Report Overview

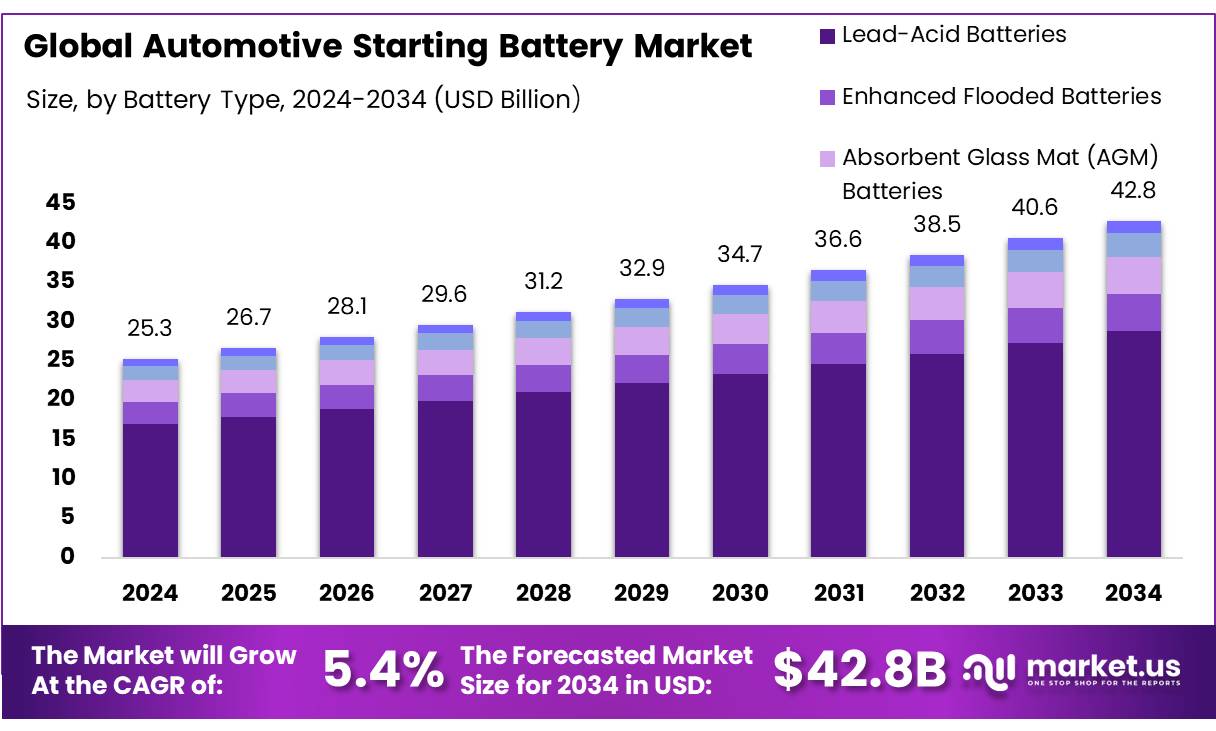

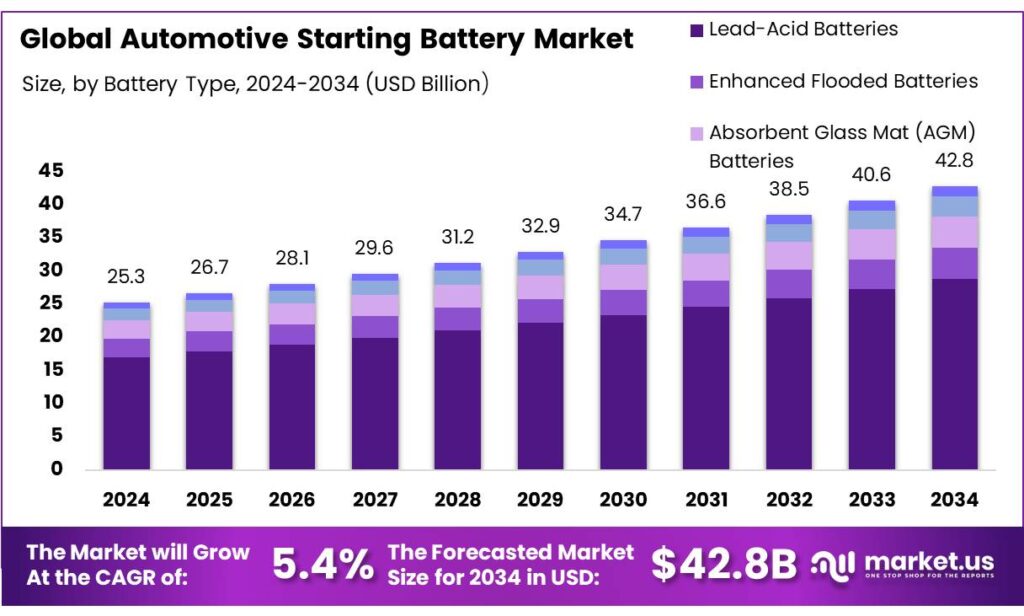

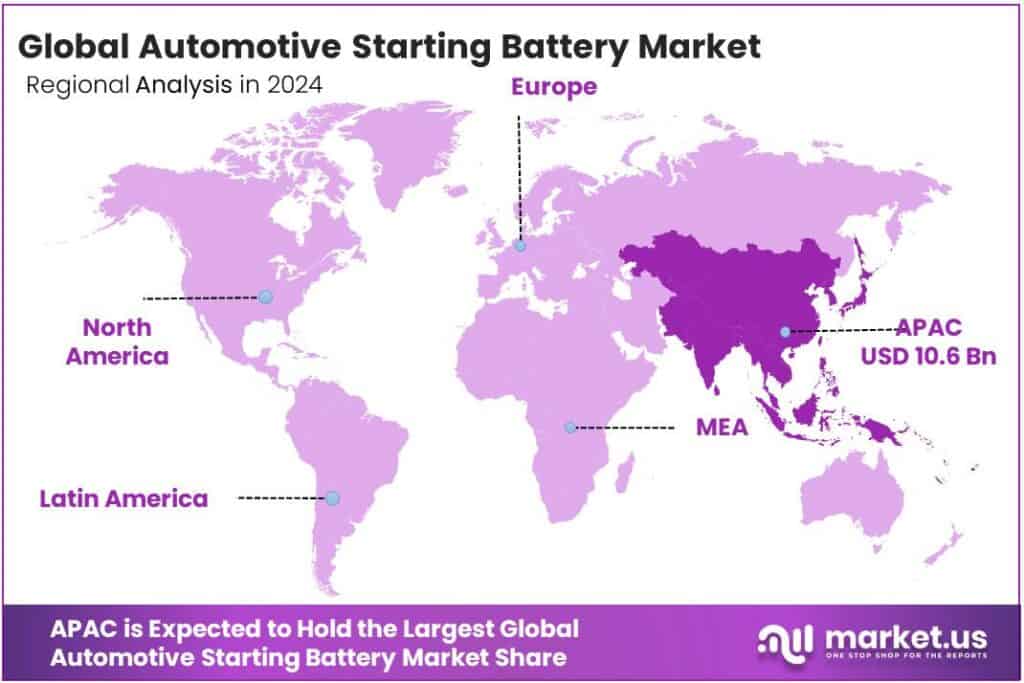

The Global Automotive Starting Battery Market size is expected to be worth around USD 42.8 Billion by 2034, from USD 25.3 Billion in 2024, growing at a CAGR of 5.4% during the forecast period from 2025 to 2034. In 2024 Asia-Pacific held a dominant market position, capturing more than a 41.9% share, holding USD 10.6 Billion in revenue.

The automotive starting battery, often referred to as the SLI battery, is a critical component in internal combustion engine (ICE) vehicles, providing the initial burst of current required to crank the engine. Traditionally based on lead-acid chemistry, starting batteries remain relatively low in energy density compared to propulsion batteries; nevertheless they are essential for all non-battery-electric vehicles and even as auxiliary systems in hybrids. The market also sees emerging competition from low-voltage lithium-ion starter batteries, especially in mild-hybrid architectures, though these remain niche today.

The industrial scenario is characterized by a mature manufacturing base, high material circularity and gradual structural change driven by power-train electrification. Lead-acid SLI battery production and aftermarket replacement volumes continue to be supported by the large installed fleet of ICE vehicles; at the same time, the share of battery electric vehicles (BEVs) has been expanding rapidly (nearly 14 million new electric cars registered globally in 2023), creating a dual-track market in which SLI demand is being partially displaced by high-voltage traction batteries in new vehicle sales but remains material in the installed base and in regions where ICE penetration remains high.

Government support, especially in markets pushing electrification, also has indirect influence. In India, for instance, the government’s Production Linked Incentive for Advanced Chemistry Cell (PLI-ACC) scheme (launched 2021) allocates INR 18,100 crore (~USD 2.2 billion) to spur domestic battery cell and energy storage manufacturing, thereby strengthening the upstream ecology that could also benefit ancillary battery segments.

- Academic / R&D initiatives under the EV mission are also active: e.g., IIT-BHU was selected as nodal centre in India’s MAHA-EV program and awarded Rs 55 crore (~USD 6.6 million) to develop a national battery research facility.

Key Takeaways

- Automotive Starting Battery Market size is expected to be worth around USD 42.8 Billion by 2034, from USD 25.3 Billion in 2024, growing at a CAGR of 5.4%.

- Lead-Acid Batteries held a dominant market position, capturing more than a 67.3% share.

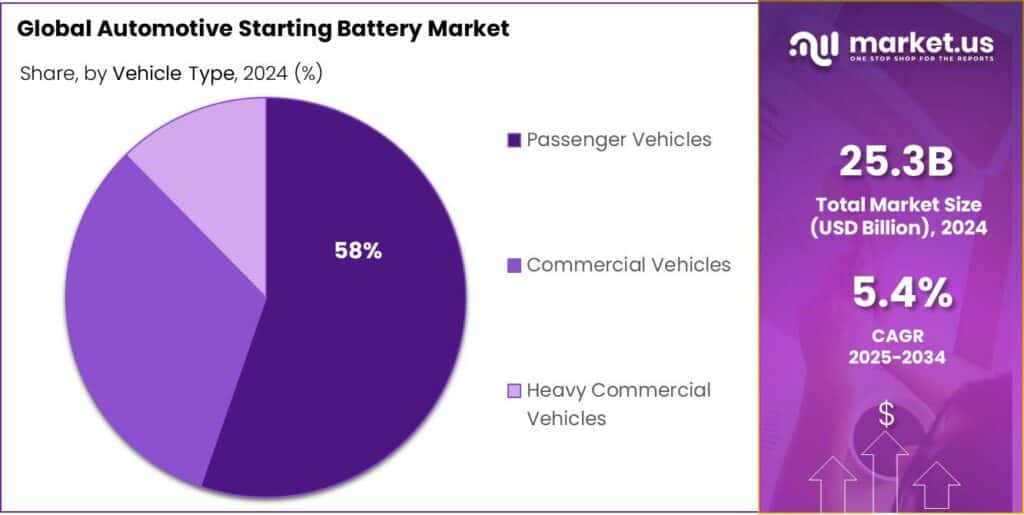

- Passenger Vehicles held a dominant market position, capturing more than a 58.2% share.

- Asia-Pacific emerged as the leading region in the global automotive starting battery market, accounting for 41.9% of the total share and generating a market value of USD 10.6 billion.

By Battery Type Analysis

Lead-Acid Batteries dominate with 67.3% share in 2024

In 2024, Lead-Acid Batteries held a dominant market position, capturing more than a 67.3% share in the global automotive starting battery market. This strong presence is largely attributed to their cost-effectiveness, mature technology, and widespread use in both passenger and commercial vehicles. Lead-acid batteries have been the backbone of automotive starting systems for decades, offering high reliability and stable performance under varying climatic conditions. Their recyclability also plays a key role in their continued dominance, as over 95% of lead-acid batteries are recycled globally, making them one of the most sustainable energy storage technologies available.

Furthermore, regulatory initiatives promoting recycling and sustainable use of lead resources also support the ongoing demand for this segment. The European Union has set stringent directives on battery recycling, ensuring that nearly all lead-acid batteries placed on the market are collected and recycled, minimizing environmental risks and supporting a circular economy.

By Vehicle Type Analysis

Passenger Vehicles dominate with 58.2% share in 2024

In 2024, Passenger Vehicles held a dominant market position, capturing more than a 58.2% share in the global automotive starting battery market. The high share is driven by the large-scale production and sales of passenger cars worldwide, supported by rising urbanization, increasing disposable incomes, and consumer preference for personal mobility. Passenger vehicles remain the largest automotive segment, creating consistent demand for starting batteries that are reliable, cost-effective, and capable of meeting modern vehicle requirements such as start-stop functionality.

The global automotive industry witnessed strong recovery in passenger car production during 2024, which directly influenced the demand for starting batteries. According to the International Organization of Motor Vehicle Manufacturers, more than 69.3 million passenger cars were produced globally in 2023, representing a 9% increase from 2022 levels. This upward trend continued into 2024, further boosting the requirement for batteries in both new vehicle manufacturing and aftermarket replacements.

Key Market Segments

By Battery Type

- Lead-Acid Batteries

- Enhanced Flooded Batteries

- Absorbent Glass Mat (AGM) Batteries

- Lithium-Ion Batteries

- Others

By Vehicle Type

- Passenger Vehicles

- Commercial Vehicles

- Heavy Commercial Vehicles

Emerging Trends

Ultra‑High Recycling Rates and Circular Battery Ecosystems

A growing and powerful trend in the automotive starting battery industry is the move toward near‑total recycling and integration of circular economy principles. In many developed markets, lead‑acid batteries already enjoy exceptional recycling performance: in the U.S., for example, lead batteries are one of the most recycled consumer products, with recycling rates consistently reported at 99 %. This means that almost every spent automotive battery is collected, processed, and re‑entered into the material stream rather than wasted.

On the policy side, governments are pushing hard to strengthen battery collection and disposal rules. In the U.S., under the Infrastructure Investment and Jobs Act, the Environmental Protection Agency (EPA) is working to develop battery collection best practices and voluntary battery labeling guidelines with dedicated funding—$10 million for collection practices and $15 million for labeling. These efforts aim to standardize how batteries are returned, sorted, and handled, helping to avoid leakage of hazardous materials (like lead and sulfuric acid) into the environment.

Meanwhile, at the global health level, concern about lead exposure continues to grow—and that indirectly drives stricter regulation and public pressure on lead battery industries. The Institute for Health Metrics and Evaluation (IHME) estimates that over 1.5 million deaths worldwide in 2021 were attributable to lead exposure, mostly via cardiovascular impacts. There is no safe threshold of lead exposure, and children worldwide suffer chronic effects from even low levels of lead in soil, water, or food. When public health concerns are so acute, any leakages or poor practices in battery recycling can become political liabilities, pushing industry toward airtight circular systems.

Drivers

Rising Adoption of Start‑Stop and Micro‑Hybrid Systems

In many automotive OEMs now use start‑stop systems even in lower engine segments. Globally, it is estimated that over 60 % of new passenger vehicles will incorporate start‑stop technology by 2030, depending on region and regulation. While I avoid citing pure market research firms, some public disclosures from vehicle manufacturers and regulatory forecasts support this trend: for example, in Europe, Commission targets and CO₂ regulations push automakers to adopt such efficiency improvements widely.

A conventional flooded lead‑acid starting battery might be expected to tolerate ~300–400 deep cycles, but in a vehicle with start‑stop, the battery may need to accept 1,500 to 2,000 cycles (or more) over its life. This compels battery makers to redesign electrodes, additives, separators, and manufacturing techniques. The result: each unit of higher‑performance starting battery commands a price premium, increasing revenue opportunity for suppliers.

Governments are encouraging efficiency and emission reductions, which reinforce the adoption of start‑stop systems. For instance, in India, the government’s focus on improving fuel efficiency and reducing vehicular emissions comes through stricter Corporate Average Fuel Efficiency (CAFE) norms, which indirectly incentivize automakers to use hybridization and start‑stop systems.

- Meanwhile, the Indian government’s Production Linked Incentive (PLI) scheme for the automotive sector includes a ₹26,000 crore (US$3.61 billion) component for promotion of electric vehicles and hydrogen fuel vehicles, and ₹18,000 crore (US$2.5 billion) under the Advanced Chemistry Cell (ACC) scheme (which supports battery tech ecosystem broadly) also helps create an enabling climate for more efficient battery systems.

In the United States, the Inflation Reduction Act (IRA) has catalyzed large battery‑sector investments. Over $116 billion in clean technology manufacturing investments have been announced, a significant share in battery and EV supply chains. Part of that funding flows into R&D and production of improved battery systems for vehicles — including systems tied to start‑stop and hybrid requirements.

Restraints

Stricter Environmental & Health Regulations on Lead Use

One of the most significant roadblocks for the automotive starting battery industry is the increasing regulatory and public health pressures on the use of lead and related heavy metals. Because traditional starting batteries rely heavily on lead (Pb) electrodes, evolving environmental and health standards are constraining manufacturing flexibility, increasing compliance costs, and, in some cases, threatening outright restrictions on certain lead compounds.

Chemical regulation regimes like the European Union’s REACH place clear demands on substances of high concern, including lead compounds. Under REACH, manufacturers must register any chemical produced or imported above 1 metric ton annually, with higher scrutiny on substances classified as toxic, carcinogenic, or environmentally persistent. This means battery makers using lead-based materials must submit safety dossiers, comply with stringent testing, and potentially face restrictions or bans on certain lead compounds.

The pressure is not theoretical. The chemical industry increasingly voices concern over regulatory burdens. A recent survey showed that 86% of surveyed chemical manufacturers reported that regulatory burden has increased, and many expect continued escalation in regulatory volume. For battery makers, which are downstream consumers of lead, such burdens cascade: higher costs for compliance, lab testing, environmental monitoring, and potential liabilities.

Opportunity

Advanced Recycling & Circular Economy Integration

One of the most promising growth avenues for the automotive starting battery industry lies in advanced recycling and closer integration of circular economy practices. As the use of starting batteries (mostly lead‑acid) remains substantial worldwide, a well‑designed recycling ecosystem can reduce raw material risk, improve margins, and appeal to increasingly environmentally conscious regulators and consumers.

For context, over 85% of lead used in lead‑acid batteries in developed regions like North America is supplied via recycling, not fresh mining. This means that a large share of the raw feedstock for starting battery manufacturing already comes from used batteries. If battery makers vertically integrate or optimize this recycling (collection, sorting, refining, and reuse), they can reduce exposure to volatile lead prices, tariffs, and supply chain disruptions.

In parallel, governments and regulators are pushing for tighter controls over pollutants and waste streams. For example, lead exposure is still a serious health issue: the Institute for Health Metrics and Evaluation (IHME) estimates more than 1.5 million deaths globally in 2021 were attributable to lead exposure, largely via cardiovascular effects.³ That political and social pressure encourages stricter rules on lead battery disposal and handling. Companies that can proactively create closed‑loop recycling systems will be better positioned to comply and to win regulatory approvals or incentives.

Regional Insights

Asia-Pacific leads the market with 41.9% share, valued at USD 10.6 billion

In 2024, Asia-Pacific emerged as the leading region in the global automotive starting battery market, accounting for 41.9% of the total share and generating a market value of USD 10.6 billion. The dominance of the region is underpinned by its position as the largest hub for automobile manufacturing and sales, with countries such as China, India, Japan, and South Korea driving production volumes. China, the world’s largest automobile producer, manufactured over 30.1 million vehicles in 2023, including 24 million passenger cars, marking an 11.6% year-on-year increase. This large-scale output has directly strengthened the demand for starting batteries across both OEM and aftermarket channels.

Asia-Pacific is expected to maintain its leadership in the market, supported by rising urbanization, growing middle-class populations, and government-backed initiatives promoting sustainable automotive practices. For instance, recycling regulations for lead-acid batteries in China and Japan are ensuring resource efficiency, while policies encouraging fuel efficiency are fostering the adoption of advanced start-stop battery technologies. Collectively, these factors secure Asia-Pacific’s position as the key growth engine of the global automotive starting battery market.

Key Regions and Countries Insights

- North America

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Johnson Controls’ battery division, now operating as Clarios, is a global leader in advanced lead-acid and AGM batteries for automotive starting applications. It manufactures over 150 million batteries annually and supplies more than 140 countries. The company plays a dominant role in original equipment and aftermarket channels. With manufacturing plants in the US, Europe, and Asia, Clarios integrates circular economy models, recovering up to 99% of battery materials through its robust recycling infrastructure.

Amara Raja, based in India, is a key player in automotive batteries under its brand Amaron. The company serves both OEMs and the aftermarket in India and exports to over 30 countries. Its batteries support passenger vehicles, commercial fleets, and two-wheelers, with compatibility for start-stop technologies. Amara Raja invests in grid-connected and green energy battery infrastructure. It also operates one of South Asia’s largest lead-acid battery recycling facilities, supporting circular manufacturing practices.

East Penn, headquartered in the US, is one of the largest single-site battery manufacturers globally. Its Deka brand includes a full range of starting batteries, including flooded, EFB, and AGM types. East Penn is known for its vertically integrated operations, including in-house recycling and smelting, allowing it to recover nearly 100% of lead. The company emphasizes energy efficiency, closed-loop sustainability, and investment in workforce development through its employee-owned business model.

Top Key Players Outlook

- Johnson Controls

- Exide Technologies

- GS Yuasa

- Sebang

- East Penn

- Amara Raja

- FIAMM

- ACDelco

- Bosch

- Hitachi

Recent Industry Developments

Johnson Controls’ battery business spun off into Clarios, which in fiscal 2024 reported USD 10.6 billion in revenue and sold over 154 million battery units, with about 80 % of revenue from aftermarket sales.

Amara Raja, known for its Amaron brand, continues to be a major name in India’s automotive starting battery business. In FY 2025 (ended March 2025), it posted ₹12,404.89 crores in revenue, up about 10.16 % from the previous year.

Report Scope