX)

Pharmaceutical stocks are generally higher following a global trend overnight after Pfizer said it had cut a deal with the White House to reduce the price of its drugs.

One healthcare stock that’s struggling is private hospital chain Ramsay Health (-3.4%) after a broker downgrade from Morgan Stanley.

ASX major pharma stocks (LSEG, ASX)

ASX major pharma stocks (LSEG, ASX)

Real estate investment trusts (REITs) are generally higher, led by heavyweight Goodman Group (+1.0%)

ASX major REITs (LSEG, ASX)

ASX major REITs (LSEG, ASX)

The retailers are patchy with Coles down 0.4% and Harvey Norman up +0.1%.

Major ASX retailers (LSEG, ASX)

Major ASX retailers (LSEG, ASX)

Top mover on the ASX 200 is the local listing of giant US aluminium producer Alcoa (+4.2%) while gold producers are well represented in the top 10.

ASX 200 top movers (LSEG, ASX)

ASX 200 top movers (LSEG, ASX)

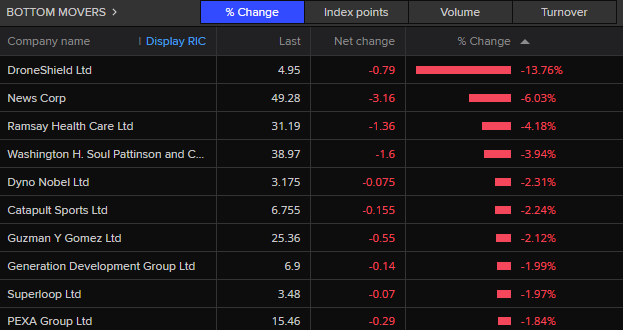

Bottom mover on the ASX 200 is yesterday’s big winner DroneShield (-13.8%) which looks like it has been hit with some profit taking after a stellar recent run.

News Corp (-6.0%) is also out of favour, following its US parent lower.

ASX 200 bottom movers (LSEG, ASX)2h agoThu 2 Oct 2025 at 12:15amASX 200 opens 0.5% higher

ASX 200 bottom movers (LSEG, ASX)2h agoThu 2 Oct 2025 at 12:15amASX 200 opens 0.5% higher

The ASX 200 has opened 0.5% higher at 8,890 (10:15am AEST).

3h agoWed 1 Oct 2025 at 11:27pm

ICYMI: Kohler’s Market Wrap

Just before yesterday’s market action becomes today’s digital fish & chip wrapper, here’s Alan with his finance report from the 7pm news.

Loading…

3h agoWed 1 Oct 2025 at 11:02pm

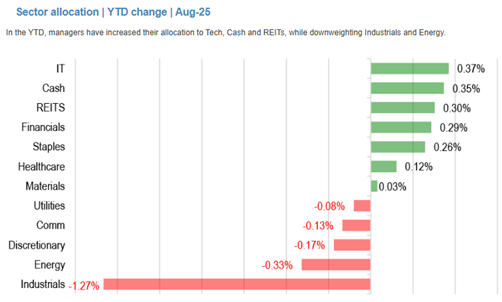

Volatile earnings season sparks exit to cash and defensive stocks

The recent ASX earnings season has sparked a decisive shift to cash and defensive stocks by fund managers, according to a survey from the big investment bank J.P. Morgan.

While the season wasn’t necessarily bad, it was volatile with some outsized share price movements — particularly by some ASX 200 stocks that missed forecasts.

On J.P. Morgan estimates, August produced the third highest monthly cash accumulation amongst fund managers since 2018

The average cash position now sits at 4.16% compared to the long term average of 3.99%.

“Alongside higher allocations to cash, managers added to defensive holdings through the course of the month,” J.P. Morgan’s head of Australian equity strategy Jason Steed wrote in a note to clients.

“The proportion of funds OW (overweight) the defensive cohort is 61%, which marks an all-time high.

“Communications is the preferred defensive exposure, with 80% of managers OW the sector.”

The Tech sector endured the largest outflows through the season.

The big mover on J.P. Morgan’s “Most Loved” index was perhaps usurpingly the local listing of the world’s biggest gold miner Newmont, which has seen holdings by fundies rise sharply since August as global investors made a dash to the safe haven of physical gold.

ASX fund manager asset allocation by sector (J.P.Morgan)

ASX fund manager asset allocation by sector (J.P.Morgan)

4h agoWed 1 Oct 2025 at 10:23pm

Musk’s personal wealth hits $US500 billion

Tesla supremo and one-time White House apparatchik Elon Musk has become the first entrepreneur to hit the $US500 billion level, according to Forbes magazine — a publisher with an obsession for the wealthy.

Mr Musk’s dash to the $US500 billion line — where he pipped the fast-moving Oracle boss Larry Ellison (around $US400 billion) — was triggered by 3.3% rise in Telsa shares overnight, courtesy of a broker upgrade from HSBC.

4h agoWed 1 Oct 2025 at 10:08pm

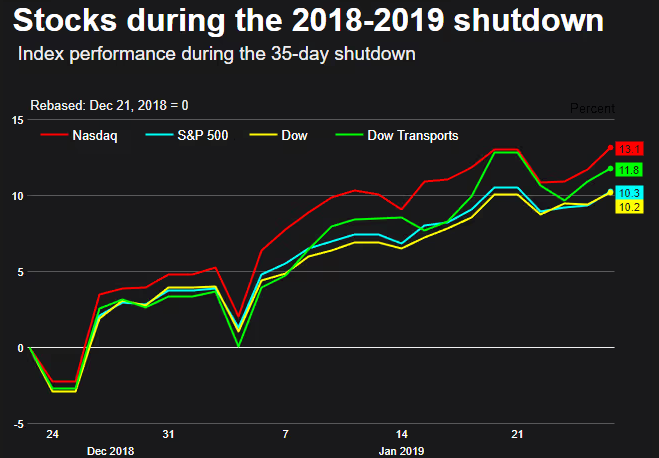

Are US government shutdowns bad for equity markets?

Off the bat, the US government has shut down 15 times since 1981 and each time the world hasn’t spun off its action.

The most immediate impact will be on the roughly 750,000 US public servants who are likely to be furloughed without pay, or have their pay delayed. That includes US troops.

Those not affected include essential service providers such as air traffic controllers, although air traffic may be slowed.

Oh, and members of Congress who caused the whole kerfuffle will continue on full pay because — well, because they are members of Congress, I guess, and they make the rules.

So, what about the markets? Well, they may initially splutter but generally they carry on in their insouciant way.

Deutsche Bank research found the S&P 500 has risen during each of the last six shutdowns.

US stocks during the 2018-2019 shutdown (LSEG Datastream)

US stocks during the 2018-2019 shutdown (LSEG Datastream)

As the Kobeissi Letter points out, “the market (read Wall Street) actually welcomes shutdowns”.

Here are the Kobeissi key points:

- The average length of a shutdown is only 8 days

- The S&P 500 has ended higher one year after a shutdown in 86% of cases

- The S&P 500 posts an average gain of +13% one year after the shutdown ends

- During the 35-day shutdown in 2018, the S&P 500 rallied +11%

- While the government is shut down, the US defers $400M/day in costs

- The Fed generally turns more dovish if government data releases are paused

4h agoWed 1 Oct 2025 at 10:02pm

You’re not fired (yet) – Fed Governor Lisa Cook spared for now

In other US jobs related news, the US Supreme Court has refused to let Donald Trump fire Lisa Cook, at least for now.

The court deferred President Trump’s application to remove Ms Cook pending further legal arguments.

Talking of jobs, the White House has bailed on its first-choice pick to be the new head of the Bureau of Labor Statistics.

You may recall, the previous head was sacked after the BLS churned out some unflattering jobs numbers and downward revisions earlier this year.

The president withdrew his nomination of E.J. Antoni, a man with impeccable conservative credentials from the impeccably conservative Heritage Foundation but with little experience in the field.

As former Reagan White House economic adviser Professor Steven Hanke opined, “Whatever you say about Trump, he knows when he’s riding a dead horse, and he knows how to dismount.”

5h agoWed 1 Oct 2025 at 9:42pmWall Street ignores weak job numbers as global stocks rally

Another batch of weak jobs data was not enough to stop Wall Street’s march higher overnight.

The S&P 500 gained 0.3%, the Nasdaq did marginally better (+0.4%) and the blue-chip Dow not quite as well (+0.1%).

This was despite the ADP Employment report showing a decline in private payrolls of 32,000 and a downwardly revised 3,000 fall in August.

The consensus forecast was for growth of 50,000 jobs in September and 54,000 more in August — fortunately, ADP employment is privately collated, so the statistician responsible may not get the sack for the numbers.

With Friday’s key public sector non-farm payrolls, wages and unemployment numbers likely to be delayed due to the US government lockdown, the ADP survey is about the only insight investors have about what is currently happening in the jobs market.

In better news for the US economy, the Institute of Supply Management (ISM) manufacturing survey pointed to a slight recovery in activity last month.

Healthcare was the strongest sector over the session after Pfizer said it had cut a deal with the White House to lower prescription drug prices. That dragged other drug companies’ share prices higher.

Europe’s STOXX 600 (+1.2%) hit a record high thanks to the improved sentiment around pharmaceutical stocks.

UK’s FTSE (+1.0%) also closed at a record high.

Gold powered higher, almost hitting $3,900/ounce at one stage, while silver kept its ballistic run going hovering around record levels.

Oil on the other hand slipped to a four-month low with the global benchmark Brent crude down 1% to $65.38/barrel on higher-than-expected US inventories and the belief that OPEC+ would boost its production target again next month.

5h agoWed 1 Oct 2025 at 9:15pm

Good morning

Good morning and welcome to another day on the ABC markets and finance blog.

Stephen Letts from ABC business team limbering up for a blow-by-blow coverage of the day’s events, where every post is hopefully a winner, but none should be construed as financial advice.

US public institutions and agencies may have been shut down, but fear not, your favourite public service broadcaster is very much open for business

In short, the ASX looks like enjoying a brisk start to the day with futures trading pointing to the ASX 200 gaining 0.5% on opening after Wall Street closed higher.

The ABS has a couple of interesting data releases this morning.

The international trade balance is expected to show a surplus of around $5 billion was racked up in August, although that forecast is very much at the mercy of the value of gold exports which is quite a volatile number.

The ABS releases its monthly Household Spending Indicator at the same time (11:30am AEST) which should continue to see spending trending higher as the RBA cuts rates.

The RBA will also drop its quarterly Financial Stability Review statement this morning,

As always, the game’s afoot, so let’s get blogging.

Loading

5h agoWed 1 Oct 2025 at 9:14pm

Market snapshot

- ASX 200 futures: +0.5% to 8,923 points

- Australian dollar: flat at 66.10US cents

- Wall Street: S&P500 +0.3%, Dow +0.1%, Nasdaq +0.4%

- Europe: Dax +1.0%, FTSE +1.0%, Eurostoxx +1.2%

- Spot gold: +0.2% at $US3,864/ounce

- Brent crude: -1.0% to $US 65.40/barrel

- Iron ore: flat at $US103.68/tonne

- Bitcoin: +2.4% at $US117,408

Prices current around 7:10am AEST