It’s impossible to predict external events in advance, but the chances of an escalation in the Ukraine war increased recently. And escalation of the war in Ukraine could fuel a fourth-quarter correction for the S&P 500 Index (^SPX), suggests Ivan Martchev, investment strategist at Navellier & Associates.

To get more articles and chart analysis from MoneyShow, subscribe to our Top Pros’ Top Picks newsletter here.)

While I think the S&P will make it to 7,000 by year end, I also think it is unrealistic for this to happen without a correction. I hope the war does not escalate, as the downside of such an event would be impossible to estimate. It is directly proportional to how big the escalation is.

But the chances increased dramatically as President Trump declared that Ukraine can push the Russians to pre-invasion borders. That’s a major shift in his policy stance. Since it is clear that Ukraine cannot do that by their forces alone, it requires the entrance of third-party countries on behalf of Ukraine to deliver such an outcome.

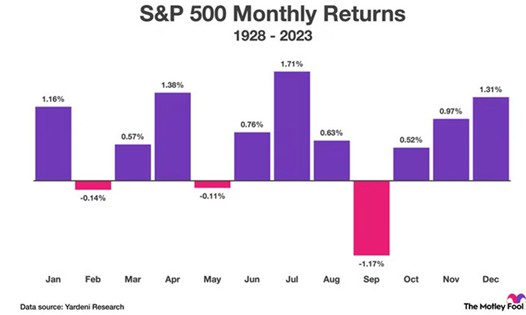

SP500 Monthly Return Chart

The escalation could take place due to a seemingly minor event. The Russians have been violating NATO airspace with their drones and jets of late. All it takes is for one NATO country to take down a Russian jet in some marginal violation of airspace – like Turkey did in 2015 during the Syrian conflict. The Russians let it go back then, but I don’t believe they will be so forgiving this time around.

See also: CTBI: A Regional Bank with Solid Dividend Growth

I hope that we have no escalation in Ukraine so that we can focus on economic issues, which are easier to forecast. I think the glass remains half full when it comes to the stock market, even though the market did not produce any downside seasonality in September.

More From MoneyShow.com: