Truck-as-a-Service Market Summary

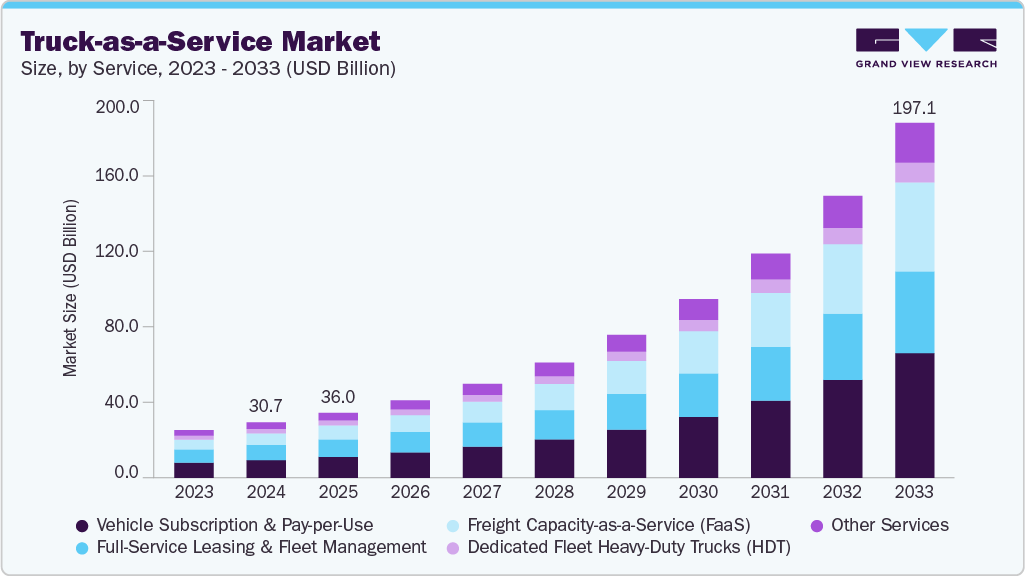

The global truck-as-a-service market size was estimated at USD 30.69 billion in 2024, and is projected to reach USD 197.07 billion by 2033, growing at a CAGR of 23.7% from 2025 to 2033. The market is gaining momentum, driven by the rising use of telematics, IoT, and predictive analytics that enhance fleet optimization and uptime.

Key Market Trends & Insights

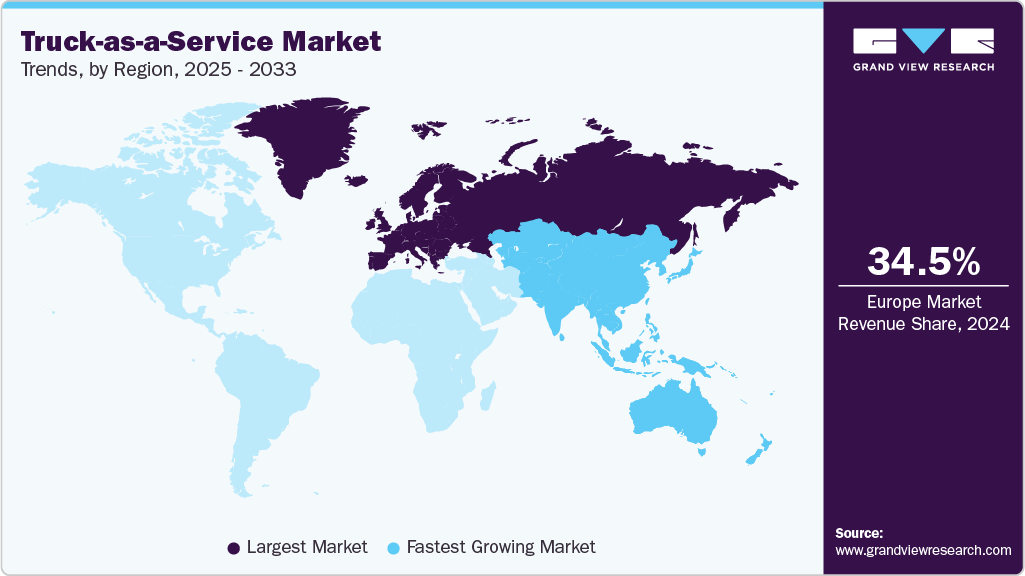

- Europe truck-as-a-service (TaaS) market accounted for a 34.5% share of the overall market in 2024.

- The German truck-as-a-service market is being shaped by increasing investment in electric and hydrogen truck infrastructure, strong government incentives, and the country’s role as Europe’s logistics hub.

- By service, the vehicle subscription & pay-per-use segment accounted for the largest share of 32.1% in 2024.

- By truck type, the heavy-duty trucks (HDT) segment held the largest market share in 2024.

- By propulsion, the internal combustion engine (ICE) segment held the largest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 30.69 Billion

- 2033 Projected Market Size: USD 197.07 Billion

- CAGR (2025-2033): 23.7%

- Europe: Largest market in 2024

- Asia Pacific: Fastest growing market

The shift toward asset-light business models, including logistics and freight subscription or pay-per-use services, is encouraging companies to access trucks through services rather than ownership. Rapid expansion in e-commerce, retail, and just-in-time delivery networks is increasing demand for flexible, on-demand truck capacity, while stringent emission regulations are accelerating the adoption of electric and alternative-fuel trucks within Truck-as-a-Service (TaaS) offerings.

Expansion of subscription-based and pay-per-use services in emerging markets presents significant opportunities, alongside the integration of autonomous and semi-autonomous driving technologies that are expected to transform efficiency and safety standards in fleet operations. However, high upfront costs and the complex integration of connected services and EV infrastructure remain key challenges for service providers. In addition, limited charging and refueling infrastructure for electric and fuel cell trucks continues to act as a restraint, restricting large-scale adoption across global fleets.

Companies are progressively opting for service-based access to trucks through vehicle subscription and pay-per-use models, reducing the need for significant capital investment in fleet ownership. This transition allows enterprises to manage operational costs more effectively, enhance fleet utilization, and scale transportation capacity based on fluctuating demand. Additionally, reliance on third-party service providers enables logistics operators to focus on core competencies, such as supply chain optimization and last-mile delivery, while outsourcing fleet management responsibilities. The adoption of subscription and pay-per-use offerings is particularly pronounced in e-commerce, retail, and just-in-time delivery networks, where flexibility and responsiveness are critical. Therefore, this trend is expected to accelerate the expansion of TaaS platforms, especially in regions witnessing rapid industrial and commercial growth.

The rapid growth of e-commerce, retail, and just-in-time delivery networks has been identified as a major driver for the Truck-as-a-Service (TaaS) market, as it increases demand for flexible, on-demand truck capacity. In India, the e-commerce sector achieved a gross merchandise value (GMV) of approximately USD 14 billion in 2025, reflecting a 12% year-on-year growth, according to India Brand Equity Foundation. The industry, valued at USD 125 billion in 2024, is projected to expand to USD 345 billion by 2030, representing a compound annual growth rate (CAGR) of 15%. Furthermore, a joint report by ANAROCK and ETRetail projects that the sector could reach USD 550 billion by 2035, driven by increasing digital adoption and evolving consumer behavior. This surge in e-commerce activity is expected to intensify reliance on TaaS platforms, enabling logistics providers to access trucks on demand and scale operations efficiently.

Governments and regulatory bodies across regions are implementing stricter emission norms to reduce greenhouse gas (GHG) output and promote sustainable logistics. Notable regulations supporting this shift include the European Union’s Euro 6/VI emission standards, the United States Environmental Protection Agency’s (EPA) Heavy-Duty Vehicle GHG regulations, and India’s Bharat Stage VI (BS-VI) norms, all of which mandate lower tailpipe emissions and encourage the deployment of cleaner powertrain technologies. In response, TaaS providers are increasingly integrating battery electric vehicles (BEVs), hybrid trucks, and fuel cell electric vehicles (FCEVs) into their service offerings. For instance, in May 2023, companies in the North American TaaS market, such as Ryder, launched RyderElectric+, a comprehensive solution combining electric vehicle leasing, charging infrastructure, telematics, and maintenance. This development underscores the market’s growing emphasis on fleet electrification, sustainability, and regulatory compliance.

The expansion of subscription-based and pay-per-use truck services in emerging markets has been recognized as a key opportunity for growth in the Truck-as-a-Service (TaaS) market. Businesses are increasingly adopting asset-light logistics models to reduce capital expenditure, optimize fleet utilization, and maintain flexibility in response to fluctuating demand. The adoption of subscription and pay-per-use offerings allows companies to scale transportation capacity rapidly while minimizing operational risks associated with fleet ownership. Also, infrastructure development and growing digital adoption in emerging economies are creating favorable conditions for service-based trucking models. For instance, in November 2023, companies in the European TaaS market, such as Scania, partnered with sennder Technologies to deploy 100 electric trucks on a pay-per-use model in Germany, with plans to expand to 5,000 vehicles by 2030, stimulating investment in supporting charging infrastructure. This trend indicates strong potential for the replication of similar models in emerging markets.

The deployment of battery electric vehicles (BEVs) and fuel cell electric vehicles (FCEVs) within TaaS platforms is heavily dependent on the availability of reliable and widespread charging or hydrogen refueling networks. In many regions, particularly in emerging markets, the lack of standardized charging stations, slow charging speeds, and uneven geographic coverage present operational challenges for fleet operators. Thus, logistics providers face constraints in planning routes, scheduling deliveries, and maintaining consistent uptime, limiting the ability to scale electric or fuel cell truck adoption efficiently. This infrastructure gap continues to impede the broader transition toward sustainable trucking solutions. Addressing these challenges through investments in public and private charging networks and policy support is expected to be critical for enabling large-scale deployment of electrified and hydrogen-powered fleets globally.

Service Insights

The vehicle subscription & pay-per-use segment accounted for the largest share of 32.1% in 2024. Factors such as the increasing adoption of asset-light logistics models, demand for flexible and on-demand truck capacity, rising e-commerce and just-in-time delivery networks, and the push toward electric and alternative-fuel trucks. These factors have encouraged companies to reduce capital expenditure on fleet ownership while maintaining operational flexibility, optimizing fleet utilization, and meeting sustainability targets. The combination of subscription-based access and pay-per-use models enables logistics and retail operators to scale their transportation capacity according to demand fluctuations, while also integrating newer technologies such as EVs and connected fleet management systems. For instance, in May 2024, Volvo Trucks North America and Volvo Financial Services introduced Volvo on Demand, a Truck-as-a-Service (TaaS) model featuring 25 Class 8 VNR Electric trucks. The program offers flexible terms, charging support, and bundled services to simplify fleet electrification and reduce upfront investment.

The freight capacity-as-a-service (FaaS) segment is expected to grow at a highest CAGR from 2025 to 2033, driven by the growing need for scalable logistics solutions, increasing adoption of on-demand transportation models, rising e-commerce and retail delivery volumes, and the integration of digital platforms for fleet management. Companies operating in this segment are focusing on streamlining fleet access, maintenance, and sustainable logistics solutions. For instance, in September 2023, Volta Trucks partnered with Spryker and AWS to enhance its TaaS offering for electric commercial vehicles. The collaboration leverages a PaaS commerce platform and serverless cloud technologies to simplify vehicle access, maintenance, and zero-emission logistics solutions for fleet operators. Such development highlights the increasing adoption of technology-driven and flexible freight capacity solutions, reinforcing the growth potential of the FaaS segment within the TaaS market.

Truck Type Insights

The heavy-duty trucks (HDT) segment accounted for the largest share in 2024. Factors such as the increasing long-haul freight demand, rising adoption of electric and alternative-fuel trucks, expanding e-commerce and retail logistics, and stricter emission regulations is supporting the segment growth. These factors are fueling investments in fleet modernization, connected fleet management, and sustainable transportation solutions, reinforcing the segment’s dominance in large-scale logistics operations.

The medium-duty trucks (MDT) segment is expected to grow at a significant CAGR during the forecast period, driven by increasing last-mile delivery requirements, urban logistics expansion, demand for flexible fleet solutions, and adoption of zero-emission vehicles. The segment’s growth is supported by trends toward smaller, more versatile trucks that can efficiently navigate urban and regional distribution networks. Also, rising e-commerce penetration, just-in-time delivery models, and the need for frequent deliveries in congested city areas are fueling MDT demand. Regulatory pressures in urban centers to reduce emissions and noise pollution are encouraging the deployment of electric and hybrid MDTs.

Propulsion Insights

The internal combustion engine (ICE) segment accounted for the largest share in 2024, supported by its dominant role in freight transport across long-haul, regional distribution, and heavy-duty applications. The segment’s growth is fueled by the widespread availability of diesel and gasoline fueling infrastructure, well-established maintenance and service networks, and comparatively lower upfront acquisition costs than electric alternatives. ICE trucks also continue to be favored for their high load-carrying capacity and operational reliability, particularly in regions where alternative-fuel infrastructure remains limited.

The hybrid segment is expected to register a notable CAGR from 2025 to 2033. Hybrid trucks are increasingly being deployed in medium- and heavy-duty applications where operators seek lower fuel consumption without compromising range or payload. The combination of internal combustion engines with battery support enables fleets to reduce emissions in urban zones while retaining flexibility for longer regional routes. Companies in this segment are focusing on innovative financing and service models to accelerate adoption. For instance, in November 2023, Hydrogen Vehicle Systems (HVS) partnered with Zeti and Gravis Capital to launch a truck-as-a-service (TaaS) model for hydrogen fuel cell trucks, offering pay-per-mile financing and funding support to help fleet operators decarbonize operations while maintaining cost certainty. Factors such as rising demand for fuel-efficient alternatives, regulatory pressure to cut emissions, growing urban delivery requirements, and the need for transitional technologies bridging ICE and fully electric trucks support the segment growth during forecast year.

End-user Insights

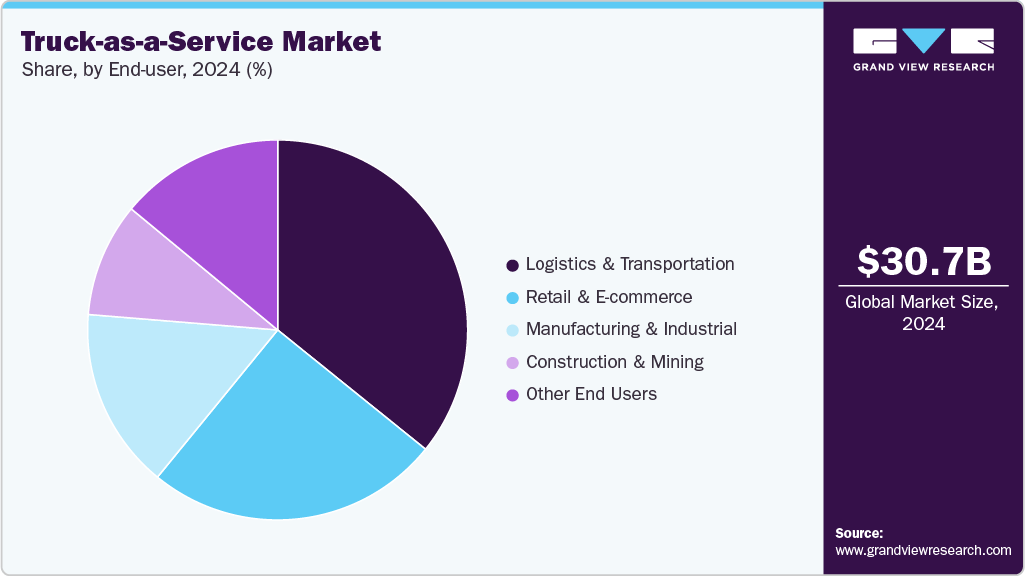

The logistics & transportation segment accounted for the largest share in 2024. TaaS models are being widely applied in long-haul freight, cross-border trade, and regional distribution networks. This segment benefits from the need to improve fleet efficiency, reduce downtime, and manage fluctuating demand without heavy capital investment in owned fleets. Growth is further driven by the rapid expansion of e-commerce and just-in-time delivery models, rising adoption of asset-light logistics strategies, increasing demand for on-demand freight capacity, and the integration of connected fleet management technologies.

The manufacturing & industrial segment is expected to register a notable CAGR from 2025 to 2033, owing to its extensive use of truck-as-a-service (TaaS) models in raw material transport, component movement, and distribution of finished goods across regional and international supply chains. Growth in this segment is being driven by increasing demand for cost-efficient fleet solutions, the need to manage volatile shipment volumes, and the rising adoption of predictive analytics and telematics for real-time visibility in industrial logistics.

Regional Insights

The Europe truck-as-a-service market accounted for 34.5% of the global share in 2024. The European truck-as-a-service market is witnessing a significant transformation, driven by stringent emission regulations, digital freight integration, and rapid adoption of electric trucks. The European Green Deal and the EU’s “Fit for 55” package are pushing logistics operators to decarbonize fleets and adopt service-based business models that lower upfront costs. Increasing road freight demand, particularly for cross-border trade within the EU, is fueling the adoption of digital freight platforms and telematics-driven solutions.

Companies are actively responding to these dynamics. For instance, in April 2023, Volta Trucks partnered with global finance company DLL to provide lease financing support for its Truck-as-a-Service offering, making the all-electric Volta Zero more accessible across multiple European markets. These factors underline how Europe’s regulatory push, financial innovation, and sustainability priorities are reshaping its TaaS landscape.

Germany Truck-as-a-Service Market Trends

The German truck-as-a-service market is being shaped by increasing investment in electric and hydrogen truck infrastructure, strong government incentives, and the country’s role as Europe’s logistics hub. Germany’s Federal Ministry for Digital and Transport (BMDV) has rolled out funding schemes for zero-emission commercial vehicles and charging networks, encouraging operators to shift from ownership models to service-based solutions. The growing presence of logistics corridors connecting ports like Hamburg and inland manufacturing hubs is also accelerating the adoption of digital freight platforms and pay-per-use fleet models. Companies are leveraging these policies and infrastructure developments to expand their TaaS footprint, offering fleet operators cost-efficient, low-emission access to trucks without the burden of high capital investment.

The UK Truck-as-a-Service market is expanding rapidly, supported by strong regulatory pressure to decarbonize road freight, the growing adoption of electric trucks in urban delivery networks, and a shift among fleet operators toward flexible, service-based ownership models. The UK government’s commitment to end the sale of new fossil-fuel trucks by 2040 and its investment in EV charging and hydrogen refueling infrastructure are accelerating this transition. Urban low-emission zones in cities like London and Birmingham are further pushing operators to seek cost-efficient alternatives to conventional diesel fleets. Companies in the region are increasingly focusing on bundled financing, maintenance, and charging solutions to reduce barriers to adoption. In April 2023, Volta Trucks appointed Sapphire Vehicle Services as its first certified service partner in the UK, enhancing its TaaS offering with dedicated EV maintenance, trained technicians, and mobile servicing to maximize fleet uptime.

Asia Pacific Truck-as-a-Service Market Trends

The Asia Pacific truck-as-a-service industry was identified as a lucrative region in 2024, driven by rising freight demand, cross-border e-commerce, and rapid urbanization across emerging economies. Countries such as India, China, and Southeast Asian nations are investing heavily in digital freight platforms and 5G-enabled telematics to improve logistics efficiency. Regional initiatives supporting cleaner transport and the adoption of connected mobility platforms are also enhancing service penetration. For instance, India’s push for fleet digitalization under the National Logistics Policy is encouraging local operators to integrate route optimization and real-time tracking services. This demonstrates how Asia Pacific’s mix of high freight volumes, digital readiness, and regulatory support continues to reinforce the region’s dominance in the global TaaS landscape.

The China truck-as-a-service industry held a substantial market share in 2024, fueled by strong government support for smart logistics and electrification. Regulations under China’s “Internet Plus Logistics” initiative are accelerating digital freight platforms, boosting efficiency in long-haul and last-mile delivery networks. Rising demand for autonomous and electric trucks also complements TaaS adoption, as fleet owners increasingly subscribe to service models instead of asset-heavy purchases.

Companies such as Full Truck Alliance (Manbang) are expanding their digital freight marketplaces, offering integrated services that combine load-matching with predictive maintenance. Also, local governments are incentivizing data-driven fleet services to cut emissions and reduce urban congestion. These developments highlight how China’s regulatory landscape, combined with technological innovation, is shaping a robust TaaS ecosystem.

The Japanese truck-as-a-service industry held a significant share in 2024, with growth supported by the country’s logistics modernization initiatives and acute driver shortage challenges. Japan’s Ministry of Land, Infrastructure, Transport, and Tourism (MLIT) is implementing policies to digitize freight operations and promote shared logistics services to ease delivery bottlenecks. Subscription-based fleet management services are gaining popularity among small and medium-sized logistics operators facing high vehicle ownership costs. Major players such as Hino Motors and Toyota Tsusho are collaborating on digital freight matching and telematics-driven fleet optimization solutions. Additionally, Japan’s roadmap for decarbonization is incentivizing fleet operators to shift toward cleaner mobility solutions under service-based models. These combined factors underscore Japan’s move toward efficiency-driven, regulation-backed TaaS adoption.

North America Truck-as-a-Service Market Trends

The North America truck-as-a-service (TaaS) industry was identified as a lucrative region in 2024. The truck-as-a-service market in North America is being driven by strong regulatory initiatives, rapid electrification of freight fleets, and the rise of digital logistics platforms. Federal policies such as the U.S. Inflation Reduction Act (IRA) and the Environmental Protection Agency’s (EPA) Clean Truck Plan are incentivizing the adoption of zero-emission trucks through tax credits, infrastructure investments, and stricter emission standards. Also, California’s Advanced Clean Trucks (ACT) regulation mandates that a growing percentage of truck sales be zero-emission vehicles, accelerating demand for flexible TaaS models.

Logistics providers and fleet operators are increasingly shifting to subscription-based and pay-per-use access to reduce capital expenditures while meeting sustainability targets. Companies including Volvo Trucks, Daimler Truck North America, and Ryder are expanding service-based offerings that combine financing, charging support, and maintenance packages to make EV truck adoption more viable across regional and long-haul operations.

U.S. Truck-as-a-Service Market Trends

The U.S. truck-as-a-service (TaaS) industry held a dominant position in 2024, driven by the growing demand for flexible fleet solutions, rapid electrification of commercial vehicles, and rising adoption of connected fleet management platforms. Federal regulations, including the EPA’s Clean Truck Plan and incentives under the Inflation Reduction Act (IRA), are promoting zero-emission trucks and supporting infrastructure across logistics networks. Increasing e-commerce volumes and the need to optimize operational costs are encouraging logistics providers to adopt subscription-based and pay-per-use TaaS models. Companies in the U.S. are focusing on integrated solutions combining vehicle leasing, maintenance, charging support, and telematics.

Key Truck-as-a-Service Company Insights

Some of the key players operating in the market include Tata Motors Limited, AB Volvo, TRATON SE, Daimler Truck AG, and Einride AB.

-

Founded in 1945 and headquartered in Mumbai, India, Tata Motors Limited is a global commercial vehicle manufacturer and provider of Truck-as-a-Service (TaaS) solutions. Tata Motors’ TaaS offerings cater to sectors such as logistics & transportation, retail & e-commerce, manufacturing, and construction. Tata Motors leverages connected vehicle technologies, telematics, and predictive maintenance systems to enhance fleet efficiency, uptime, and operational performance across diverse markets. Its TaaS programs also include electric and alternative-fuel trucks, enabling fleet operators to reduce emissions and comply with regional sustainability regulations.

-

Founded in 1927 and headquartered in Gothenburg, Sweden, AB Volvo is a commercial vehicle manufacturer and provider of truck-as-a-service (TaaS) solutions. The company provides vehicle subscription & pay-per-use, full-service leasing & fleet management, digital fleet optimization, and maintenance solutions for sectors such as logistics & transportation, retail & e-commerce, industrial, and construction. AB Volvo operates a global network of manufacturing and service facilities and leverages telematics, electrification, and autonomous driving technologies to enhance fleet efficiency, uptime, and sustainability. Its TaaS programs enable flexible, cost-efficient fleet access while supporting the transition to zero-emission commercial vehicles.

Key Truck-as-a-Service Companies:

The following are the leading companies in the truck-as-a-service market. These companies collectively hold the largest market share and dictate industry trends.

- Daimler Truck AG (Daimler AG)

- AB Volvo (Volvo Group)

- TRATON SE (Scania, MAN)

- Tata Motors Limited

- Einride AB

- BYD Company Limited

- Volta Trucks

- Xos, Inc.

- Nikola Corporation

- Hyliion Holdings Corp.

Recent Developments

-

In September 2024, Volvo Trucks delivered 70 Volvo VNR Electric trucks under the SWITCH-ON initiative, deploying them to multiple fleets across Southern California for regional freight and drayage applications. The program, supported by EPA and South Coast AQMD funding, also integrates Volvo on Demand, Volvo’s Truck-as-a-Service (TaaS) model, enabling fleets to access electric trucks with minimized upfront investment.

-

In August 2023, Webfleet partnered with e-fleet solutions provider VEV to accelerate commercial EV fleet adoption. The collaboration supports end-to-end EV transition, including site electrification, charging infrastructure, vehicle sourcing, and ongoing fleet operations, leveraging telematics and data-driven insights to optimize energy use and operational efficiency.

-

In June 2022, WattEV unveiled plans to operate 12,000 electric trucks under its Truck-as-a-Service (TaaS) model by 2030, supported by a gigawatt-scale charging network. The company began construction of its first major hub, the Bakersfield Electric Truck Stop, featuring solar generation, battery storage, and megawatt charging capacity.

-

In March 2022, American startup WattEV ordered 50 Volvo VNR Electric trucks to deploy under its Truck-as-a-Service (TaaS) model. The company is also developing a network of charging depots across California, offering 250 kW fast charging and plans to scale toward 1.2 MW ultra-fast charging.

Truck-as-a-Service Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 36.04 billion

Revenue Forecast in 2033

USD 197.07 billion

Growth rate

CAGR of 23.7% from 2025 to 2033

Base year for estimation

2024

Historical data

2020 – 2023

Forecast period

2025 – 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report Coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments Covered

Service, truck type, propulsion, end-user, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Kingdom of Saudi Arabia (KSA); South Africa

Key companies profiled

Daimler Truck AG; AB Volvo; TRATON SE; Tata Motors Limited; Einride AB; BYD Company Limited; Volta Trucks; Xos, Inc.; Nikola Corporation; Hyliion Holdings Corp.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Truck-as-a-Service Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global truck-as-a-service market report based on service, truck type, propulsion, end-user, and region.

-

Service Outlook (Revenue, USD Million, 2021 – 2033)

-

Vehicle Subscription & Pay-per-Use

-

Full-Service Leasing & Fleet Management

-

Freight Capacity-as-a-Service (FaaS)

-

Dedicated Fleet Heavy-Duty Trucks (HDT)

-

Other Services

-

-

Truck Type Outlook (Revenue, USD Million, 2021 – 2033)

-

Heavy-Duty Trucks (HDT)

-

Medium-Duty Trucks (MDT)

-

Light-Duty Trucks (LDT)

-

-

Propulsion Outlook (Revenue, USD Million, 2021 – 2033)

-

Internal Combustion Engine (ICE)

-

Battery Electric Vehicle (BEV)

-

Hybrid

-

Fuel Cell Electric Vehicle (FCEV)

-

-

End-user Outlook (Revenue, USD Million, 2021 – 2033)

-

Regional Outlook (Revenue, USD Million, 2021 – 2033)

Frequently Asked Questions About This Report

b. The global truck-as-a-service market size was estimated at USD 30.69 billion in 2024, and is projected to reach USD 197.07 billion by 2033.

b. The global truck-as-a-service market is expected to grow at a compound annual growth rate of 23.7% from 2025 to 2033 to reach USD 197.07 billion by 2033.

b. Europe truck-as-a-service market accounted for 34.5% of the global share in 2024, driven by stringent emission regulations, digital freight integration, and rapid adoption of electric trucks. The European Green Deal and the EU’s “Fit for 55” package are pushing logistics operators to decarbonize fleets and adopt service-based business models that lower upfront costs.

b. Some key players operating in the TaaS market include Daimler Truck AG, AB Volvo, TRATON SE, Tata Motors Limited, Einride AB, BYD Company Limited, Volta Trucks, Xos, Inc., Nikola Corporation, and Hyliion Holdings Corp.

b. Key factors that are driving the market growth include rising use of telematics, IoT, and predictive analytics, growing shift toward asset-light business models, and rapid expansion in e-commerce, retail, and just-in-time delivery network.